San Francisco already has sky-high home prices and a lack of inventory. Public offerings from Lyft and other tech companies is likely to put even more pressure on its real estate market.

With the wealth created through Lyft’s upcoming IPO, current and former employees of the ridehailing business could purchase every single home listed for sale in the company’s hometown of San Francisco in cash—and still have $100 million left over.

Based on a public offering price of $65 per share, the midpoint of the range Lyft set on Monday, current and former employees hold $1.397 billion worth of stock in the company. For the following analysis, we calculated how much Bay Area real estate that money could hypothetically buy based on list prices of homes for sale as of March 19, 2019 and assuming buyers pay all cash.

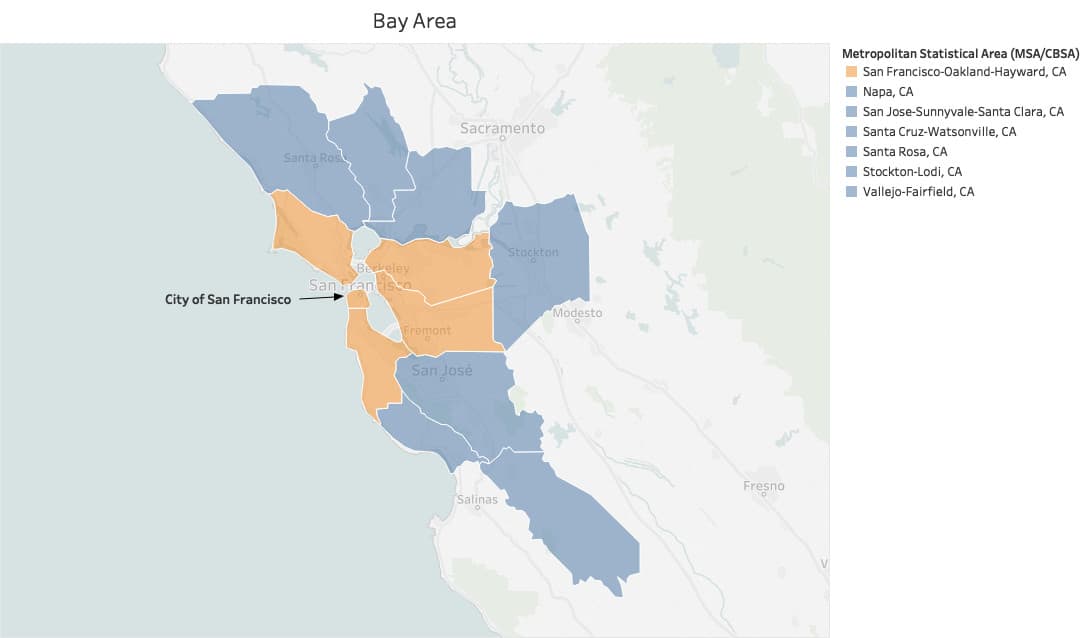

If all $1.397 billion of the total stock wealth were to go into the San Francisco Bay Area real estate market once Lyft goes public (and the IPO lockup period ends), current and former employees would be able to buy:

- All 624 homes for sale in the city of San Francisco for $1.3 billion, with roughly $100 million left over.

- Nearly half of the least expensive homes for sale—2,224 homes—in the San Francisco-Oakland-Hayward metropolitan statistical area for $1.36 billion.

- The top 2% of homes for sale by list price—100 homes—in the San Francisco-Oakland-Hayward metropolitan statistical area for $1.27 billion.

- Nearly one-third of the least expensive homes for sale—3,120 homes—in the entire Bay Area (the San Jose-San Francisco-Oakland combined statistical area) for $1.35 billion.

- The top 0.7% of homes for sale by list price—77 homes—in the entire Bay Area (the San Jose-San Francisco-Oakland combined statistical area) for $1.35 billion.

The fact that current and former Lyft employees could hypothetically purchase every single active listing in San Francisco with their upcoming stock wealth is representative of the huge impact this year’s tech IPOs could have on the Bay Area housing market. Lyft is just the first of several San Francisco-based tech companies that may go public this year, with filings from Uber, Slack and Pinterest expected to come down the pipeline soon and Airbnb rumored to go public sometime in 2019 or 2020.

With a median home sale price of $1.3 million, San Francisco is the most expensive large housing market in the U.S. and it could become even more costly with the influx of liquid wealth being created with this year’s tech IPOs. And the city’s housing supply, already relatively low—for the sake of comparison, 624 homes are currently for sale in San Francisco versus 1,491 in the city of Seattle, which has a slightly smaller population—could fall even further.

“San Francisco is already experiencing a crippling housing shortage. Outdated zoning regulations have stifled construction of new multi-family units, so there just isn’t enough housing for everyone,” said Redfin chief economist Daryl Fairweather. “The influx of cash brought by the upcoming Lyft IPO will put even more pressure on home prices in San Francisco and the Bay Area as a whole.”

Bay Area IPOs Could Also Impact Other Real Estate Markets

The San Francisco Bay Area topped the list of metros people were looking to leave in the fourth quarter of 2018, with 23.8 percent of local Redfin.com users searching for homes outside the metro area. Of the Bay Area-based Redfin users searching for homes outside the metro, the most popular destination was the Sacramento metro area, where the typical home sells for $385,000. The most popular out-of-state destination was the Seattle area, where the typical home sells for $546,000. Of Bay Area-based Redfin users looking for homes, 18.7 percent were searching in Sacramento and 15.9 percent were searching in Seattle.

If the recipients of Lyft’s IPO wealth were to purchase homes outside San Francisco, their cash could have an even more dramatic impact on the real estate markets that are popular with people looking to leave the Bay Area.

If all $1.397 billion of the stock wealth were to go into the Sacramento real estate market, current and former Lyft employees could purchase all 1,173 homes for sale in the city of Sacramento for $526 million, with roughly $870 million left over. They could buy 99 percent—1,477 homes—of all homes for sale in Seattle for $1.31 million.

“We’ve seen more and more people looking to leave the Bay Area, and this year’s IPOs could accelerate that trend and potentially push home prices up in other parts of the country too,” Fairweather said. “Some employees from Lyft and other tech companies still won’t have enough cash for a down payment on a typical San Francisco home, and they may leave the area to buy a home in more affordable West Coast areas like Sacramento, Seattle or Portland.”

Methodology

For this report, we used Lyft’s S-1 filing, combined with Redfin data, to determine the number of homes (single-family homes, townhouses and condos) current and former Lyft employees could hypothetically purchase with their stock wealth once the company conducts its initial public offering. Current and former Lyft employees held approximately 8,600,322 shares underlying RSUs that will have satisfied vesting conditions upon the IPO’s completion and that will be left after obligatory tax withholding in connection with vesting. We multiplied the number of shares by $65, the midpoint of Lyft’s proposed public offering price range of $62 to $68, to get $559 million. Current and former Lyft employees also hold $838.7 million worth of vested stock options as of December 31, 2018. $559 million + $838.7 million = $1.397 billion. We looked at all of the active listings in the city of San Francisco, the San Francisco-Oakland-Hayward metropolitan statistical area and the San Jose-San Francisco-Oakland combined statistical area. Then, we took the aggregate value of the Lyft stock wealth and created a running total of list prices in each of those regions until the $1.397 billion was exhausted. We repeated the process for the city of Seattle and the city of Sacramento.

This post first appeared on Redfin.com. To see the original, click here.