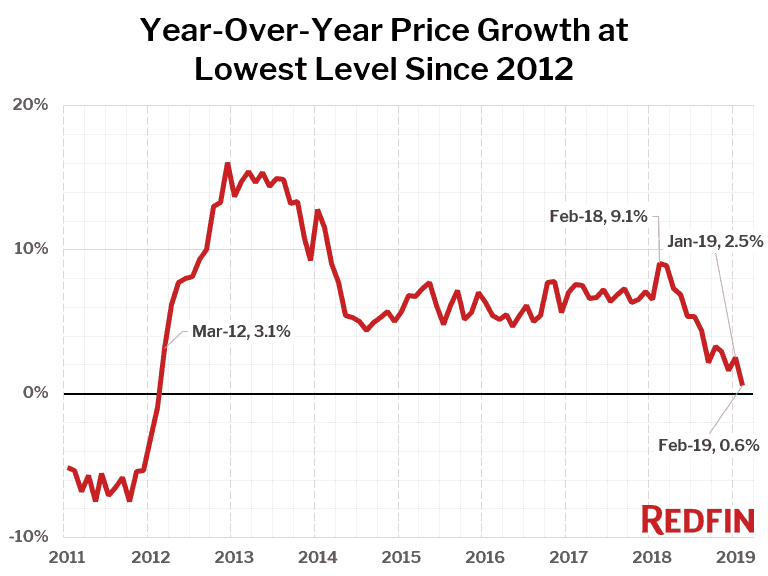

U.S. home-sale prices increased just 0.6 percent in February compared to a year ago, to a median of $287,400 across the metros Redfin tracks. This is the smallest year-over-year price increase recorded since prices stopped falling year-over-year in March 2012.

| Market Summary | February 2019 | Month-Over-Month | Year-Over-Year |

|---|---|---|---|

| Median sale price | $287,400 | 1.0% | 0.6% |

| Homes sold | 189,100 | 3.3% | 1.9% |

| New listings | 273,500 | 0.3% | -4.8% |

| All Homes for sale | 760,800 | 0.0% | 2.9% |

| Median days on market | 59 | 2 | 2 |

| Months of supply | 4 | -0.2 | 0 |

| Sold above list | 17.8% | 0.9% | -3.7% |

| Median Off-Market Redfin Estimate | $298,400 | -0.1% | 5.2% |

| Average Sale-to-list | 97.7% | 0.4% | 0.0% |

“When home prices are going up quickly, buyers feel like they are forced to move fast and purchase a home before prices rise even more. Now that home prices are growing slower than inflation (prices for consumer goods were up 1.5% annually in February), there really isn’t much downside to taking your time,” said Redfin chief economist Daryl Fairweather. “And now that mortgage rates are no longer going up every week, buyers in many markets have the luxury of knowing that whether they buy now or later they will pay about the same for a home.”

Home prices fell year over year in just 10 of the 85 largest metro areas Redfin tracks:

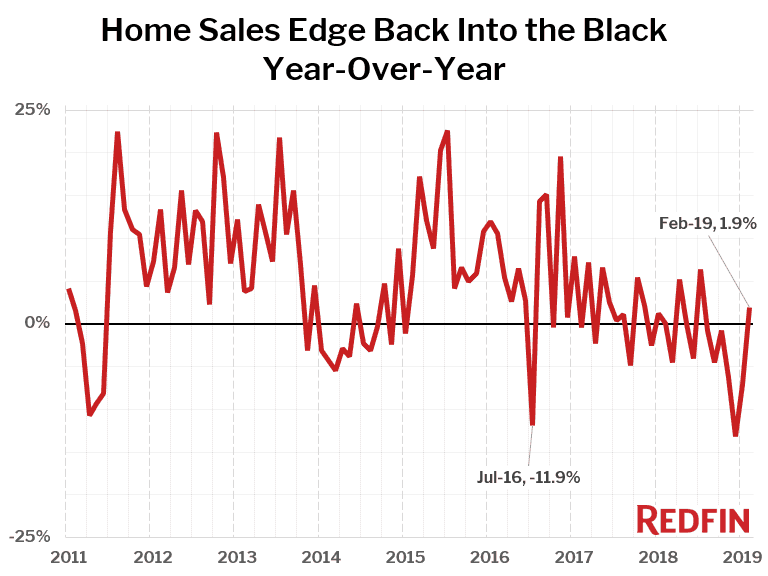

Completed home sales rose nationally for the first time in seven months and only the third time in the past 12 months in February, up 1.9 percent from a year earlier. Growth in home sales has see-sawed above and below zero, but the overall trend has been falling since late 2016. February may be the start of a reversal in this trend. Home sales fell in 41 of the 85 largest metro areas that Redfin tracks.

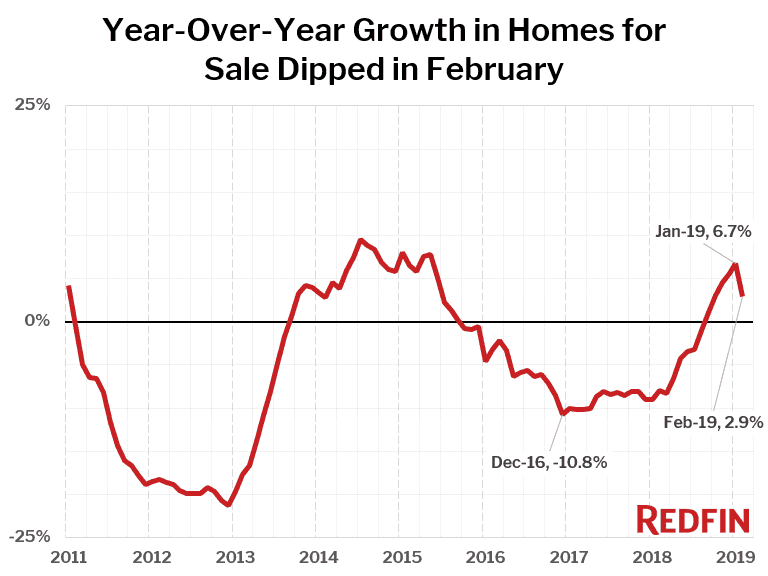

The number of homes for sale at the end of the month was up 2.9 percent from a year earlier in February. The number of homes newly listed for sale fell from February 2018 (-4.8%).

Of the 85 largest metro areas Redfin tracks, 49 saw an increase in the number of homes for sale compared to a year earlier, with the largest gains coming in Seattle (+101.2%) and San Jose (+82.1%). Months of supply (inventory divided by monthly sales) is still very low in both these markets—1.9 in Seattle and 2.5 in San Jose, giving sellers a clear upper hand. A market that is balanced between buyers and sellers typically has between four and six months of supply.

The metro areas with the biggest declines in homes for sale were New Orleans (-35.0%) and St. Louis (-23.8%).

Home-selling speeds, which reached a record-fast median pace of 35 days on market last May, slowed year-over-year again in February. The typical home that sold in February went under contract in a median of 59 days, two days longer than a year earlier.

“Because homes are sitting on the market longer and the market is less competitive than last year, first-time homebuyers now have a better chance of winning a home,” said Fairweather. “That could mean more potential buyers in the spring. Home sales are already rebounding this month, and that trend may continue now that the market is more balanced.”

In February, 17.8 percent of homes sold above the list price, down from 21.5 percent in February 2018, but up slightly from January. Meanwhile 20.5 percent of homes on the market in February had a price drop, up from February 2018’s share of 18.1 percent. The share of homes that went under contract within two weeks inched up to 15.4 percent in February, up just barely from the February 2018 level of 15.3 percent.

Other February Highlights

Competition

- Oakland, CA was the fastest market, with half of all homes pending sale in just 18 days, up from 13 days a year earlier. San Francisco and Denver were the next fastest markets with 22 and 27 median days on market, followed by Grand Rapids, MI (28) and Tacoma, WA (30). This marks a stark change from January, when Buffalo (now the 17th fastest with a median 42 days on market), Grand Rapids and Omaha (now the 7th fastest with a median 33 days on market) were the nation’s fastest housing markets.

- The most competitive market in February was San Francisco where 61.0% of homes sold above list price, followed by 49.1% in Oakland, CA, 46.0% in San Jose, CA, 40.4% in Tacoma, WA, and 30.8% in Salt Lake City.

Prices

- Newark, NJ had the nation’s highest price growth, rising 12.2% since last year to $330,000. Milwaukee had the second highest growth at 11.8% year-over-year price growth, followed by Buffalo, NY (11.7%), Cincinnati (11.3%), and Grand Rapids, MI (9.6%).

- 10 metros saw price declines in February. Bridgeport, CT declined the most since last year falling 15.2 percent to $335,000.

Sales

- Grand Rapids, MI led the nation in year-over-year sales growth, up 32.8%, followed by Baltimore, up 28.2%. Tampa, FL rounded out the top three with sales up 26.4% from a year ago.

- Fresno, CA saw the largest decline in sales since last year, falling 29.3%. Home sales in Buffalo, NY and Orange County, CA declined by 26.3% and 18.5%, respectively.

Inventory

- Seattle had the highest increase in the number of homes for sale, up 101% year over year, followed by San Jose, CA (82%) and Oxnard, CA (48%).

- New Orleans had the largest decrease in overall inventory, falling 35% since last February. St. Louis (-24%), Rochester, NY (-23%), and Camden, NJ (-21%) also saw far fewer homes available on the market than a year ago.

Redfin Estimate

- The median list price-to-Redfin Estimate ratio was 95.0% in San Francisco, the lowest of any market. Only 12.3% of homes in San Francisco were listed for more than their Redfin Estimate.

- Conversely, the median list price-to-Redfin Estimate ratio was 102.3% in Miami and 102.3% in West Palm Beach, FL, which means sellers are listing their homes for more than the estimated value in those metro areas.

New this month: You can now generate a downloadable/printable summary of your local housing market stats in the Redfin Data Center. Here’s the national view:

Below are market-by-market breakdowns for prices, inventory, new listings and sales for markets with populations of 750 thousand or more. For downloadable data on all of the markets Redfin tracks, visit the Redfin Data Center.

Median Sale Price

| Redfin Metro | Median Sale Price | Month-Over-Month | Year-Over-Year |

|---|---|---|---|

| Albany, NY | $202,000 | 0.0% | 7.9% |

| Allentown, PA | $185,000 | 0.1% | 8.8% |

| Atlanta, GA | $234,800 | 2.9% | 8.3% |

| Austin, TX | $295,800 | 0.3% | -0.3% |

| Bakersfield, CA | $230,500 | -0.2% | 2.4% |

| Baltimore, MD | $250,000 | 2.0% | 2.9% |

| Baton Rouge, LA | $199,900 | 3.0% | 2.5% |

| Birmingham, AL | $189,400 | 5.1% | 1.3% |

| Boston, MA | $451,700 | -3.9% | 3.1% |

| Bridgeport, CT | $335,000 | -6.2% | -15.2% |

| Buffalo, NY | $145,200 | 3.7% | 11.7% |

| Camden, NJ | $172,000 | 1.2% | 9.6% |

| Charlotte, NC | $235,100 | 2.2% | 4.7% |

| Chicago, IL | $230,000 | 3.1% | 2.7% |

| Cincinnati, OH | $177,400 | 7.5% | 11.3% |

| Cleveland, OH | $139,000 | 0.7% | 5.7% |

| Columbus, OH | $195,000 | 3.0% | 8.4% |

| Dallas, TX | $285,000 | 5.2% | -0.4% |

| Dayton, OH | $129,000 | 13.9% | 7.9% |

| Denver, CO | $399,900 | 1.4% | 0.5% |

| Detroit, MI | $125,000 | 4.2% | 8.7% |

| El Paso, TX | $163,000 | 8.0% | 8.0% |

| Fort Lauderdale, FL | $260,000 | 6.5% | 7.0% |

| Fort Worth, TX | $235,000 | 2.6% | 4.4% |

| Fresno, CA | $260,000 | -1.9% | -1.2% |

| Grand Rapids, MI | $194,000 | -0.5% | 9.6% |

| Greenville, SC | $200,000 | -3.7% | 5.3% |

| Hampton Roads, VA | $220,000 | 4.8% | 1.4% |

| Hartford, CT | $195,500 | -0.3% | 0.8% |

| Honolulu, HI | $543,000 | -8.9% | -2.2% |

| Houston, TX | $232,000 | 3.6% | 2.8% |

| Indianapolis, IN | $170,000 | 3.0% | 1.7% |

| Jacksonville, FL | $222,000 | 5.7% | 0.9% |

| Kansas City, MO | $200,000 | -4.3% | 5.3% |

| Knoxville, TN | $186,800 | 1.0% | 1.0% |

| Las Vegas, NV | $275,000 | -1.8% | 7.2% |

| Long Island, NY | $445,000 | 2.7% | 7.5% |

| Los Angeles, CA | $600,000 | 1.7% | 0.8% |

| Louisville, KY | $182,000 | 0.0% | 7.1% |

| McAllen, TX | $149,200 | -1.6% | 2.9% |

| Memphis, TN | $166,000 | 6.4% | 8.3% |

| Miami, FL | $295,000 | 1.9% | 5.4% |

| Milwaukee, WI | $190,000 | -1.0% | 11.8% |

| Minneapolis, MN | $265,000 | 3.7% | 8.2% |

| Montgomery County, PA | $284,200 | -4.0% | 0.8% |

| Nashville, TN | $279,000 | -1.8% | 1.5% |

| New Haven, CT | $199,000 | 7.6% | 7.6% |

| New Orleans, LA | $210,000 | 6.0% | 8.0% |

| New York, NY | $380,000 | -3.8% | -1.3% |

| Newark, NJ | $330,000 | 1.7% | 12.2% |

| Oakland, CA | $700,000 | 6.1% | 5.6% |

| Oklahoma City, OK | $173,800 | 3.8% | 8.7% |

| Omaha, NE | $190,000 | -2.6% | 5.6% |

| Orange County, CA | $678,500 | -0.9% | -2.4% |

| Orlando, FL | $249,400 | 3.9% | 6.1% |

| Oxnard, CA | $575,000 | -0.9% | 0.0% |

| Philadelphia, PA | $189,900 | 0.3% | 5.5% |

| Phoenix, AZ | $267,000 | 0.4% | 4.1% |

| Pittsburgh, PA | $155,000 | 4.0% | 4.1% |

| Portland, OR | $390,000 | 2.6% | 3.0% |

| Providence, RI | $255,000 | -1.9% | 4.1% |

| Raleigh, NC | $286,000 | 4.0% | 4.0% |

| Richmond, VA | $232,200 | -0.9% | 2.5% |

| Riverside, CA | $366,000 | 2.2% | 3.7% |

| Rochester, NY | $131,000 | 0.8% | 4.8% |

| Sacramento, CA | $385,000 | 4.3% | 2.4% |

| Salt Lake City, UT | $320,000 | 0.0% | 5.3% |

| San Antonio, TX | $218,000 | 1.6% | 4.8% |

| San Diego, CA | $561,000 | 1.1% | 2.2% |

| San Francisco, CA | $1,280,000 | 3.9% | -7.9% |

| San Jose, CA | $1,040,000 | 1.5% | -11.3% |

| Seattle, WA | $547,300 | 5.3% | 3.3% |

| St. Louis, MO | $165,000 | -4.6% | 0.0% |

| Tacoma, WA | $357,400 | 5.8% | 8.3% |

| Tampa, FL | $225,000 | 2.3% | 7.1% |

| Tucson, AZ | $215,100 | 0.1% | 3.9% |

| Tulsa, OK | $158,000 | 1.9% | -1.2% |

| Warren, MI | $190,000 | 1.1% | 4.7% |

| Washington, DC | $379,900 | 1.3% | 2.7% |

| West Palm Beach, FL | $273,600 | 5.2% | 6.1% |

| Worcester, MA | $245,000 | 0.0% | 3.4% |

| National | $287,400 | 1.0% | 0.6% |

Homes Sold

| Redfin Metro | Homes Sold | Month-Over-Month | Year-Over-Year |

|---|---|---|---|

| Albany, NY | 527 | -16.5% | 10.7% |

| Allentown, PA | 601 | -9.9% | 14.3% |

| Atlanta, GA | 6,624 | -1.2% | -3.4% |

| Austin, TX | 2,102 | 23.3% | -3.5% |

| Bakersfield, CA | 486 | -9.2% | -14.6% |

| Baltimore, MD | 2,966 | -8.4% | 28.2% |

| Baton Rouge, LA | 739 | 33.9% | 5.9% |

| Birmingham, AL | 1,146 | 37.6% | 12.0% |

| Boston, MA | 2,294 | -15.4% | 7.4% |

| Bridgeport, CT | 596 | -10.8% | -0.2% |

| Buffalo, NY | 530 | -25.0% | -26.3% |

| Camden, NJ | 1,578 | -10.2% | 21.4% |

| Charlotte, NC | 2,469 | 11.1% | 1.9% |

| Chicago, IL | 5,475 | 4.0% | -0.3% |

| Cincinnati, OH | 1,436 | 11.7% | 10.2% |

| Cleveland, OH | 1,528 | -1.5% | 3.9% |

| Columbus, OH | 1,952 | 13.6% | 21.8% |

| Dallas, TX | 3,822 | 21.3% | -11.4% |

| Dayton, OH | 757 | 4.6% | 21.5% |

| Denver, CO | 3,577 | 14.5% | 20.4% |

| Detroit, MI | 1,165 | -44.1% | -17.6% |

| El Paso, TX | 491 | -2.4% | 0.8% |

| Fort Lauderdale, FL | 2,113 | -2.1% | -9.6% |

| Fort Worth, TX | 2,155 | 24.6% | -5.6% |

| Fresno, CA | 444 | -17.0% | -29.3% |

| Grand Rapids, MI | 964 | 7.5% | 32.8% |

| Greenville, SC | 951 | 59.6% | 24.5% |

| Hampton Roads, VA | 1,693 | 12.6% | 20.2% |

| Hartford, CT | 735 | -14.0% | 0.8% |

| Honolulu, HI | 517 | -9.9% | -12.7% |

| Houston, TX | 5,256 | 26.1% | -6.0% |

| Indianapolis, IN | 1,814 | 13.3% | -9.0% |

| Jacksonville, FL | 1,927 | 3.7% | 15.7% |

| Kansas City, MO | 1,824 | 5.1% | -9.4% |

| Knoxville, TN | 845 | -3.2% | 1.2% |

| Las Vegas, NV | 2,443 | 4.8% | -6.1% |

| Long Island, NY | 2,092 | -31.2% | 3.5% |

| Los Angeles, CA | 3,765 | 0.8% | -13.7% |

| Louisville, KY | 983 | -0.6% | 8.0% |

| McAllen, TX | 210 | 10.5% | -2.3% |

| Memphis, TN | 949 | 12.3% | 16.6% |

| Miami, FL | 2,114 | -5.8% | 12.3% |

| Milwaukee, WI | 1,157 | 18.3% | 24.8% |

| Minneapolis, MN | 3,475 | -1.8% | 25.3% |

| Montgomery County, PA | 1,282 | -19.5% | 6.0% |

| Nashville, TN | 2,496 | 11.1% | 12.2% |

| New Haven, CT | 545 | -12.9% | -4.2% |

| New Orleans, LA | 1,030 | 19.5% | 12.1% |

| New York, NY | 5,941 | -18.9% | 4.8% |

| Newark, NJ | 1,700 | -16.3% | -2.7% |

| Oakland, CA | 1,373 | 8.5% | -6.2% |

| Oklahoma City, OK | 1,386 | 13.5% | 15.8% |

| Omaha, NE | 705 | 10.8% | -0.3% |

| Orange County, CA | 1,510 | 3.1% | -18.5% |

| Orlando, FL | 3,420 | 15.9% | 20.5% |

| Oxnard, CA | 485 | 6.8% | -1.8% |

| Philadelphia, PA | 1,230 | -21.6% | -13.3% |

| Phoenix, AZ | 6,199 | 20.1% | -10.2% |

| Pittsburgh, PA | 1,411 | -6.3% | 14.5% |

| Portland, OR | 2,231 | 11.8% | -7.8% |

| Providence, RI | 1,008 | -16.7% | -5.9% |

| Raleigh, NC | 1,661 | 22.9% | 15.5% |

| Richmond, VA | 1,078 | 3.7% | 1.6% |

| Riverside, CA | 3,223 | 1.0% | -12.8% |

| Rochester, NY | 568 | -21.2% | -8.4% |

| Sacramento, CA | 1,667 | 5.6% | -13.6% |

| Salt Lake City, UT | 1,070 | 11.1% | -14.0% |

| San Antonio, TX | 1,819 | 9.4% | -1.7% |

| San Diego, CA | 2,060 | 12.6% | -11.7% |

| San Francisco, CA | 587 | 20.8% | -10.8% |

| San Jose, CA | 733 | 17.5% | -12.5% |

| Seattle, WA | 2,678 | 20.0% | -6.5% |

| St. Louis, MO | 2,254 | 3.3% | -1.3% |

| Tacoma, WA | 913 | 9.7% | -15.2% |

| Tampa, FL | 4,702 | 16.0% | 26.4% |

| Tucson, AZ | 1,068 | 8.8% | -10.8% |

| Tulsa, OK | 806 | 11.6% | 4.1% |

| Warren, MI | 2,628 | -3.5% | 25.3% |

| Washington, DC | 5,425 | -9.1% | 2.1% |

| West Palm Beach, FL | 1,868 | -2.5% | -14.4% |

| Worcester, MA | 622 | -11.8% | 12.7% |

| National | 189,100 | 3.3% | 1.9% |

New Listings

| Redfin Metro | New Listings | Month-Over-Month | Year-Over-Year |

|---|---|---|---|

| Albany, NY | 647 | -10.4% | -12.7% |

| Albuquerque, NM | 1,050 | 1.8% | -13.3% |

| Allentown, PA | 804 | -4.5% | -5.5% |

| Atlanta, GA | 9,492 | 3.8% | 8.7% |

| Austin, TX | 3,038 | 7.7% | -2.3% |

| Bakersfield, CA | 830 | -5.3% | -11.5% |

| Baltimore, MD | 3,581 | 12.9% | -6.5% |

| Baton Rouge, LA | 1,026 | -0.4% | -11.6% |

| Birmingham, AL | 1,348 | 3.2% | -10.0% |

| Boston, MA | 3,800 | 3.8% | -5.9% |

| Bridgeport, CT | 1,316 | 15.3% | -13.0% |

| Buffalo, NY | 717 | -4.9% | -10.3% |

| Camden, NJ | 1,870 | -1.4% | -10.1% |

| Charlotte, NC | 3,555 | 4.4% | -6.2% |

| Chicago, IL | 11,782 | 31.7% | -0.6% |

| Cincinnati, OH | 2,006 | 13.5% | -2.9% |

| Cleveland, OH | 2,386 | 9.7% | 1.9% |

| Columbus, OH | 2,038 | 5.5% | -5.0% |

| Dallas, TX | 6,411 | 3.2% | 7.2% |

| Dayton, OH | 833 | 12.1% | -16.4% |

| Denver, CO | 4,461 | 6.6% | 4.1% |

| Detroit, MI | 1,699 | -0.2% | 5.1% |

| El Paso, TX | 841 | -0.2% | 9.2% |

| Fort Lauderdale, FL | 4,051 | -12.3% | -5.1% |

| Fort Worth, TX | 3,283 | 3.8% | 11.7% |

| Fresno, CA | 738 | -7.9% | -16.3% |

| Grand Rapids, MI | 923 | -1.8% | -11.6% |

| Greenville, SC | 1,089 | -2.2% | -2.5% |

| Hampton Roads, VA | 2,200 | 4.2% | 0.8% |

| Hartford, CT | 1,180 | 14.0% | -13.7% |

| Honolulu, HI | 891 | -22.3% | -6.0% |

| Houston, TX | 8,731 | 2.2% | 4.0% |

| Indianapolis, IN | 2,179 | 6.7% | -5.8% |

| Jacksonville, FL | 2,738 | 5.2% | -0.8% |

| Kansas City, MO | 2,193 | -4.0% | -19.5% |

| Knoxville, TN | 1,149 | -0.9% | 42.7% |

| Las Vegas, NV | 3,746 | -8.7% | 0.4% |

| Long Island, NY | 2,910 | -4.3% | -6.2% |

| Los Angeles, CA | 6,177 | -7.9% | -15.7% |

| Louisville, KY | 1,097 | -9.3% | -11.2% |

| McAllen, TX | 441 | -2.0% | -0.5% |

| Memphis, TN | 1,091 | 4.5% | -8.3% |

| Miami, FL | 4,190 | -12.3% | -4.8% |

| Milwaukee, WI | 1,246 | 2.2% | -11.0% |

| Minneapolis, MN | 3,831 | 9.5% | -17.1% |

| Montgomery County, PA | 2,141 | 9.7% | -14.0% |

| Nashville, TN | 3,272 | -2.6% | -6.6% |

| New Haven, CT | 923 | 21.3% | -10.6% |

| New Orleans, LA | 1,256 | -11.2% | 17.8% |

| New York, NY | 10,994 | 0.8% | -3.8% |

| Newark, NJ | 3,067 | 12.9% | -5.9% |

| Oakland, CA | 2,346 | 12.8% | -2.6% |

| Oklahoma City, OK | 1,730 | -0.4% | -0.9% |

| Omaha, NE | 771 | -0.9% | -19.4% |

| Orange County, CA | 2,734 | 2.0% | -12.1% |

| Orlando, FL | 4,319 | -3.4% | 1.0% |

| Oxnard, CA | 681 | -9.1% | -18.3% |

| Philadelphia, PA | 2,482 | 7.7% | -5.6% |

| Phoenix, AZ | 8,345 | -12.1% | -7.3% |

| Pittsburgh, PA | 1,867 | -0.2% | -2.4% |

| Portland, OR | 2,742 | -4.5% | 0.8% |

| Providence, RI | 1,536 | 4.8% | -7.0% |

| Richmond, VA | 1,511 | 6.7% | -10.9% |

| Riverside, CA | 4,903 | -10.2% | -17.0% |

| Rochester, NY | 837 | 9.3% | -4.5% |

| Sacramento, CA | 2,360 | 5.8% | -16.0% |

| Salt Lake City, UT | 1,342 | -5.7% | -13.0% |

| San Antonio, TX | 2,864 | -0.3% | 8.1% |

| San Diego, CA | 3,003 | -6.9% | -13.0% |

| San Francisco, CA | 953 | -4.2% | -7.5% |

| San Jose, CA | 1,351 | 21.9% | 5.9% |

| Seattle, WA | 2,957 | -5.6% | -14.4% |

| St. Louis, MO | 3,187 | 14.8% | -12.9% |

| Tacoma, WA | 954 | -15.8% | -18.4% |

| Tampa, FL | 5,969 | -8.9% | 0.8% |

| Tucson, AZ | 1,568 | -13.4% | -2.3% |

| Tulsa, OK | 1,091 | 3.5% | -4.1% |

| Warren, MI | 2,652 | -6.7% | -7.1% |

| Washington, DC | 7,249 | 19.5% | -13.3% |

| West Palm Beach, FL | 3,962 | -14.6% | -3.5% |

| Worcester, MA | 771 | 0.4% | -15.5% |

| National | 273,500 | 0.3% | -4.8% |

All Homes for Sale

| Redfin Metro | All Homes for Sale | Month-Over-Month | Year-Over-Year |

|---|---|---|---|

| Albany, NY | 2,303 | -7.7% | 0.7% |

| Albuquerque, NM | 2,878 | -20.9% | -30.5% |

| Allentown, PA | 2,443 | -5.6% | 10.5% |

| Atlanta, GA | 21,517 | -3.3% | -16.4% |

| Austin, TX | 6,402 | -1.8% | 5.9% |

| Bakersfield, CA | 1,846 | -2.7% | -2.9% |

| Baltimore, MD | 8,807 | 2.8% | 2.6% |

| Baton Rouge, LA | 3,948 | -0.7% | 17.0% |

| Birmingham, AL | 4,138 | 1.4% | -13.9% |

| Boston, MA | 6,383 | 0.3% | 18.9% |

| Bridgeport, CT | 4,850 | 7.7% | -5.4% |

| Buffalo, NY | 1,575 | -8.2% | -2.0% |

| Camden, NJ | 5,742 | -0.1% | -21.2% |

| Charlotte, NC | 9,917 | 3.4% | 2.5% |

| Chicago, IL | 34,272 | 8.8% | 2.9% |

| Cincinnati, OH | 6,047 | 6.9% | -1.4% |

| Cleveland, OH | 6,922 | 0.4% | -5.1% |

| Columbus, OH | 4,898 | 1.4% | 3.1% |

| Dallas, TX | 15,327 | -1.1% | 22.8% |

| Dayton, OH | 2,173 | 1.2% | -12.8% |

| Denver, CO | 5,986 | 2.1% | 36.7% |

| Detroit, MI | 4,357 | -6.2% | 13.5% |

| El Paso, TX | 2,409 | -2.2% | -15.0% |

| Fort Lauderdale, FL | 15,661 | 4.4% | 15.1% |

| Fort Worth, TX | 6,342 | -5.2% | 11.8% |

| Fresno, CA | 1,585 | -5.3% | 11.6% |

| Grand Rapids, MI | 1,818 | -7.7% | 6.2% |

| Greenville, SC | 3,816 | 4.1% | 6.9% |

| Hampton Roads, VA | 5,975 | -1.4% | -10.6% |

| Hartford, CT | 4,184 | 2.2% | -11.8% |

| Honolulu, HI | 3,588 | 1.4% | 19.4% |

| Houston, TX | 25,005 | -1.9% | 12.8% |

| Indianapolis, IN | 4,338 | -11.0% | -15.4% |

| Jacksonville, FL | 7,441 | 1.9% | 8.7% |

| Knoxville, TN | 3,596 | 1.2% | 0.6% |

| Las Vegas, NV | 10,533 | 0.2% | 18.4% |

| Long Island, NY | 9,650 | 1.9% | 6.0% |

| Los Angeles, CA | 16,923 | 0.5% | 17.4% |

| Louisville, KY | 2,662 | -5.1% | 7.0% |

| McAllen, TX | 1,984 | -1.2% | 5.5% |

| Memphis, TN | 2,503 | -3.1% | -9.7% |

| Miami, FL | 19,338 | -1.6% | 5.6% |

| Milwaukee, WI | 3,776 | 3.9% | -9.1% |

| Minneapolis, MN | 7,246 | -2.4% | -4.2% |

| Montgomery County, PA | 5,244 | 8.0% | -20.7% |

| Nashville, TN | 10,321 | 2.0% | 20.7% |

| New Haven, CT | 3,079 | 3.1% | -12.7% |

| New Orleans, LA | 3,781 | -11.3% | -35.0% |

| New York, NY | 46,294 | 2.1% | 1.4% |

| Newark, NJ | 8,964 | 5.2% | 2.5% |

| Oakland, CA | 2,914 | 7.8% | 40.8% |

| Oklahoma City, OK | 4,412 | -8.5% | -13.9% |

| Omaha, NE | 1,401 | -9.3% | -5.0% |

| Orange County, CA | 7,550 | 3.2% | 20.6% |

| Orlando, FL | 9,845 | -3.8% | 5.8% |

| Oxnard, CA | 2,037 | 7.9% | 48.5% |

| Philadelphia, PA | 6,107 | 9.1% | -11.9% |

| Phoenix, AZ | 20,645 | -1.4% | 2.7% |

| Pittsburgh, PA | 7,620 | 1.1% | -11.0% |

| Portland, OR | 5,681 | -5.0% | 36.6% |

| Providence, RI | 4,436 | -3.6% | 3.6% |

| Raleigh, NC | 5,677 | 1.5% | -2.4% |

| Richmond, VA | 2,731 | -5.7% | -2.5% |

| Riverside, CA | 15,454 | -2.1% | 4.5% |

| Rochester, NY | 1,312 | 0.9% | -23.2% |

| Sacramento, CA | 3,940 | -7.1% | 5.7% |

| Salt Lake City, UT | 2,814 | -24.3% | 5.4% |

| San Antonio, TX | 7,674 | -2.0% | 0.4% |

| San Diego, CA | 6,414 | -6.9% | 24.1% |

| San Francisco, CA | 1,356 | 1.2% | 31.4% |

| San Jose, CA | 1,816 | 12.2% | 82.1% |

| Seattle, WA | 5,027 | -2.7% | 101.2% |

| St. Louis, MO | 7,746 | -4.1% | -23.8% |

| Tacoma, WA | 1,469 | -13.9% | 8.4% |

| Tampa, FL | 14,363 | -2.8% | 12.2% |

| Tucson, AZ | 4,590 | 1.7% | -2.5% |

| Tulsa, OK | 2,977 | -13.8% | -13.8% |

| Warren, MI | 6,252 | -9.6% | 13.3% |

| Washington, DC | 13,521 | 10.7% | -0.7% |

| West Palm Beach, FL | 15,996 | 3.3% | 5.2% |

| Worcester, MA | 1,740 | -6.1% | -9.4% |

| National | 760,800 | 0.0% | 2.9% |

Median Off-Market Redfin Estimate

| Redfin Metro | Estimate | Month-Over-Month | Year-Over-Year |

|---|---|---|---|

| Albany, NY | $213,600 | -0.2% | 3.5% |

| Allentown, PA | $208,200 | -0.2% | 5.6% |

| Atlanta, GA | $219,000 | 0.2% | 10.3% |

| Austin, TX | $300,500 | 0.2% | 4.2% |

| Bakersfield, CA | $215,000 | -0.3% | 6.9% |

| Baltimore, MD | $252,300 | -0.4% | 3.1% |

| Baton Rouge, LA | $151,400 | -0.3% | 2.9% |

| Birmingham, AL | $148,000 | -0.3% | 5.0% |

| Boston, MA | $488,400 | 0.5% | 5.2% |

| Buffalo, NY | $155,700 | -0.1% | 5.6% |

| Camden, NJ | $192,300 | -0.1% | 3.5% |

| Charlotte, NC | $205,900 | 0.2% | 10.1% |

| Chicago, IL | $241,600 | -0.2% | 5.4% |

| Cincinnati, OH | $167,600 | -0.1% | 7.3% |

| Cleveland, OH | $138,000 | -0.1% | 6.6% |

| Columbus, OH | $190,300 | 0.7% | 8.3% |

| Dallas, TX | $256,400 | 0.0% | 5.5% |

| Dayton, OH | $116,400 | -0.1% | 4.8% |

| Denver, CO | $410,200 | 0.1% | 6.3% |

| Detroit, MI | $106,200 | 0.5% | 21.9% |

| Fort Lauderdale, FL | $265,700 | 0.5% | 6.8% |

| Fort Worth, TX | $213,600 | 0.2% | 8.1% |

| Fresno, CA | $253,800 | 0.1% | 6.7% |

| Grand Rapids, MI | $160,100 | 0.3% | 7.9% |

| Greenville, SC | $169,400 | 0.0% | 8.1% |

| Hampton Roads, VA | $223,700 | -0.1% | 3.6% |

| Honolulu, HI | $688,600 | -0.1% | 2.8% |

| Houston, TX | $208,000 | 0.0% | 5.6% |

| Indianapolis, IN | $159,900 | -0.2% | 8.3% |

| Jacksonville, FL | $218,200 | 0.6% | 8.6% |

| Kansas City, MO | $185,800 | 0.0% | 6.7% |

| Knoxville, TN | $150,900 | 0.2% | 8.0% |

| Las Vegas, NV | $273,800 | 0.2% | 11.3% |

| Long Island, NY | $444,000 | 0.2% | 5.0% |

| Los Angeles, CA | $628,000 | -0.2% | 6.2% |

| Louisville, KY | $151,100 | 0.2% | 4.7% |

| Memphis, TN | $136,500 | 0.6% | 6.5% |

| Miami, FL | $298,000 | 0.4% | 6.0% |

| Milwaukee, WI | $208,300 | 0.1% | 9.4% |

| Minneapolis, MN | $257,600 | -0.3% | 6.4% |

| Montgomery County, PA | $315,300 | -0.2% | 2.8% |

| Nashville, TN | $249,000 | 0.3% | 7.7% |

| New Orleans, LA | $169,500 | -0.2% | 2.0% |

| Newark, NJ | $373,100 | 0.3% | 14.5% |

| Oakland, CA | $757,100 | -0.4% | 4.4% |

| Oklahoma City, OK | $141,900 | 0.4% | 5.0% |

| Omaha, NE | $169,600 | 0.2% | 6.4% |

| Orange County, CA | $708,500 | -0.4% | 3.1% |

| Orlando, FL | $232,200 | 0.2% | 7.0% |

| Oxnard, CA | $600,000 | 0.0% | 3.3% |

| Philadelphia, PA | $196,400 | -1.3% | 2.5% |

| Phoenix, AZ | $269,200 | 0.4% | 7.5% |

| Pittsburgh, PA | $144,000 | -0.2% | 6.5% |

| Portland, OR | $390,500 | 0.0% | 3.2% |

| Providence, RI | $294,700 | 0.1% | 5.0% |

| Raleigh, NC | $258,100 | -0.8% | 3.7% |

| Richmond, VA | $222,900 | 0.1% | 5.5% |

| Riverside, CA | $364,400 | -0.1% | 5.5% |

| Rochester, NY | $143,600 | 0.0% | 5.9% |

| Sacramento, CA | $399,900 | -0.1% | 4.7% |

| Salt Lake City, UT | $325,900 | 0.3% | 8.9% |

| San Antonio, TX | $192,700 | 0.2% | 5.8% |

| San Diego, CA | $588,800 | -0.3% | 4.0% |

| San Francisco, CA | $1,322,700 | -0.4% | 4.7% |

| San Jose, CA | $1,201,200 | -0.6% | 4.8% |

| Seattle, WA | $555,000 | -0.3% | 5.0% |

| St. Louis, MO | $155,400 | -0.1% | 5.4% |

| Tacoma, WA | $345,500 | 0.3% | 7.7% |

| Tampa, FL | $219,000 | 0.1% | 6.6% |

| Tucson, AZ | $208,500 | 0.3% | 7.5% |

| Tulsa, OK | $138,600 | -0.2% | 4.1% |

| Warren, MI | $210,300 | -0.3% | 6.4% |

| Washington, DC | $386,800 | -0.1% | 3.3% |

| West Palm Beach, FL | $265,100 | 0.0% | 3.4% |

| Worcester, MA | $283,900 | 0.1% | 5.7% |

| National | $298,400 | -0.1% | 5.2% |

This post first appeared on Redfin.com. To see the original, click here.