Volatility on Wall Street and global economic uncertainty may have contributed to a decline in high-priced home sales in the luxury market.

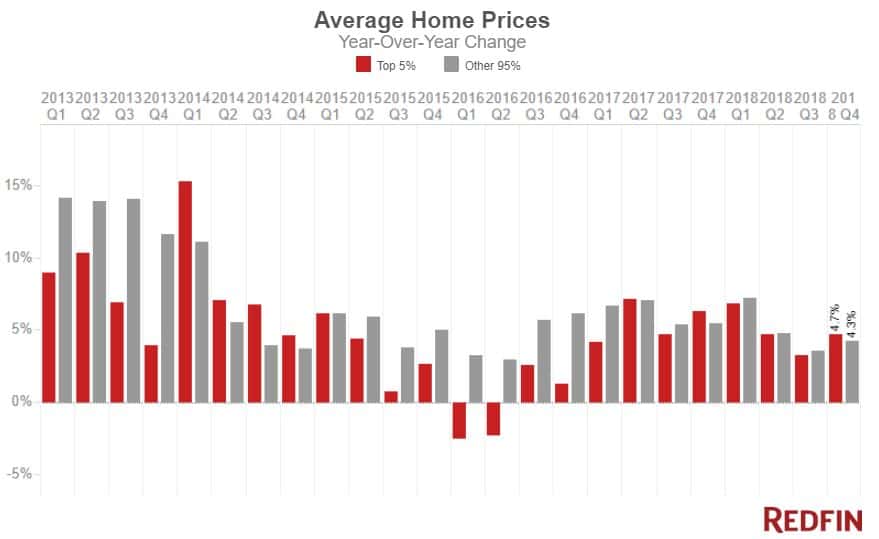

The average sale price for luxury homes nationwide rose 4.7 percent annually to an average of $1,772,000 in the fourth quarter of 2018. That’s on par with the annual growth seen in the second quarter of last year and up from a 3.2 percent growth rate in the third quarter. For this analysis, Redfin tracks home sales in more than 1,000 cities across the country and defines a home as luxury if it’s among the 5 percent most expensive homes sold in the quarter.

In the other 95 percent of the market, home prices grew 4.3 percent to an average of $341,000 in the fourth quarter.

The typical luxury home that sold in the fourth quarter went under contract in 74 days, up from 65 days in both the second and third quarters of 2018. Last quarter’s average is comparable to 2017, when luxury homes that sold in both the second and third quarters took an average of 73 days to go under contract and 78 days in the fourth quarter. Compare that with non-luxury homes: Homes that sold in the final quarter of last year took 56 days to go under contract, down from 63 days in the fourth quarter the year before.

Luxury homes sold fastest in Oakland, where homes that sold in the fourth quarter went under contract in an average of 28 days. That’s followed by San Jose (32 days), San Francisco (39 days), Seattle (44 days) and Los Angeles (54 days).

| Q4 market summary | Luxury market (top 5%) | Rest of market (bottom 95%) |

| Average sale price | $1,772,000 | $341,000 |

| Average sale price YoY | +4.7% | +4.3% |

| Average days on market | 74 | 56 |

| Days on market YoY | -4 | -7 |

| Percent of homes that sold above list price | 1.2% | 18.5% |

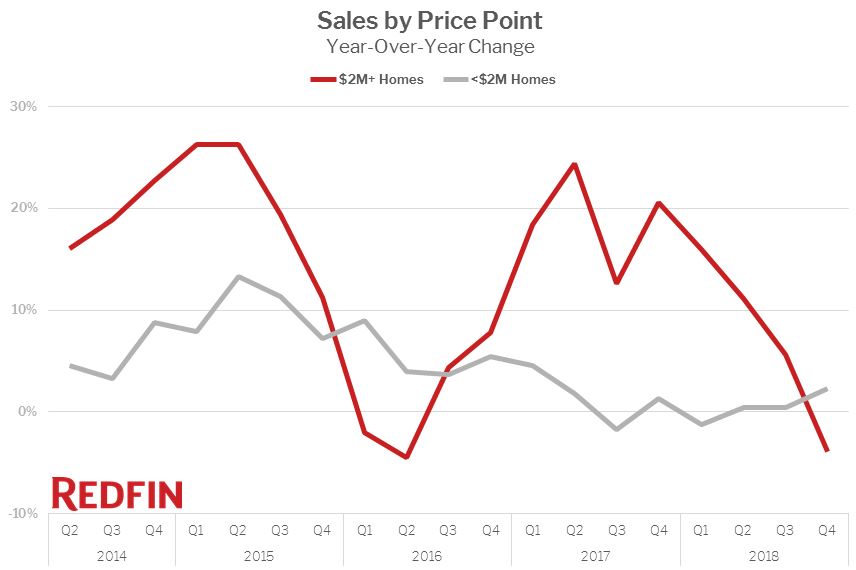

Sales and supply of $2 million-plus homes decline

Sales of homes priced at or above $2 million dropped 3.9 percent annually in the fourth quarter. That’s the first time in more than two years sales of luxury homes have fallen on a year-over-year basis.

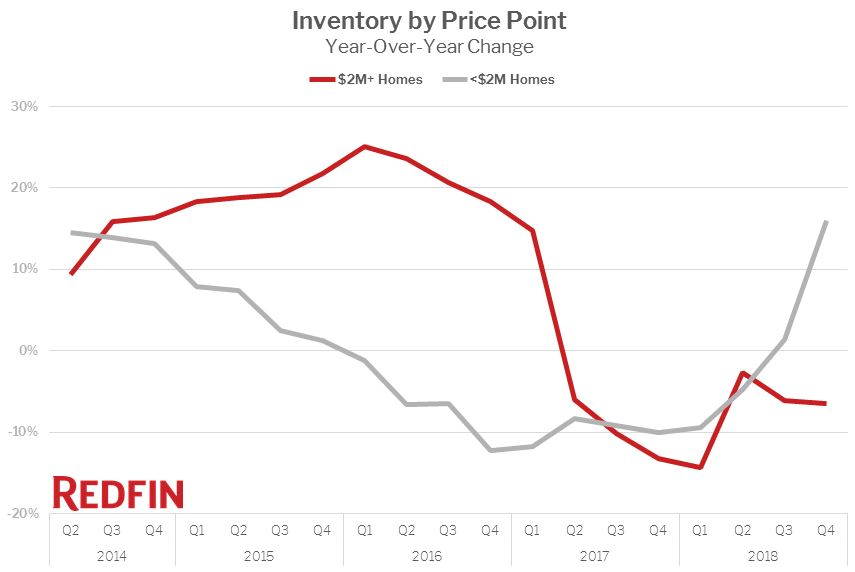

The fact that sales of high-priced homes declined as their prices grew at a relatively strong rate can be explained in part by the basics of supply and demand. Compared with a year earlier, there were 6.5 percent fewer $2 million-plus homes on the market last quarter, the seventh quarter in a row inventory of luxury homes has dropped annually.

Supply of homes priced under $2 million, meanwhile, has been on a steady upward trend since the beginning of 2018.

While domestic and global economic uncertainty may have put a bit of a damper on demand for luxury homes, the decreased supply was enough to continue to push prices up at a strong but sustainable rate just below 5 percent annually.

“In the fourth quarter of 2018 there was a lot of economic uncertainty—mortgage interest rates peaked in November, and the stock market was all over the place. This may have encouraged luxury sellers to hold on to their real estate assets and also caused luxury buyers to be reluctant to make major home purchases,” said Redfin chief economist Daryl Fairweather. “There’s also economic uncertainty abroad. For example, China’s economy slowed down at the end of 2018, which may be affecting a segment of U.S. luxury sellers and buyers whose wealth is invested overseas.”

Fairweather continued, “Finally, it’s worth noting that when we’re examining the most expensive segment of the housing market nationwide, a disproportionate amount of the movement seen in prices and sales is driven by activity—or lack thereof—in major expensive coastal markets like San Francisco and San Jose, where sales fell by double digits while price growth slowed or reversed at the end of the year.”

Biggest price gains

Cities in Florida experienced some of the biggest increases in luxury home prices. In West Palm Beach, the average sale price for the top 5 percent of homes sold in the fourth quarter was $1,628,000, up 35 percent from the year before, and in St. Petersburg prices shot up 30.7 percent to $1,427,000.

“When I moved to St. Petersburg in 2006, it had a quiet downtown with one block of shops and restaurants and a very short list of luxury condo buildings—most of which were built before 1980,” said Redfin agent Brian Walsh. “As the town has grown, it’s become known for its walkability, an exploding restaurant and nightlife scene and a beautiful waterfront, all of which makes it uniquely positioned to become the jewel of the Gulf Coast.”

“Now that the secret’s out, folks who have money to burn are flocking to St. Petersburg,” Walsh continued. “A few new luxury buildings have recently gone up, and spec builders are tearing down older, smaller homes and building large, modern properties that fit in beautifully with the aesthetic of the city.”

Here’s a look at West Palm Beach, St. Petersburg and the rest of the top 10 cities where luxury home prices shot up the fastest in the fourth quarter:

| Luxury market (top 5%) | Rest of market (bottom 95%) | |||

| City | Average sale price | YoY change | Average sale price | YoY change |

| West Palm Beach, FL | $1,628,000 | 35% | $225,000 | 7.1% |

| St. Petersburg, FL | $1,427,000 | 30.7% | $263,000 | 24.6% |

| Reno, NV | $1,429,000 | 24% | $379,000 | 8.3% |

| Boca Raton, FL | $3,142,000 | 23.9% | $363,000 | 3.7% |

| San Diego, CA | $2,961,000 | 15.2% | $632,000 | 2.6% |

| Raleigh, NC | $1,119,000 | 13.6% | $304,000 | 9% |

| Seattle, WA | $2,233,000 | 11% | $687,000 | 1.9% |

| Phoenix, AZ | $1,080,000 | 10.3% | $278,000 | 6.9% |

| Houston, TX | $1,553,000 | 8.6% | $258,000 | 4.5% |

| Spring, TX | $1,021,000 | 7.7% | $267,000 | 6.4% |

Biggest price declines

Florida cities also dominate the list of places where luxury home prices have dropped the most. Sarasota clocks in at number one with an average luxury price of $1,760,000, down 30.7 percent annually. That’s followed by Fort Lauderdale, where the average luxury home went for $2,689,000, down 26 percent from the year before. Here’s the rest of the list:

| Luxury market (top 5%) | Rest of market (bottom 95%) | |||

| City | Average sale price | YoY change | Average sale price | YoY change |

| Sarasota, FL | $1,760,000 | -30.7% | $301,000 | -20.2% |

| Fort Lauderdale, FL | $2,689,000 | -26% | $413,000 | 2.7% |

| Miami, FL | $1,743,000 | -15.3% | $325,000 | 5.5% |

| Paradise, NV | $1,066,000 | -8.9% | $251,000 | 8.2% |

| Alpharetta, GA | $1,247,000 | -7.1% | $407,000 | 1.5% |

| San Jose, CA | $2,216,000 | -5.9% | $1,002,000 | 1.3% |

| Boston, MA | $3,560,000 | -4.6% | $722,000 | 1.8% |

| Littleton, CO | $1,129,000 | -4.3% | $441,000 | 6.5% |

| Charlotte, NC | $1,058,000 | -1.6% | $262,000 | 5.2% |

| Oakland, CA | $2,228,000 | -1.6% | $791,000 | 8.1% |

Most expensive sales

Can’t afford a $46 million Hawaiian mansion? At least you can look at pictures on Redfin.com. Here’s a peek at the 10 most expensive homes sold in the fourth quarter of 2018.

- This Kauai property isn’t a hotel, but it sure does look like one. The 6-bedroom, 8.5-bathroom home, which features an infinity pool overlooking a white-sand beach, sold for just over $46 million in November, making it the most expensive sale of the fourth quarter.

- The second most expensive property sold last quarter, a 6-bedroom, 8-bathroom home that sits on the Orange County coast between Newport Beach and Laguna Beach, went for $30.5 million. The 15,000-square-foot home features a movie theater, game room, saltwater aquarium and gym—and that’s just on the inside.

- Drive up the coast to Los Angeles for the third most expensive property of the quarter, a $29.5 million lot located in the Hollywood Hills. The 4.5-acre property is ready for development and features sweeping views from the ocean through downtown.

- The California love continues with this $27.6 million Beverly Hills estate. The 5-bedroom, 8-bathroom, known as the Rutherford House, is a “contemporary Art Deco masterpiece.”

- The only property in the Northeast on last quarter’s list is Swain’s Neck, a 63-acre retreat overlooking Polpis Harbor in Nantucket. The property, which sold for $25 million, features a main house with five bedroom suites along with a guest cottage, studio, gate house and boathouse.

- With 51,000 square feet of living space, this Rolling Hills, California property is the 36th largest residence in the US, according to the listing. Known as Hacienda de la Paz, the 7.4-acre estate features two pools, two tennis courts and access to horse stables. It sold for $22.4 million.

- This newly built home, located in the Bel Air neighborhood of Los Angeles, sold for $20.5 million. Featuring five bedrooms and seven bathrooms, the property comes complete with an infinity pool, saltwater aquarium, theater and cigar room.

- With seven bedrooms and eight-and-a-half bathrooms, this Miami Beach home sits on 110 feet of waterfront. The contemporary, fully automated property sold for $20.4 million.

- Located in Woodside, California, this 12,500-square-foot estate went for $20 million. The newly constructed home sits on four acres, complete with an olive grove, barn and guest cottage.

- Number 10 on the list sold for $26 million less than number one—but it still cost its new owners $20 million. The nine-bedroom, 11-bathroom home, located on Keawakapu beach in Maui, provides a “private and secure environment away from the public eye but open to stunning Pacific Ocean views,” according to the listing.

Visit the Redfin Data Center for more housing market statistics for metro areas around the country.

METHODOLOGY

Redfin tracks the most expensive five percent of homes sold in more than 1,000 U.S. cities and compares price changes to the bottom 95 percent of homes in those cities. Analysis is based on multiple-listing and county recorder sales data in markets served by Redfin. To determine luxury market winners and losers, we looked at cities with at least 45 luxury sales in the quarter and an average luxury sale price of $1 million or higher. For inventory and sales, Redfin looked at homes priced at or above $2 million that were sold in the fourth quarter of 2018.

This post first appeared on Redfin.com. To see the original, click here.