Digital mortgage solutions are reducing discrimination in mortgage lending.

Getty

Digital mortgage solutions are doing more than just adding convenience for borrowers. According to a new study, they’re also reducing discrimination against minorities — as well as the interest rates they receive as a result.

“Consumer-lending Discrimination in the FinTech Era,” a study from the National Bureau of Economic Research, has found a link between the number of growing digital mortgage offerings and reduced discrimination in the lending industry.

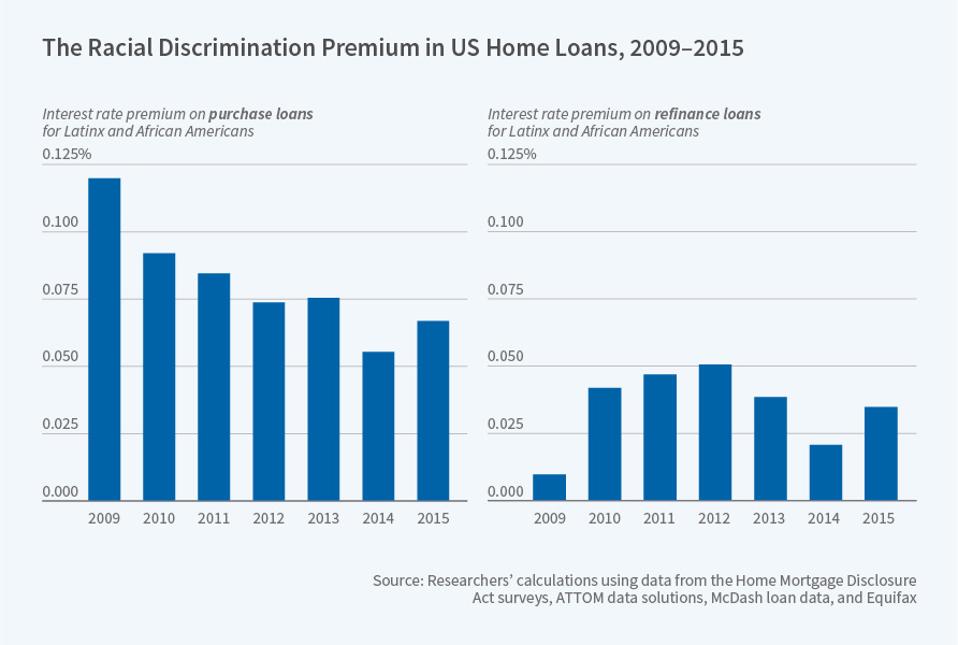

According to the findings, black and Latinx homebuyers currently see an interest rate that’s 0.79% higher on average than other borrowers. It’s a big difference, but it’s one that has shrunk significantly in recent years. In 2009, Latinx and black borrowers saw rates nearly 1.25% higher than other borrowers.

This chart shows the difference in interest rates between for minority borrowers.

Courtesy of the National Bureau of Economic Research

The change is thanks to an increased move toward automation in the mortgage industry, one in which many lenders are using app-based, algorithmic processes, rather than face-to-face ones.

For loans originated using online or app-based platforms, Latinx and black homebuyers pay just 0.53% more than other groups — a reduction of 0.26%. They also pay less to refinance than with face-to-face processes.

All in all, the study finds that algorithmic lending reduces discrimination by 40% when compared to face-to-face lending options. It also encourages borrowers to shop around more and increases competition among lenders.

Additionally, algorithmic lending also removes discrimination in accept-or-reject decisions on mortgage lending, according to the study. Black and Latinx borrowers are rejected 6% more than non-minority ones, even with the same financial profiles. The study found that automated mortgage solutions would have removed this bias, accepting and rejecting comparable candidates evenly.

The number of mortgage lenders offering algorithmic loan origination has grown in recent years. Of the 2,000-plus lenders analyzed in the study, 45% offer some sort of online or app-based mortgage process.

“While these lenders continue to provide conventional, face-to-face loan applications, the trend is clearly toward automated underwriting,” the study says.

Online mortgage solution Rocket Mortgage is just one such example. The platform accounted for two-thirds of its parent company Quicken Loans’ $32 billion in originations last quarter.