And three southern metros—Louisville, Charlotte and Nashville—experienced the largest rise in low-income homeownership from 2012 to 2017.

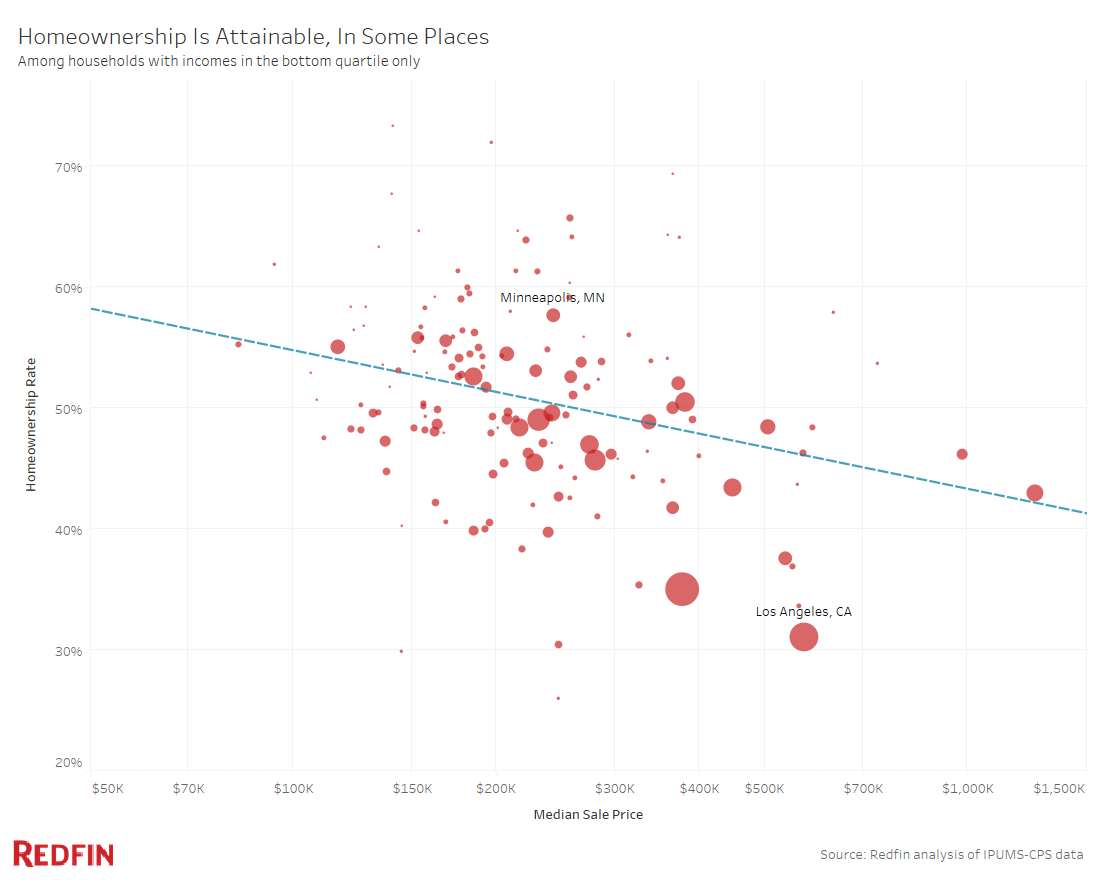

Minneapolis has the nation’s highest homeownership rate for low-income families. In the Minneapolis area, 57.7 percent of households with incomes in the bottom 25th percentile for the metro area were homeowners in 2017, followed by Pittsburgh (55.8%) and St. Louis (55.5%), all inland areas where the typical home sells for the less than the national median of $285,000. Minneapolis, Pittsburgh and St. Louis are also all in the top 10 of Redfin’s ranking of most affordable metros for millennials, with St. Louis and Pittsburgh coming in at first and second.

“Homeownership allows people to share in the prosperity of their communities and gain wealth through home equity,” said Redfin chief economist Daryl Fairweather. “In many expensive metros, low-income residents aren’t able to access the benefits of homeownership because of a lack of affordable starter homes. But in areas like Minneapolis and Pittsburgh, low-income workers are still able to get their foot in the door on the American Dream of homeownership.”

| Top Metros for Low-Income Homeownership, Ranked by Rates Among Bottom 25% of Income Earners in 2017 | |||||||

| Rank | Metro area | Homeownership rate among households in bottom 25% of income (2017) | Homeownership rate among households in bottom 25% of income (2012) | Percentage point change in low-income homeownership from 2012 to 2017 | Income cutoff for bottom 25% of earners in metro area (2017) | Homeownership rate overall (2017) | Median sale price (Jan. 2019) |

| 1 | Minneapolis, MN | 57.7% | 53.7% | 4 pts. | $55,000 | 75.6% | $255,000 |

| 2 | Pittsburgh, PA | 55.8% | 53.8% | 2 pts. | $41,000 | 74.3% | $149,000 |

| 3 | St. Louis, MO | 55.5% | 52.3% | 3.2 pts. | $43,000 | 74.4% | $173,000 |

| 4 | Detroit, MI | 55% | 51.8% | 3.2 pts. | $40,200 | 74.8% | $122,000 |

| 5 | Tampa, FL | 54.4% | 52.2% | 2.2 pts. | $36,000 | 68.9% | $220,000 |

| 6 | Louisville, KY | 54.2% | 49% | 5.2 pts. | $41,750 | 74.2% | $181,000 |

| 7 | Salt Lake City, UT | 53.8% | 53.2% | 0.6 pts. | $52,000 | 75.4% | $319,000 |

| 8 | Nashville, TN | 53.7% | 49.6% | 4.1 pts. | $43,400 | 71.7% | $284,000 |

| 9 | Charlotte, NC | 53.1% | 48.9% | 4.2 pts. | $40,600 | 70.9% | $230,000 |

| 10 | Philadelphia, PA | 52.6% | 53.2% | -0.6 pts. | $51,000 | 72.8% | $190,000 |

“Minneapolis has a large supply of condos and townhomes that are priced lower than the median for the area, which is one reason why it’s affordable for people of all different means and backgrounds,” said Chris Prescott, a Redfin market manager in Minneapolis. “There are still some great locations in the area where homebuyers can purchase a single-family fixer-upper at an affordable price and build equity. Plus, it’s a large geographic area, so buyers can live outside the core and still enjoy a reasonable commute into the city or find a good job in our growing suburbs.”

Los Angeles, New York and San Diego, all expensive coastal markets, are home to the three lowest homeownership rates for households in the bottom quartile of income at 31 percent, 35 percent and 37.6 percent, respectively. Los Angeles and San Diego feature in the top three least affordable places for millennials. This analysis includes the 50 largest metro areas in the U.S.

| Bottom Metros for Low-Income Homeownership, Ranked by Rates Among Bottom 25% of Income Earners in 2017 | |||||||

| Rank | Metro area | Homeownership rate among households in bottom 25% of income (2017) | Homeownership rate among households in bottom 25% of income (2012) | Percentage point change from 2012 to 2017 | Median household income for bottom 25% of earners in metro area | Homeownership rate overall | Median sale price (Jan. 2019) |

| 1 | Los Angeles, CA | 31% | 28.3% | 2.7 pts. | $44,600 | 54.3% | $590,000 |

| 2 | New York, NY | 35% | 32.2% | 2.8 pts. | $50,800 | 60.8% | $938,000* |

| 3 | San Diego, CA | 37.6% | 33.5% | 4.1 pts. | $50,000 | 57.7% | $559,000 |

| 4 | Las Vegas, NV | 39.7% | 38.6% | 1.1 pts. | $38,807 | 59.5% | $280,000 |

| 5 | Columbus, OH | 39.8% | 37.4% | 2.4 pts. | $43,000 | 66% | $188,000 |

| 6 | Milwaukee, WI | 40.5% | 36.9% | 3.6 pts. | $42,800 | 66.3% | $190,000 |

| 7 | Sacramento, CA | 41.7% | 37% | 4.7 pts. | $46,000 | 64.4% | $369,000 |

| 8 | Virginia Beach, VA | 42.2% | 39.9% | 2.3 pts. | $47,000 | 64.7% | $250,000 |

| 9 | Memphis, TN | 42.2% | 40.1% | 2.1 pts. | $33,550 | 65.1% | $156,000 |

| 10 | Providence, RI | 42.6% | 39.8% | 2.8 pts. | $46,200 | 65.9% | $238,000 |

*Average sale price of a home in New York City in Q4 2018, per REBNY

In nine of the 10 metro areas with the highest homeownership rates for low-income families, the rate went up from 2012 to 2017, with the largest gains in Louisville (5.2 percentage points), Charlotte (4.2 pts.) and Nashville (4.1 pts.). Philadelphia is the only are in the top 10 where the homeownership rate went down during that time period, but the drop was only 0.6 percentage points. The rate also rose in all 10 of the least affordable areas for low-income families, with Sacramento (4.7 pts.) and San Diego (4.1) points seeing the biggest increases. There are many explanations for rising homeownership rates among low-income families in expensive areas, including households in the bottom quartile of income moving out of rental properties and into informal living arrangements with family or friends.

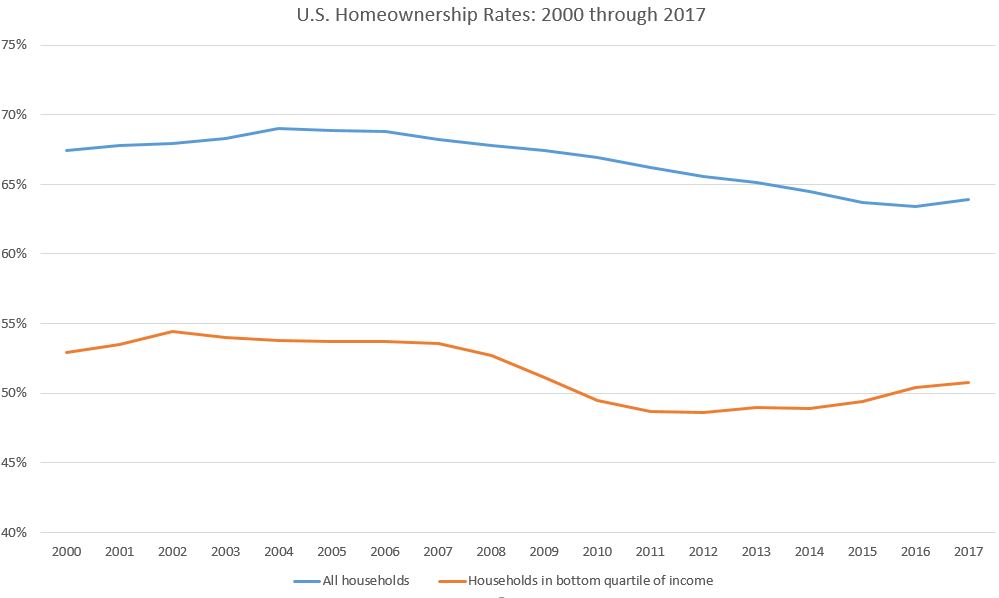

The national overall homeownership rate and that for the bottom quartile of owners trended downward starting in 2004. For the bottom quartile, it started to tick up in 2012, while the overall rate didn’t start increasing until 2017.

In general, homeownership for people in the bottom income quartile is more common where housing is relatively inexpensive. But as is evident in the chart below, low-income homeownership is also scarce in some inexpensive areas such as Columbus and Memphis.

This post first appeared on Redfin.com. To see the original, click here.