Alabama golf course home listed at $405,000

realtor.com

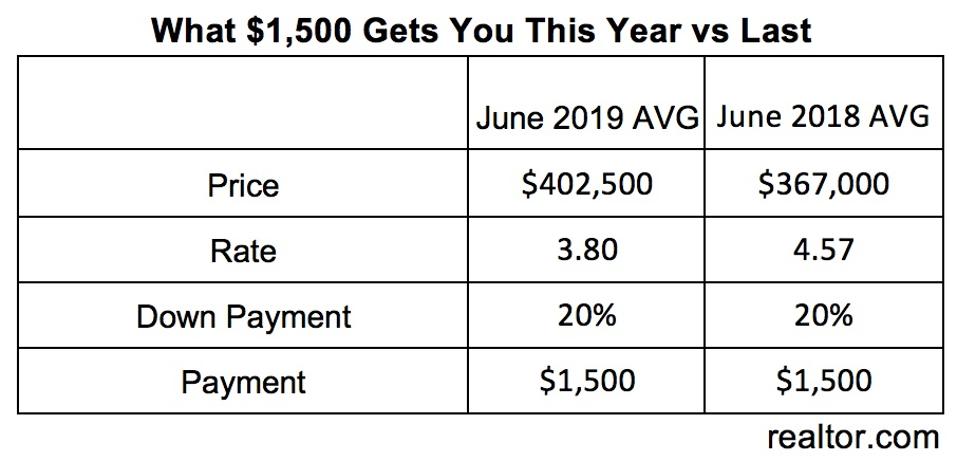

Realtor.com reports how much more home buying power there is today thanks to lower mortgage rates. The national online real estate platform recently reported on how much further a $1,500 mortgage payment goes today compared to one year ago.

Thanks to 30-year mortgage rates hovering below 4% buyers can afford more home even in areas with rising listing prices. “According to realtor.com, buyers who spend $1,500 on monthly mortgage payments can afford to purchase a $402,500 home this year, compared to $367,500 last year when mortgage rates were 4.57 percent.

Danielle Hale, Chief Economist at realtor.com explains it. “Last year, buyers would have needed to spend an additional $145 a month on top of the $1,500 to afford a $402,500 home.”

How much house a $1500 mortgage will buy this year compared to last year

realtor.com

Let’s look at the numbers around the country to see just how much more home you can get today. Realtor.com’s number-crunching assumed a 20 percent down payment and included principal and interest payments only.

In Alabama this year you can get a 3,138 square foot home on a Robert Trent Jones Golf Course with hardwood flooring and screened in porch overlooking the golf course for a listing price of $405,000. Last year you would have paid $367,500 for a home with 2,947 square feet, not on a golf course.

“An extra $35,000 in purchasing power depending on where you are in the country can really make a difference to buyers today. It still counts even with home prices up 6% nationally,” said Hale. “That increase in purchase power is greater than the national price increase,” she adds.

Last June in Peoria, Arizona a Phoenix suburb a 1,625 square foot home on a 6,500 square foot lot was listed at $369,000. Today in Queens Creek, about 38 miles northwest of Phoenix, $402,800 will get you a 3,218 square-foot home on an 8,402 square foot lot, built in 2015. Obviously, more home for the money this year.

Heading to Jacksonville, Florida a good market for home buyers $399,500 buys a three-car garage 2,892 square foot open floor plan home with gourmet kitchen. A year ago, for $368,100 in Ocala, you could buy a 2,300 square foot home. “Buyers once they are out there looking depending once again on where are surprised by how much more house, they can get this year because of lower mortgage rates. That savings of $145 a month over a year does count,” Hail observes.

Even if homebuyers prefer not to stretch their budget to that higher number, they can use their extra spending dollars for new furniture, home renovations and depending on where you live maybe even install a swimming pool.