Interest rates changed direction this week by creeping back over 3%

getty

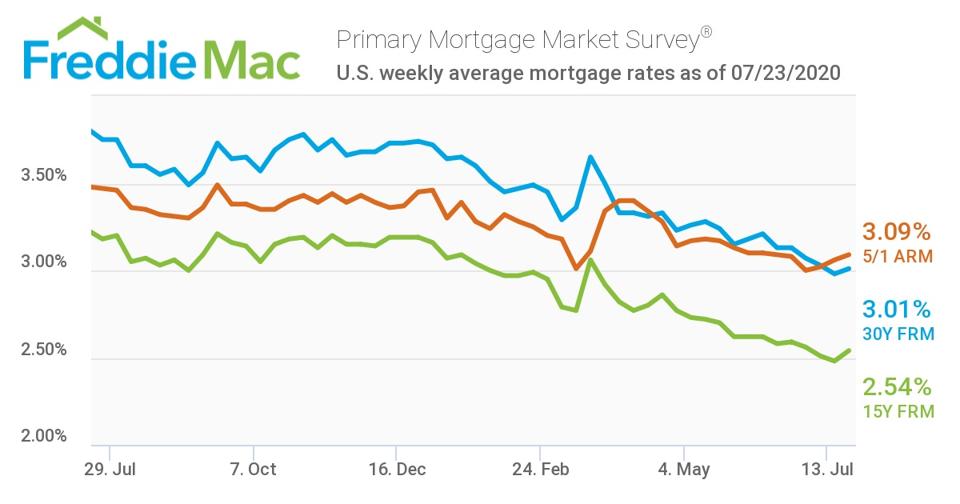

The story of the month was last week when mortgage interest rates dipped below 3% for the first time on record—a threshold many in the industry doubted would ever happen. The trend has reversed its course—slightly—in the past week with 30-year fixed rate loans landing at 3.01%, according to the weekly report from Freddie Mac.

The 15-year fixed rate loans are still comfortably below 3%, with an average rate of 2.54% for the past week. This is an increase from last week when they had dropped to 2.48%. For both the 15- and 30-year loans this is the first time in several weeks they have increased. All the increases that have taken place prior to early July since the outbreak of Covid were also only slight fluctuations for what has been a consistently downward trend ever since March.

Interest rates have been steadily decreasing since March

Freddie Mac

Data released today from the U.S. Census Bureau showed the number of home sales that closed in June increased by 14% compared to May. With 776,000 total closed transactions, it was also the highest number of home sales for June since 2007.

“Record-low mortgage rates and pent-up demand from the spring continue to be main drivers for the housing market this summer,” commented Mortgage Banker Association’s Joel Kan’s, Associate Vice President of Economic and Industry Forecasting in a statement. “Sales were up 7 percent year-over-year, and all regions except for the South were back to a sales pace higher than a year ago.”

The weekly data on how many mortgage applications have been recorded show demand has remained strong, with a 19% increase compared to the week before.

While all the numbers point to a robust recovery from the dearth of sales a few months ago, there are still reasons to be cautious over the coming months. Sam Khater, Freddie Mac’s Chief Economist, said in the release, “The most recent consumer spending data has been pointing to slow growth since mid-June. The concern is that the pause in economic activity will cause unemployment to remain elevated which will lead to longer-term labor market distress.”