After an unprecedented first half of 2020, what could the next six months bring? Here is what five … [+]

Getty

Mortgage rates are searching for a historic bottom. Home prices are inching up toward record highs. Home shoppers are looking for deals. Homeowners are weighing selling versus refinancing.

A lot is going on in the U.S. housing market on the backdrop of an even messier national state of affairs. After an unprecedented first half of 2020, what could the next six months bring? Here is what five housing economists and experts anticipate.

Is it going to be a V-shaped or a W-shaped housing market recovery? Why?

Mark Fleming, chief economist at First American Financial Corporation, a provider of title insurance and settlement services:

“It seems hard to deny that when one looks at many of the housing market statistics, a “V” shape is quite apparent. The main reason for the strong rebound is that factors existing before the coronavirus hit (lack of supply, low mortgage rates and a millennial demand for homeownership) have continued or even gained strength. Mortgage rates are even lower, supply is even tighter and millennials are still house hunting.”

Ralph McLaughlin, chief economist and senior vice president of analytics at Haus, a home equity startup:

“It’s going to be a W shape housing market recovery for three reasons. First, we think there will be an initial rebound simply due to pent-up demand for home buying that would have otherwise occurred in March, April, and May but will simply be pushed to June, July, and August. But after that, we’re not expecting new demand to replace it at comparable levels, which will lead to another drop in activity. Second, and I think we’re seeing this already, is that the virus will make a comeback, which will lead to less demand for homebuying in the fall. Third, there’s a possibility that we’ll see a broader impact on housing demand if the federal unemployment insurance bonus runs out at the end of the month.”

Taylor Marr, lead economist at real estate brokerage Redfin:

“Most certainly a W, though the second dip is likely to be way more muted than the first. The initial impact was so deep, because uncertainty was extremely high. Financial markets and mortgage markets hate uncertainty, so they were impacted more by the initial shock. However, they, then, stabilized and have been recovering, which has helped housing recover as well. After the pent-up demand subsides past the middle of the W (where we likely are now), housing will return more to a steady state, but economic impacts continue to linger as cases surge in key states resulting in rolling back opening the economy.”

What housing indicators will trend up in the second half of 2020?

Todd Teta, chief product and technology officer at real estate data and solutions provider Attom Data:

“If prices continue to level off or go down, which seems likely given current economic conditions, home equity levels will also drop. At the same time, unless the economy races ahead, unemployment will remain high, which probably will lead to foreclosures rising after the moratorium is lifted on lenders pursuing delinquent homeowners with federally insured mortgages. (The moratorium is currently in effect until August 31.) Under the current scenario, the most likely thing to trend up will be foreclosures, whenever the moratorium expires.”

Fleming: “One absolutely clear beneficiary of the supply and demand imbalance in the market today will be price appreciation. We expect it to remain strong, even accelerate in many markets this summer. You can’t buy what’s not for sale. And buyers will likely feel pressure to escalate their bids to win the “bidding war” on homes that are for sale.”

Marr: “Home builders have been supplying more of the inventory. As the virus continues to spread, new construction is especially attractive to tour and build.”

What housing indicators might be slower to recover than others? Why?

Jeff Tucker, economist at real estate listing website Zillow:

“The incredibly limited supply of homes could keep a lid on home sales activity for the rest of the year. It’s hard to record a home sale if no one is willing to sell their home.”

McLaughlin: “We expect that some indicators are likely to follow a W, while others might follow a different path. We’re expecting employment growth, home sales, price growth, and housing starts to follow a “W’ pattern, which will give us several ups and downs, whereas we’re forecasting refinance activity to be more waterfall shaped. Other indicators are likely to buck the trend. For example, we could actually see an uptick in the homeownership rate if renters are hit harder than owners.”

What will have to happen for more home sellers to come back to the market?

Fleming: “The challenge is that sellers are also buyers. About two-thirds of all home buyers are existing homeowners. What will it take for more existing homeowner buyers to come back to the market? Ironically, more supply! Housing is not like most goods. It has to be “better” than the one the potential buyer currently owns now, and when the supply dwindles, it becomes harder to find a better house and easier to just refinance and do a renovation instead. This fear of not being able to find something better, the fact that selling and moving is, let’s face it, a pain and costly, combined with the fact that one can refinance into an amazingly low rate. Why move?”

Marr: “Lower coronavirus transmission rates within a community will ease some health concerns of sellers, and continual reopening of the economy will ease concerns about job losses as well. The longer the pandemic keeps businesses closed, the more cautious sellers will be about their own financial situation. But it’s also an issue of lack of inventory, which makes this a bit of a chicken or the egg issue. Move-up buyers need to find another home before they decide to list, but there aren’t enough homes for sale as sellers aren’t listing as much (relative to buyers making offers).”

Tucker: “A lot of boomers were already sitting tight in their homes, and now it’s understandable that people would delay moving into nursing homes. The best hope for a source of new listings might be builders, who seem to be recovering confidence after pressing pause on construction during shutdowns this spring.”

Is the home-buying demand we are seeing today sustainable for the rest of the year?

Fleming: “No, it will tail off a little. When the virus hit and we all had to stay at home, the haircuts and restaurant meals missed were consumption never to return. But, home buying can be deferred. Part of the big surge in demand as stay-at-home orders have been lifted was the pent-up (at home) spring demand, which deferred until the early summer. So, I expect as that deferred demand works its way through, demand will cool down. But I still expect it to remain strong by historic standards. Our research shows that millennial demand for homeownership continues to gain strength, and is a strong demographic demand tailwind for the housing market.”

Marr: “No. Much of the surge in demand the last few weeks was pent-up from the spring buying season. Demand is likely to ease now, but there are still many tailwinds for housing. The first is record low mortgage rates, which incentivizes renters to buy as monthly mortgage payments come down. The second is the growth of working from home, home gyms, homeschooling, etc. that makes home more important than ever. This creates more demand for purchasing a bigger or better home. The third is demographic. Pandemic aside, there were already very large numbers of millennial households entering into prime first-time home buying age. Finally, growing unemployment is the biggest headwind, but that remains much more concentrated to the rental market so far.”

Where are home prices going?

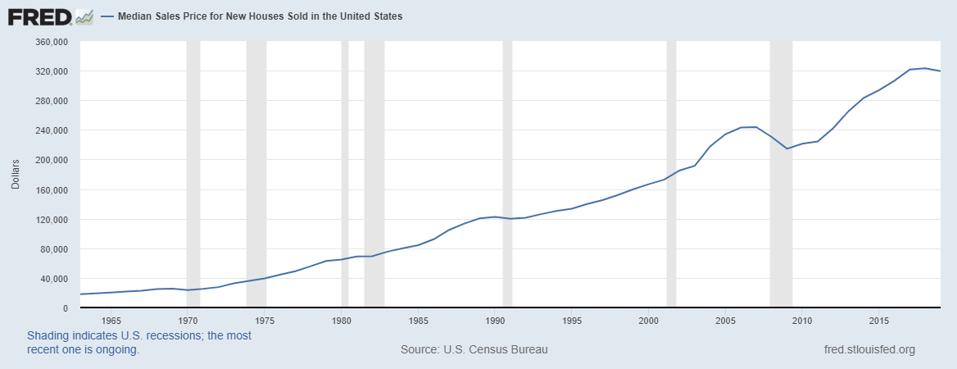

Fleming: “Our research has found that in past recessions, house prices show their “downside stickiness,” meaning they remain flat or their growth slows during economic downturns, but often do not decline much with one exception – the Great Recession. Because of the downside stickiness of home prices, and the supply and demand imbalance that exists in the market today, we anticipate nominal house price appreciation to actually accelerate this summer. House prices are going up!”

Marr: “As mortgage rates decline, prices rise. Demand fell, but so did supply, which muted any impact to home prices. Right now, they are continuing to grow at the same pace as before the pandemic. Growth may slow as the economic impacts grow, but the consensus is that home prices will continue to rise over the year.”

![S&P/Case-Shiller U.S. National Home Price Index [CSUSHPISA]](https://specials-images.forbesimg.com/imageserve/5f08bb98cf35c00006995d44/960x0.jpg?fit=scale)

The S&P/Case-Shiller U.S. national home price index tracks the behavior of home prices during … [+]

St. Louis Fed

Tucker: “Overall, Zillow is forecasting a slight decline in home prices through October, followed by a slow recovery through 2021.”

McLaughlin: “We think price growth is going to slow, and even possibly turn negative, by the beginning of next year, as lower aggregate demand emerges and legislation that protects homeowners from foreclosure expire. However, we do expect price grow quite strongly by the end of next year, growing between 4-6% on a year-over-year basis.”

Teta: “Some pockets around the country may do well – like suburban areas around big cities if large numbers of people decide to move because of concerns that it’s too risky to stay in densely populated places where the virus has spread so rampantly. That could sew a silver lining into the market. But it may be more likely that the price boom of recent years is in serious jeopardy.”

St. Louis Fed

The consensus is that mortgage rates will stay low – do you agree? What will keep them low? What may make them go up?

Marr: “The global economic environment is very uncertain and will be for quite some time, which keeps long-term bond yields low—which mortgage rates track. A swath of positive economic news will shift investment from bonds to stocks, which may make rates rise, but the rise would be limited as the spread between mortgage rates and 10-year treasury yields continues to be fairly high and has a bit of room to narrow, before mortgage rates rise much.”

Teta: “It does look like they will stay low in the near future, or longer. The federal government is actively looking for ways to stimulate the economy, which includes low interest rates. Until the economy shows a significant recovery or when inflation spikes, the current super-low rates probably are unlikely to rise much for some time. When there is notable inflation, that could certainly shift rates back up.”

Who might emerge as “winners” in the 2020 housing market?

Fleming: “Homeowners are the clear winners. Low mortgage rates mean the cost of owning is at historically low levels and who gains all the benefits of strong house price appreciation? Homeowners.”

Tucker: “Identifying winners is a little macabre, but millions of homeowners could save thousands of dollars on interest by locking in these low interest rates with a purchase or refinance loan.”

Teta: “Savvy bargain hunters and possibly sellers in suburban regions. Buyers with good credit, enough money for a significant down payment and some patience could land some very nice deals if prices keep flattening out or declining. Those buyers could include investors who can rent out properties for a while and then flip them when the market bounces back. On the seller side, anyone who finds themselves in newly sought-after areas also could benefit nicely from a shift in interest among buyers who want to move away from areas where the virus has spiked.”

Who the “losers” might be?

Fleming: “Potential first-time home buyers. The nominal price of homes is only going to rise and even though rates are low now, they will eventually rise. The “real” house-buying power adjusted price of homes is still low, but will only rise in the coming years. Now’s the time to buy if you can find something!”

McLaughlin: “Buyers who thought they were going to get the deal of a century.”

Going into the second half of 2020, what concerns you and why?

Fleming: “First and foremost is the health crisis. Addressing that is both good economic and good housing policy. After that, the problem that we had BC (Before Coronavirus) and will have AC (After Coronavirus) is a shortage of housing supply. We have to build more homes to meet the growing millennial demand.”

Tucker: “The biggest risk to both the rental market and the owner-occupied market is a continued resurgence of viral infections, which would jeopardize state plans to reopen sectors of the economy, and complicate school starting in the fall. As emergency fiscal policies from the CARES Act expire, especially boosted unemployment benefits which are scheduled to end in July, American households could end up worse off than they were this spring.”

Teta: “There are no signs of an imminent market crash. But the greatest fear is that the pandemic continues for months and months and then conditions spiral into a vicious cycle that tanks prices, sends foreclosures soaring upward and causes problems in the banking system, similar to what happened right before Great Recession hit in 2007. That’s a worst-case scenario, but it is not out of the question.”