WeWork’s valuation challenges highlight the potential issues that SoftBank’s other real estate investments — namely Compass and Opendoor — may face in their march towards IPO. (Photo by TIMOTHY A. CLARY/AFP/Getty Images)

AFP/Getty Images

On its path to a now-delayed IPO, SoftBank-backed WeWork’s valuation has fallen from $47 billion to somewhere between $10 billion and $15 billion. This precipitous drop appears to be a collective repudiation of not only WeWork’s business model and SoftBank’s valuation philosophy, but of the inverted economics of big money unicorns without a path to profitability.

WeWork’s valuation challenges highlight the potential issues that SoftBank’s other real estate investments—namely Compass and Opendoor—may face in their march towards IPO.

Strong growth, fueled by capital

WeWork shares a number of traits with Compass, a real estate brokerage, and Opendoor, an iBuyer: They all deal in real estate, have raised massive amounts of capital from SoftBank at multibillion dollar valuations, and are growing incredibly fast. All three are unprofitable, pay most of their revenues away as a cost of sale, struggle with their identity as a tech company, and, in the case of Compass, have a profitable, publicly traded rival that is valued far less.

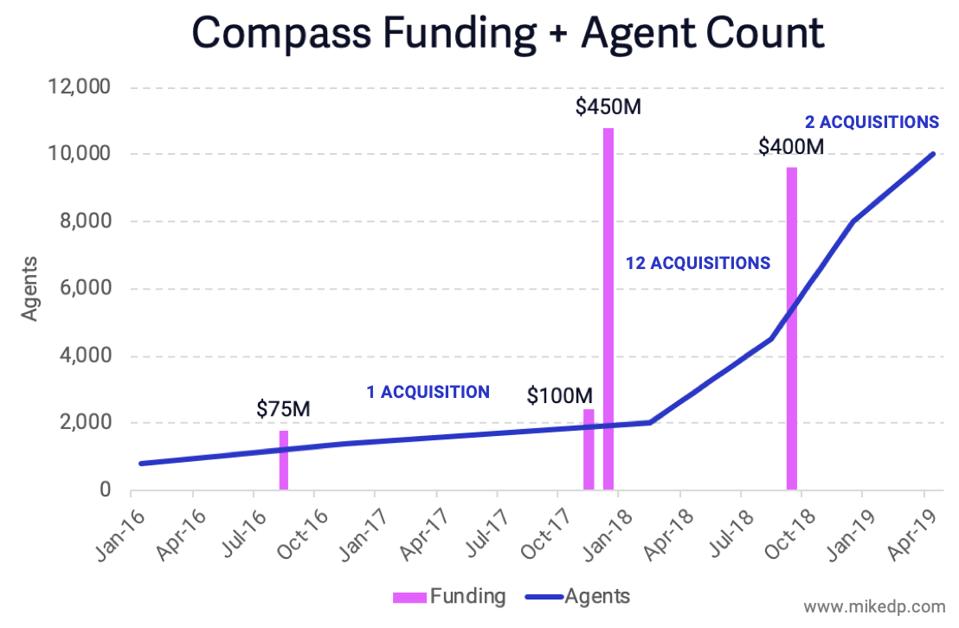

Compass’ business model is fueled by capital. It has raised more than $1.5 billion, which it is using to acquire brokerages and recruit agents at an unprecedented scale. It is turning dollars into agents, which in turn generate revenue.

Mike DelPrete

Opendoor has raised over $1 billion—more than 10 times its nearest competitor—and has used that capital to fuel a rapid national expansion (in addition to launching a mortgage venture and acquiring a title company). Opendoor is on track to purchase around 17,000 homes in 2019.

Mike DelPrete

When a company raises such large sums of capital, there is only one possible exit: an IPO. The other path—an acquisition by another company—is priced out of the equation due to the massive valuations involved; other companies can’t afford the transaction. Case in point: Compass’ $6.4 billion valuation is on par with Zillow and nearly four times higher than Redfin.

When selling my company years ago, a trusted advisor told me that a business is worth what someone else is willing to pay for it. SoftBank is certainly guilty of testing the upper bounds of private company valuations, and the WeWork episode makes it clear that what SoftBank is willing to pay for a company is quite different than anyone else.

Justifying a sky-high valuation

Both WeWork and Compass have profitable, publicly traded rivals that are valued far less (IWG for WeWork and Realogy for Compass). In the case of WeWork, “IWG has substantially more square footage and more customers, and has actually made a profit—yet its market cap is just 8% of what SoftBank’s latest funding round thinks WeWork is worth,” according to Recode.

The Wall Street Journal examines why WeWork is struggling to sell its story to investors, and sums up the narrative as follows:

- WeWork’s revenue is growing fast, but so are its expenses.

- WeWork’s operating losses are keeping pace with its revenues.

- WeWork is raising increasingly large sums—but has yet to announce a profit.

- And a profitable, publicly traded rival is valued at far less.

In 2018 (the last full year where complete information is available), Compass’ publicly traded rival, Realogy, had 42 times the number of transactions, 11 times the sales volume, seven times the revenue—and actually made a profit!—but an enterprise valuation on par with Compass.

WeWork, Compass and Opendoor have valuations that are pegged to their impressive growth rates, but when that growth is dependent on having and spending vast sums of money in an unsustainable manner, it’s difficult to justify.

Impact on Compass and Opendoor

If the pressure from the public markets continues to push for profitability, it may accelerate (or force) a change in the operating economics at Compass and Opendoor, which up until now have fueled their massive growth with massive expenditures.

A drive to increase revenue could lead Opendoor to raise its fees, or Compass to reduce its generous commission splits with agents; either move would severely limit growth. Reducing expenses would come in the form of office consolidation (Compass has over 250 offices across the U.S.), ratcheting down employee perks, or even staff layoffs.

(Uber, another one of SoftBank’s investments, recently announced a round of layoffs from its product and engineering teams: 435 people, or 8%of its entire workforce, were let go. This comes just a few months after Uber, whose stock is down over 20% since IPO, announced that it was cutting 400 employees from its marketing division.)

Stock options

Those most impacted at WeWork, Compass and Opendoor may end up being employees and contractors that have stock options. Compass, in particular, has used this as a key tool for agent recruitment and retention, and a dropping valuation would make those options worth a small fraction of what was initially promised.

In addition to stock options granted to induce agents to join Compass, those agents can also invest a portion of their commissions into the company. As of November 2018, more than 1,000 Compass agents had invested over $20 million into stock options.

And while Compass’ valuation isn’t dropping—it recently increased from $4.4 billion to $6.4 billion—the rate of increase is slowing.

Mike DelPrete

Compass is not WeWork, and nor is Opendoor. But to succeed, all three businesses require an unprecedented amount of capital and a willingness to buy into a vision that is driven more by words than numbers and where the long-term validity of the business model is easier to assert than to prove.

The current WeWork fiasco (and to be clear, we’re talking about a 70% to 80% drop in value simply as a result of opening the books and being honest about the business) shows that valuations can’t keep rising unchecked by the realities of basic economic principles—and that investor patience does have a limit.