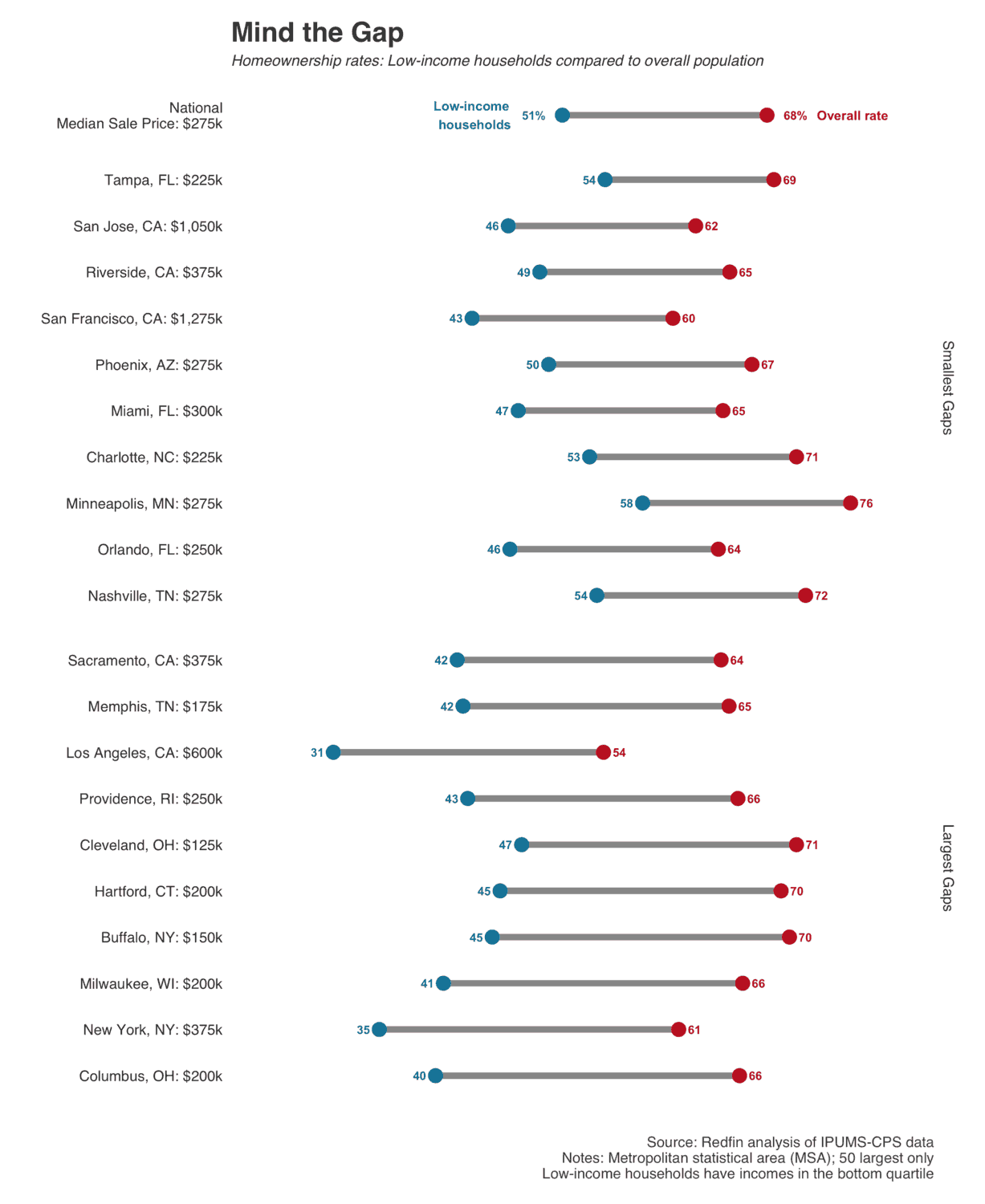

San Jose and San Francisco, among the nation’s most expensive housing markets, have two of the smallest gaps between the homeownership rates of low-income families and the overall population.

Tampa, Florida has the smallest gap in homeownership rates between low-income families and the overall population. That’s followed by three California metros: San Jose, Riverside and San Francisco. While Tampa and Riverside are relatively affordable, San Jose and San Francisco have both seen their median home sale prices surpass $1 million in recent years, far beyond the realm of affordability for many families.

“San Jose’s overall homeownership rate is low due to a lack of affordability throughout the metro area,” said local Redfin agent Kalena Masching. “Prices are so high that homes are often unaffordable even for relatively high income earners, making it so that a software developer is not much more likely than someone in a middle-paying profession to be a homeowner.”

Home prices in both San Jose and San Francisco, located in the epicenter of Bay Area tech wealth, have more than doubled over the last seven years. Prices in Riverside have also more than doubled, though the prices are lower—they have risen from $178,000 to $366,000.

“Some of the metros with the smallest gaps in homeownership between low and higher earners, particularly those in California, are places that have seen rapid home-price appreciation over the last decade,” said Redfin chief economist Daryl Fairweather. “In areas like San Jose and San Francisco, homeownership has less to do with what residents currently earn relative to home prices, and more to do with whether they bought a home several years ago before prices multiplied. And in California, property tax increases are capped below actual price appreciation, meaning it’s often more affordable for residents to stay in homes long term than to move, regardless of current income.”

In Tampa, one potential reason for the small gap is the area’s high rate of homeownership for low-income families. More than half (54.4%) of Tampa-area families earning the bottom 25 percent of income for the metro area are homeowners, the fifth highest rate in the country. That’s likely partly due to the area’s relative affordability: Tampa’s median sale price is $225,000, compared to $287,000 nationally. But while Tampa is inexpensive compared to much of the U.S., home prices in the area have more than doubled in the last seven years, like they have in San Jose, Riverside and San Francisco.

“Tampa is unique in that many of its high-end neighborhoods directly border more affordable areas that are approachable for people earning lower incomes. A good portion of homes in the affordable neighborhoods still have a lot of properties selling for less than $200,000,” said local Redfin agent Brian Walsh. “Some of those areas are close to the beach and downtown, but for people willing to spend a bit of time commuting to work, truly affordable suburban life is approachable for a large group of working families.”

The areas with the largest homeownership gaps for low-income families are located mostly in the Midwest or on the East Coast, with Columbus, New York, Milwaukee and Buffalo topping the list. Median sale prices in those areas have gone up in the last seven years, though not as quickly as they have in the California areas. In Columbus and Buffalo, median sale prices are $195,000 and $145,000, respectively, each up roughly 50 percent since the beginning of 2012. In Milwaukee, the typical home sells for $190,000, up from $173,000 in October 2014, the first month for which data is available. And in New York City, the average sale price of a home in the fourth quarter of 2018 was $938,000, up from $775,000 in the fourth quarter of 2012, per the Real Estate Board of New York (REBNY).

“Historically, Americans accumulated wealth through homeownership, which helped lessen the class divide between low- and high-income families,” said Fairweather. “But the housing affordability crisis we face today prevents many low-income families from achieving that piece of the American Dream. There are still some affordable metros, like Tampa and Charlotte, that have high homeownership rates not only for the overall population but specifically for low-income families. For those metros, there isn’t as much class disparity between who benefits from a prosperous economy.”

This post first appeared on Redfin.com. To see the original, click here.