Homebuyers are in the strongest position in years as the supply of homes for sale grows at fastest rate since May 2015

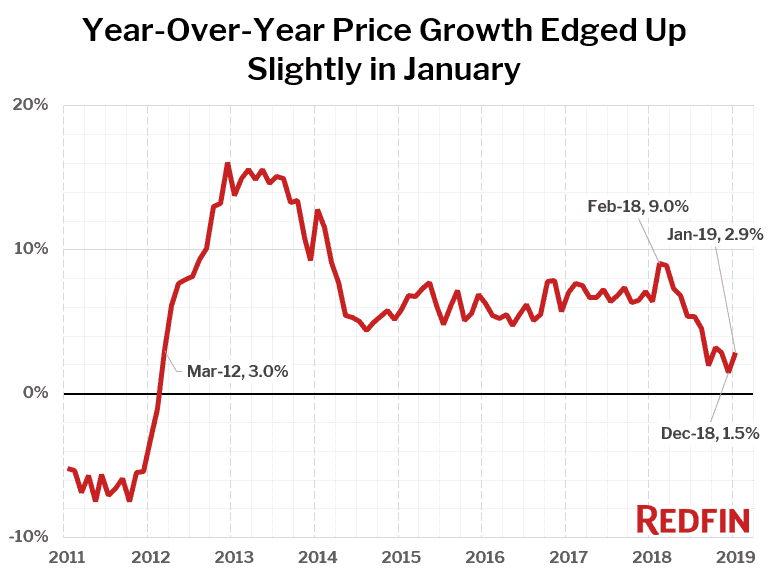

The housing market started off 2019 with buyers in a much better position than they were a year earlier. U.S. home-sale prices increased 2.9 percent in January compared to a year ago, to a median of $285,900 across the metros Redfin tracks. Albeit slight, last month’s price jump represents a rebound from December’s 1.5 percent increase, the smallest year-over-year price increase recorded since March 2012.

| Market Summary | January 2019 | Month-Over-Month | Year-Over-Year |

|---|---|---|---|

| Median sale price | $285,900 | -2.1% | 2.9% |

| Homes sold | 179,500 | -15.5% | -7.6% |

| New listings | 270,800 | 68.3% | 4.4% |

| All Homes for sale | 748,100 | 1.1% | 6.3% |

| Median days on market | 57 | 6 | 1 |

| Months of supply | 4.2 | 0.7 | 0.6 |

| Sold above list | 16.7% | -1.4% | -3.5% |

| Median Off-Market Redfin Estimate | $298,800 | 5.6% | 6.3% |

| Average Sale-to-list | 97.3% | -0.3% | -0.4% |

“Things are looking good for buyers in 2019. The supply of homes for sale is increasing faster than it has in nearly four years,” said Redfin chief economist Daryl Fairweather. “December was a rough month for home sales, but homeowners appear to be undeterred in the new year as more are listing their homes for sale. We predicted price growth would slow down and that prices would drop in coastal cities like San Francisco and Seattle, but we didn’t know how sellers would react to a cooler market. It’s encouraging to see that listings are up–it means that sellers aren’t taking the ball and going home.”

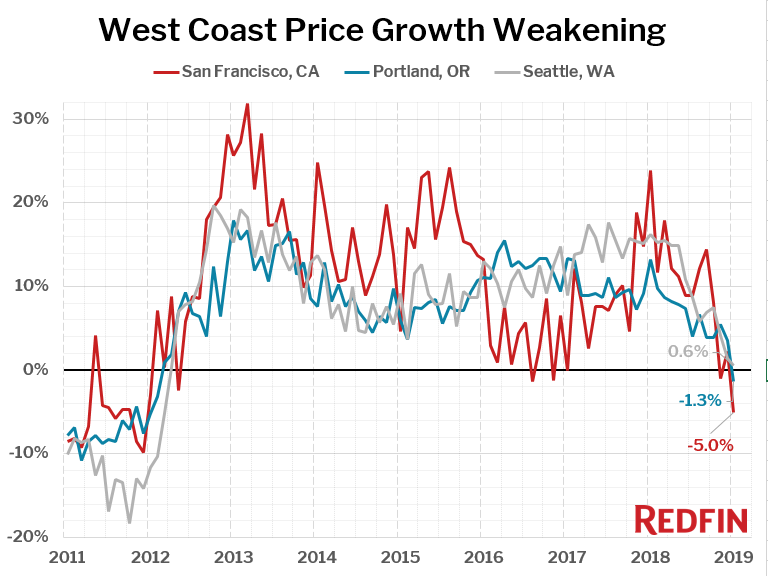

Home prices fell year over year in 10 of the 81 largest metro areas Redfin tracks, including San Francisco (-5.0%) and Portland, Oregon (-1.3%). This is a major shift for two markets that consistently posted strong price growth throughout most of 2018 and where prices haven’t declined significantly since 2012. In Seattle, prices were still growing last month, but barely, up just 0.6 percent year over year, and seem to be following a similar trajectory as their West Coast counterparts.

Completed home sales nationally fell for the sixth consecutive month in January, down 7.6 percent from a year earlier. Home sales declined in 57 of the 81 largest metro areas that Redfin tracks.

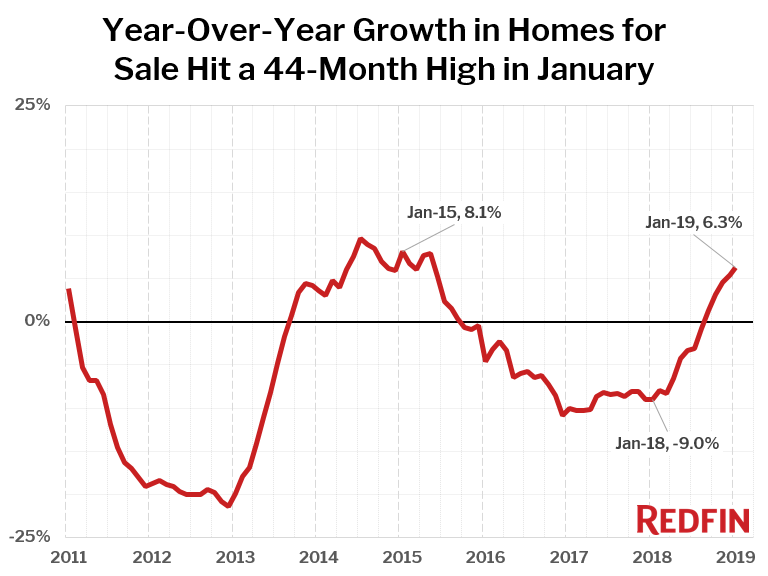

The number of homes newly listed for sale in January rose from a year earlier (+4.4%), helping to push the total number of homes for sale up 6.3 percent, the biggest supply increase since May of 2015.

“We expect the supply of homes for sale to increase, giving buyers more homes to buy, but not so many that prices drop broadly,” said CEO Glenn Kelman during Redfin’s earnings call last week.

Of the 81 largest metro areas Redfin tracks, 54 saw an increase in the number of homes for sale compared to a year earlier, with the largest gains coming in Seattle (+109.1%) and San Jose (+100.8%). Despite these large increases in for-sale inventory, both markets still had less than three months of supply (inventory divided by monthly sales—2.3 in Seattle and 2.5 in San Jose), keeping them in seller’s market territory last month. A market that is balanced between buyers and sellers typically has between four and six months of supply.

The metro areas with the biggest decline in homes for sale were New Orleans (-25.5%), Rochester, NY (-22.2%) and Camden, NJ (-18.6%).

Several indicators of home-buying competition suggest that 2019 kicked off as one of the tamest in years. Home-selling speeds, which reached a record-fast median pace of 35 days on market last May, slowed last month for the first time since July 2015. The typical home that sold in January went under contract in a median of 57 days, one day longer than a year earlier. In January, 16.7 percent of homes sold above the list price, down from 20.2 percent in January 2018, and the smallest share recorded in four years. Meanwhile 23.2 percent of homes on the market in January had a price drop, up from January 2018’s share of 18.9 percent. The share of homes that went under contract within two weeks dipped to 13.3 percent in January, down from the January 2018 level of 16.1 percent.

Other January Highlights

Competition

- Grand Rapids, MI and Buffalo, NY were the fastest markets, with half of all homes pending sale in just 28 days, up from 26 days a year earlier in Grand Rapids, and down from 35 days a year earlier in Buffalo. Omaha, NE was the next fastest markets with 29 median days on market, followed by Philadelphia (30) and Detroit (33).

- The most competitive market in January was San Francisco where 48.9% of homes sold above list price, followed by 36.7% in Oakland, CA, 35.3% in Tacoma, WA, 33.6% in Buffalo, NY, and 33.2% in San Jose, CA.

Prices

- Raleigh, NC had the nation’s highest price growth, rising 14.6% since last year to $247,000. Las Vegas had the second highest growth at 12% year-over-year price growth, followed by Albany, NY (10.8%), St. Louis (10.5%), and Knoxville, TN (9.84%).

- 10 metros saw price declines in January. San Francisco declined the most since last year falling 5 percent to $1,235,000.

Sales

- Hampton Roads, VA led the nation in year-over-year sales growth, up 18.2%, followed by Long Island, NY, up 13.3%. Birmingham, AL rounded out the top three with sales up 11.7% from a year ago.

- Detroit saw the largest decline in sales since last year, falling 34.7%. Home sales in Philadelphia and West Palm Beach, FL declined by 34.3% and 26.2%, respectively.

Inventory

- Seattle had the highest increase in the number of homes for sale, up 109% year over year, followed by San Jose, CA (101%).

- New Orleans had the largest decrease in overall inventory, falling 25.5% since last January. Rochester, NY (-22%), Camden, NJ (-19%), and Atlanta (-18%) also saw far fewer homes available on the market than a year ago.

Redfin Estimate

- The median list price-to-Redfin Estimate ratio was 94.8% in San Francisco, the lowest of any market. This indicates the typical home for sale in January was listed at a price 5.5% below its estimated value. Only 11.4% of homes in San Francisco were listed for more than their Redfin Estimate.

- Conversely, the median list price-to-Redfin Estimate ratio was 102.4% in Miami and 102.2% in West Palm Beach, FL, which means sellers are listing their homes for more than the estimated value in those metro areas. In Miami, 84.4% of homes were listed above their Redfin Estimate, the highest percentage of any metro.

Below are market-by-market breakdowns for prices, inventory, new listings and sales for markets with populations of 750 thousand or more. For downloadable data on all of the markets Redfin tracks, visit the Redfin Data Center.

Median Sale Price

| Redfin Metro | Median Sale Price | Month-Over-Month | Year-Over-Year |

|---|---|---|---|

| Albany, NY | $205,000 | 3.5% | 10.8% |

| Allentown, PA | $183,000 | -4.9% | -1.1% |

| Atlanta, GA | $229,900 | -1.3% | 4.8% |

| Austin, TX | $295,000 | -3.3% | 1.7% |

| Bakersfield, CA | $231,000 | 2.7% | 5.7% |

| Baltimore, MD | $249,900 | 0.0% | 4.2% |

| Baton Rouge, LA | $205,000 | 1.5% | 6.1% |

| Birmingham, AL | $182,500 | -5.5% | 4.2% |

| Boston, MA | $470,000 | 3.9% | 4.4% |

| Bridgeport, CT | $355,000 | -6.3% | -4.1% |

| Buffalo, NY | $140,500 | -4.6% | 4.1% |

| Camden, NJ | $175,000 | 3.6% | 7.4% |

| Charlotte, NC | $230,000 | -4.0% | 5.5% |

| Chicago, IL | $224,000 | -0.9% | 1.9% |

| Cincinnati, OH | $166,500 | 3.7% | 5.4% |

| Cleveland, OH | $137,000 | -5.5% | 8.7% |

| Columbus, OH | $189,900 | -3.6% | 5.1% |

| Dallas, TX | $273,700 | -7.2% | 1.4% |

| Dayton, OH | $114,400 | -11.2% | 1.7% |

| Denver, CO | $392,000 | -0.3% | 3.2% |

| Detroit, MI | $122,000 | -1.6% | 8.9% |

| El Paso, TX | $151,200 | -5.2% | 2.2% |

| Fort Lauderdale, FL | $253,000 | -0.8% | 4.1% |

| Fort Worth, TX | $228,000 | -4.2% | 4.1% |

| Fresno, CA | $265,000 | 0.6% | 7.5% |

| Grand Rapids, MI | $192,000 | 1.1% | 7.9% |

| Greenville, SC | $206,800 | -1.5% | 8.9% |

| Hampton Roads, VA | $212,000 | -3.6% | -3.1% |

| Hartford, CT | $200,000 | -7.0% | 2.6% |

| Honolulu, HI | $598,000 | 11.4% | 5.8% |

| Houston, TX | $223,100 | -7.1% | 1.7% |

| Indianapolis, IN | $165,000 | -5.7% | 4.5% |

| Jacksonville, FL | $210,000 | -6.2% | 0.5% |

| Kansas City, MO | $209,000 | 2.1% | 8.3% |

| Knoxville, TN | $186,800 | -3.5% | 9.8% |

| Las Vegas, NV | $280,000 | 1.8% | 12.0% |

| Long Island, NY | $445,000 | 5.2% | 6.0% |

| Los Angeles, CA | $590,000 | -1.7% | 2.6% |

| Louisville, KY | $180,000 | -2.7% | 2.0% |

| McAllen, TX | $149,000 | 2.1% | -0.3% |

| Memphis, TN | $160,000 | -2.7% | -1.5% |

| Miami, FL | $290,000 | -0.7% | 1.8% |

| Milwaukee, WI | $195,000 | -0.5% | 6.6% |

| Minneapolis, MN | $257,800 | -2.7% | 5.2% |

| Montgomery County, PA | $300,000 | 0.0% | 3.6% |

| Nashville, TN | $282,500 | -2.6% | 4.7% |

| New Haven, CT | $185,300 | -10.7% | 0.2% |

| New Orleans, LA | $204,400 | -4.7% | 6.9% |

| New York, NY | $395,000 | 2.6% | 2.6% |

| Newark, NJ | $322,000 | -2.4% | 3.9% |

| Oakland, CA | $663,000 | -3.2% | 2.0% |

| Oklahoma City, OK | $167,000 | 1.6% | 5.7% |

| Omaha, NE | $191,500 | 2.0% | 5.5% |

| Orange County, CA | $685,000 | 0.7% | 1.6% |

| Orlando, FL | $242,500 | -3.0% | 3.2% |

| Oxnard, CA | $580,000 | -3.3% | -3.3% |

| Philadelphia, PA | $195,000 | 4.3% | 8.9% |

| Phoenix, AZ | $266,000 | 0.4% | 7.0% |

| Pittsburgh, PA | $147,800 | -7.7% | -1.2% |

| Portland, OR | $380,000 | -0.8% | -1.3% |

| Providence, RI | $260,000 | -1.9% | 6.1% |

| Raleigh, NC | $247,000 | 5.9% | 14.6% |

| Richmond, VA | $235,000 | -0.2% | 5.4% |

| Riverside, CA | $357,500 | -0.4% | 2.1% |

| Rochester, NY | $130,300 | -4.3% | 2.7% |

| Sacramento, CA | $369,000 | -5.4% | 0.0% |

| Salt Lake City, UT | $319,200 | 1.3% | 9.0% |

| San Antonio, TX | $215,000 | -2.7% | 4.9% |

| San Diego, CA | $560,000 | -0.9% | 4.7% |

| San Francisco, CA | $1,235,000 | -8.5% | -5.0% |

| San Jose, CA | $1,025,000 | 0.5% | 3.0% |

| Seattle, WA | $518,000 | -3.5% | 0.6% |

| St. Louis, MO | $173,000 | 0.3% | 10.5% |

| Tacoma, WA | $337,000 | -0.9% | 8.4% |

| Tampa, FL | $220,000 | -4.3% | 6.3% |

| Tucson, AZ | $215,000 | 2.4% | 7.6% |

| Tulsa, OK | $155,000 | -3.4% | -2.5% |

| Warren, MI | $189,900 | -0.1% | 3.8% |

| Washington, DC | $380,000 | -2.6% | 3.3% |

| West Palm Beach, FL | $263,000 | -2.6% | 1.2% |

| Worcester, MA | $245,000 | -4.9% | 2.1% |

| National | $285,900 | -2.1% | 2.9% |

Homes Sold

| Redfin Metro | Homes Sold | Month-Over-Month | Year-Over-Year |

|---|---|---|---|

| Albany, NY | 605 | -26.5% | -12.4% |

| Allentown, PA | 657 | -10.6% | 1.5% |

| Atlanta, GA | 5,862 | -24.2% | -13.5% |

| Austin, TX | 1,626 | -36.1% | -8.5% |

| Bakersfield, CA | 522 | -17.8% | -8.9% |

| Baltimore, MD | 3,390 | 23.9% | 9.4% |

| Baton Rouge, LA | 586 | -0.5% | -5.5% |

| Birmingham, AL | 905 | -4.2% | 11.7% |

| Boston, MA | 2,632 | -28.0% | -13.1% |

| Bridgeport, CT | 674 | -29.7% | -10.6% |

| Buffalo, NY | 643 | -38.2% | -21.9% |

| Camden, NJ | 1,740 | 12.3% | 6.2% |

| Charlotte, NC | 2,173 | -23.6% | -6.2% |

| Chicago, IL | 5,201 | -24.7% | -25.5% |

| Cincinnati, OH | 1,353 | -23.3% | -7.8% |

| Cleveland, OH | 1,524 | -26.1% | -5.2% |

| Columbus, OH | 1,981 | 16.3% | 9.9% |

| Dallas, TX | 3,059 | -36.3% | -15.7% |

| Dayton, OH | 814 | 1.1% | 11.5% |

| Denver, CO | 3,302 | 4.7% | 3.9% |

| Detroit, MI | 1,190 | -39.6% | -34.7% |

| El Paso, TX | 488 | -25.7% | 6.8% |

| Fort Lauderdale, FL | 2,181 | -7.1% | -8.1% |

| Fort Worth, TX | 1,687 | -34.0% | -15.4% |

| Fresno, CA | 509 | -23.3% | -12.1% |

| Grand Rapids, MI | 1,022 | 10.1% | -7.7% |

| Greenville, SC | 664 | -20.1% | -8.3% |

| Hampton Roads, VA | 1,629 | 3.6% | 18.2% |

| Hartford, CT | 869 | -27.0% | -4.9% |

| Honolulu, HI | 572 | -17.2% | -8.0% |

| Houston, TX | 4,088 | -39.8% | -12.6% |

| Indianapolis, IN | 1,587 | -32.5% | -11.5% |

| Jacksonville, FL | 1,883 | -0.7% | 8.0% |

| Kansas City, MO | 1,706 | -22.1% | -14.4% |

| Knoxville, TN | 821 | -8.2% | -1.3% |

| Las Vegas, NV | 2,268 | -15.3% | -18.9% |

| Long Island, NY | 2,709 | -14.9% | 13.3% |

| Los Angeles, CA | 3,723 | -22.3% | -16.4% |

| Louisville, KY | 1,061 | 8.9% | 1.2% |

| McAllen, TX | 177 | -11.1% | -9.2% |

| Memphis, TN | 917 | 12.7% | 4.4% |

| Miami, FL | 2,406 | 30.8% | 7.4% |

| Milwaukee, WI | 1,158 | 10.4% | 7.3% |

| Minneapolis, MN | 3,885 | -9.5% | 11.6% |

| Montgomery County, PA | 1,500 | -20.0% | -10.4% |

| Nashville, TN | 2,343 | -8.3% | 1.6% |

| New Haven, CT | 621 | -14.1% | -6.2% |

| New Orleans, LA | 872 | -5.4% | -4.6% |

| New York, NY | 7,556 | 17.4% | 4.7% |

| Newark, NJ | 1,980 | -14.7% | -17.2% |

| Oakland, CA | 1,239 | -25.5% | -11.5% |

| Oklahoma City, OK | 1,257 | 0.4% | 4.0% |

| Omaha, NE | 633 | -25.9% | -20.3% |

| Orange County, CA | 1,460 | -17.5% | -20.1% |

| Orlando, FL | 3,218 | 8.2% | 4.8% |

| Oxnard, CA | 447 | -17.5% | -13.4% |

| Philadelphia, PA | 1,361 | -31.5% | -34.3% |

| Phoenix, AZ | 5,165 | -15.1% | -15.5% |

| Pittsburgh, PA | 1,392 | -29.6% | -11.1% |

| Portland, OR | 1,929 | -21.8% | -11.1% |

| Providence, RI | 1,151 | -25.1% | -5.8% |

| Raleigh, NC | 217 | -41.0% | -6.5% |

| Richmond, VA | 1,076 | -10.5% | 2.5% |

| Riverside, CA | 3,184 | -12.4% | -18.4% |

| Rochester, NY | 663 | -27.7% | -14.8% |

| Sacramento, CA | 1,559 | -18.9% | -21.7% |

| Salt Lake City, UT | 939 | -24.2% | -21.0% |

| San Antonio, TX | 1,585 | -24.7% | 0.5% |

| San Diego, CA | 1,799 | -18.9% | -18.5% |

| San Francisco, CA | 483 | -33.4% | -4.7% |

| San Jose, CA | 623 | -28.3% | -11.6% |

| Seattle, WA | 2,185 | -28.1% | -13.1% |

| St. Louis, MO | 2,160 | -21.0% | -5.9% |

| Tacoma, WA | 815 | -24.9% | -18.3% |

| Tampa, FL | 4,345 | 13.9% | 4.4% |

| Tucson, AZ | 969 | -18.1% | -2.6% |

| Tulsa, OK | 773 | 0.3% | 1.7% |

| Warren, MI | 2,884 | 23.0% | -5.2% |

| Washington, DC | 5,468 | -16.9% | -3.7% |

| West Palm Beach, FL | 1,809 | -18.9% | -26.2% |

| Worcester, MA | 686 | -26.6% | -13.2% |

| National | 179,500 | -15.5% | -7.6% |

New Listings

| Redfin Metro | New Listings | Month-Over-Month | Year-Over-Year |

|---|---|---|---|

| Albany, NY | 719 | 49.8% | 5.3% |

| Albuquerque, NM | 1,031 | 37.3% | -7.3% |

| Allentown, PA | 837 | 68.8% | 10.7% |

| Atlanta, GA | 9,070 | 61.6% | 19.8% |

| Austin, TX | 2,813 | 66.7% | 13.2% |

| Bakersfield, CA | 870 | 70.6% | -4.0% |

| Baltimore, MD | 3,148 | 44.6% | -0.1% |

| Baton Rouge, LA | 1,013 | 61.3% | 5.5% |

| Birmingham, AL | 1,276 | 71.7% | -1.7% |

| Boston, MA | 3,628 | 129.8% | 26.5% |

| Bridgeport, CT | 1,133 | 139.0% | 7.0% |

| Buffalo, NY | 756 | 38.5% | 6.2% |

| Camden, NJ | 1,878 | 63.2% | -2.2% |

| Charlotte, NC | 3,400 | 75.9% | 11.5% |

| Chicago, IL | 8,899 | 82.8% | -5.0% |

| Cincinnati, OH | 1,765 | 68.4% | 3.3% |

| Cleveland, OH | 2,155 | 49.4% | -1.8% |

| Columbus, OH | 1,928 | 49.2% | 7.0% |

| Dallas, TX | 6,158 | 62.9% | 6.2% |

| Dayton, OH | 737 | 47.7% | -5.0% |

| Denver, CO | 4,172 | 111.8% | 10.3% |

| Detroit, MI | 1,688 | 20.9% | -2.6% |

| El Paso, TX | 841 | 54.3% | 32.4% |

| Fort Lauderdale, FL | 4,589 | 61.6% | 2.9% |

| Fort Worth, TX | 3,132 | 59.9% | 8.8% |

| Fresno, CA | 794 | 65.1% | -7.7% |

| Grand Rapids, MI | 733 | 24.2% | -18.8% |

| Greenville, SC | 1,109 | 71.1% | 5.7% |

| Hampton Roads, VA | 2,106 | 59.4% | 11.3% |

| Hartford, CT | 1,030 | 56.3% | -1.3% |

| Honolulu, HI | 1,141 | 73.4% | 13.8% |

| Houston, TX | 8,521 | 54.1% | 10.1% |

| Indianapolis, IN | 2,035 | 41.4% | 2.6% |

| Jacksonville, FL | 2,588 | 62.0% | 7.3% |

| Kansas City, MO | 2,179 | 46.6% | -7.8% |

| Knoxville, TN | 1,167 | 61.6% | 54.6% |

| Las Vegas, NV | 4,096 | 56.7% | 11.9% |

| Long Island, NY | 3,044 | 97.0% | 12.9% |

| Los Angeles, CA | 6,654 | 95.1% | -4.4% |

| Louisville, KY | 1,197 | 60.5% | 4.3% |

| McAllen, TX | 443 | 38.9% | -6.1% |

| Memphis, TN | 1,026 | 30.2% | 3.6% |

| Miami, FL | 4,693 | 52.2% | -1.5% |

| Milwaukee, WI | 1,230 | 13.6% | 0.5% |

| Minneapolis, MN | 3,473 | 86.1% | 4.5% |

| Montgomery County, PA | 1,946 | 95.2% | 2.0% |

| Nashville, TN | 3,291 | 61.5% | 9.1% |

| New Haven, CT | 766 | 56.6% | 0.0% |

| New Orleans, LA | 1,388 | 69.3% | 36.3% |

| New York, NY | 10,793 | 95.1% | 9.1% |

| Newark, NJ | 2,704 | 84.7% | 4.0% |

| Oakland, CA | 2,061 | 141.6% | 3.6% |

| Oklahoma City, OK | 1,609 | 49.4% | -5.5% |

| Omaha, NE | 777 | 81.1% | 1.0% |

| Orange County, CA | 2,641 | 105.8% | -2.7% |

| Orlando, FL | 4,451 | 57.1% | 4.7% |

| Oxnard, CA | 741 | 79.9% | 6.5% |

| Philadelphia, PA | 2,305 | 59.5% | 6.7% |

| Phoenix, AZ | 8,526 | 69.2% | -9.2% |

| Pittsburgh, PA | 1,873 | 69.3% | 11.2% |

| Portland, OR | 2,833 | 104.7% | 18.1% |

| Providence, RI | 1,461 | 65.3% | 10.8% |

| Richmond, VA | 1,381 | 71.6% | 1.7% |

| Riverside, CA | 5,382 | 74.4% | -7.2% |

| Rochester, NY | 762 | 79.3% | 10.3% |

| Sacramento, CA | 2,224 | 71.2% | -11.1% |

| Salt Lake City, UT | 1,414 | 62.5% | -4.8% |

| San Antonio, TX | 2,850 | 58.2% | 9.1% |

| San Diego, CA | 3,175 | 96.6% | -6.5% |

| San Francisco, CA | 992 | 270.1% | 10.5% |

| San Jose, CA | 1,102 | 179.7% | 10.1% |

| Seattle, WA | 3,123 | 141.5% | 0.1% |

| St. Louis, MO | 2,775 | 57.1% | -6.3% |

| Tacoma, WA | 1,128 | 88.6% | -2.3% |

| Tampa, FL | 6,545 | 57.7% | 2.8% |

| Tucson, AZ | 1,801 | 80.3% | 7.7% |

| Tulsa, OK | 1,042 | 45.5% | -5.8% |

| Warren, MI | 2,815 | 48.9% | 2.3% |

| Washington, DC | 6,025 | 64.4% | -5.8% |

| West Palm Beach, FL | 4,634 | 62.1% | 1.6% |

| Worcester, MA | 763 | 51.1% | 10.4% |

| National | 270,800 | 68.3% | 4.4% |

All Homes for Sale

| Redfin Metro | All Homes for Sale | Month-Over-Month | Year-Over-Year |

|---|---|---|---|

| Albany, NY | 2,442 | -6.9% | 3.6% |

| Albuquerque, NM | 3,575 | 3.3% | -1.2% |

| Allentown, PA | 2,925 | 15.9% | 30.2% |

| Atlanta, GA | 21,249 | -5.1% | -18.5% |

| Austin, TX | 6,349 | -4.1% | 9.4% |

| Bakersfield, CA | 1,839 | -3.4% | -2.3% |

| Baltimore, MD | 8,770 | -4.3% | 2.1% |

| Baton Rouge, LA | 4,373 | 12.1% | 35.1% |

| Birmingham, AL | 4,001 | 2.8% | -14.3% |

| Boston, MA | 6,141 | -3.3% | 24.9% |

| Bridgeport, CT | 4,441 | 1.0% | -2.7% |

| Buffalo, NY | 1,676 | -9.9% | 0.7% |

| Camden, NJ | 5,761 | -0.9% | -18.6% |

| Charlotte, NC | 9,532 | 2.9% | 0.9% |

| Chicago, IL | 31,150 | 0.0% | 2.8% |

| Cincinnati, OH | 5,691 | 4.4% | -1.0% |

| Cleveland, OH | 6,765 | -3.0% | -5.9% |

| Columbus, OH | 4,775 | -1.6% | 5.7% |

| Dallas, TX | 14,705 | -1.7% | 21.6% |

| Dayton, OH | 2,158 | -7.6% | -7.8% |

| Denver, CO | 5,698 | -1.0% | 37.0% |

| Detroit, MI | 4,472 | -8.8% | 10.9% |

| El Paso, TX | 2,405 | 0.8% | -12.0% |

| Fort Lauderdale, FL | 15,270 | 9.3% | 16.3% |

| Fort Worth, TX | 6,194 | -4.1% | 8.9% |

| Fresno, CA | 1,608 | -2.7% | 15.4% |

| Grand Rapids, MI | 1,522 | -13.7% | -12.7% |

| Greenville, SC | 3,738 | 6.8% | 9.7% |

| Hampton Roads, VA | 5,948 | -3.6% | -10.8% |

| Hartford, CT | 3,995 | -7.1% | -10.2% |

| Honolulu, HI | 3,603 | 14.4% | 26.8% |

| Houston, TX | 24,705 | -1.5% | 12.2% |

| Indianapolis, IN | 4,630 | -11.9% | -12.8% |

| Jacksonville, FL | 7,133 | 1.9% | 10.6% |

| Knoxville, TN | 3,640 | 11.2% | 1.1% |

| Las Vegas, NV | 10,362 | 6.3% | 23.2% |

| Long Island, NY | 9,347 | 1.1% | 7.9% |

| Los Angeles, CA | 15,945 | 2.0% | 20.6% |

| Louisville, KY | 2,755 | -3.4% | 8.6% |

| McAllen, TX | 1,968 | 1.7% | 8.5% |

| Memphis, TN | 2,521 | -4.1% | -7.0% |

| Miami, FL | 19,425 | 2.5% | 8.0% |

| Milwaukee, WI | 3,659 | 0.3% | -9.0% |

| Minneapolis, MN | 7,219 | -7.1% | 4.5% |

| Montgomery County, PA | 5,114 | 4.5% | -16.9% |

| Nashville, TN | 10,059 | 2.5% | 24.5% |

| New Haven, CT | 2,921 | -7.2% | -11.4% |

| New Orleans, LA | 4,215 | 9.3% | -25.5% |

| New York, NY | 44,537 | -2.5% | 2.6% |

| Newark, NJ | 8,421 | 0.0% | 3.0% |

| Oakland, CA | 2,615 | 11.7% | 54.6% |

| Oklahoma City, OK | 4,281 | -8.0% | -17.6% |

| Omaha, NE | 1,514 | -11.1% | 0.1% |

| Orange County, CA | 6,987 | 3.4% | 27.8% |

| Orlando, FL | 9,848 | -0.4% | 6.6% |

| Oxnard, CA | 1,567 | -0.2% | 29.6% |

| Philadelphia, PA | 5,823 | 5.9% | -11.3% |

| Phoenix, AZ | 18,284 | 5.1% | -6.9% |

| Pittsburgh, PA | 7,499 | 0.6% | -9.8% |

| Portland, OR | 5,843 | -4.5% | 47.6% |

| Providence, RI | 4,530 | -5.2% | 8.5% |

| Richmond, VA | 2,763 | -6.1% | 0.3% |

| Riverside, CA | 15,053 | 0.1% | 7.3% |

| Rochester, NY | 1,325 | -9.2% | -22.2% |

| Sacramento, CA | 4,090 | -8.1% | 16.4% |

| Salt Lake City, UT | 4,193 | 15.8% | 53.8% |

| San Antonio, TX | 7,498 | -3.4% | -1.1% |

| San Diego, CA | 6,475 | -2.4% | 37.6% |

| San Francisco, CA | 1,305 | 32.0% | 47.1% |

| San Jose, CA | 1,550 | 11.0% | 100.8% |

| Seattle, WA | 5,004 | -9.4% | 109.1% |

| St. Louis, MO | 9,692 | 3.6% | 1.7% |

| Tacoma, WA | 1,629 | -10.7% | 8.3% |

| Tampa, FL | 14,365 | 1.5% | 13.6% |

| Tucson, AZ | 4,441 | 8.2% | -2.1% |

| Tulsa, OK | 4,013 | 14.9% | 15.8% |

| Warren, MI | 6,767 | -8.3% | 18.0% |

| Washington, DC | 13,344 | 2.2% | 2.7% |

| West Palm Beach, FL | 15,503 | 10.2% | 5.0% |

| Worcester, MA | 1,761 | -14.2% | -6.6% |

| National | 748,100 | 1.1% | 6.3% |

Median Off-Market Redfin Estimate

| Redfin Metro | Estimate | Month-Over-Month | Year-Over-Year |

|---|---|---|---|

| Albany, NY | $214,100 | -0.5% | 3.6% |

| Allentown, PA | $208,700 | -0.2% | 5.7% |

| Atlanta, GA | $218,600 | 0.4% | 11.0% |

| Austin, TX | $299,900 | 0.0% | 4.1% |

| Bakersfield, CA | $215,700 | 0.1% | 7.7% |

| Baltimore, MD | $253,300 | -0.2% | 3.5% |

| Baton Rouge, LA | $151,800 | 0.3% | 2.7% |

| Birmingham, AL | $148,500 | -0.1% | 5.3% |

| Boston, MA | $485,900 | -0.3% | 5.4% |

| Buffalo, NY | $155,900 | -0.4% | 5.9% |

| Camden, NJ | $192,400 | -0.2% | 3.4% |

| Charlotte, NC | $205,600 | 0.3% | 13.3% |

| Chicago, IL | $242,000 | -0.2% | 5.6% |

| Cincinnati, OH | $167,800 | -0.1% | 8.0% |

| Cleveland, OH | $138,200 | 0.0% | 6.6% |

| Columbus, OH | $189,000 | 0.3% | 10.0% |

| Dallas, TX | $256,300 | 0.1% | 5.8% |

| Dayton, OH | $116,500 | -0.2% | 5.3% |

| Denver, CO | $409,800 | 0.1% | 7.4% |

| Detroit, MI | $105,700 | -0.4% | 22.5% |

| Fort Lauderdale, FL | $264,500 | 0.7% | 6.5% |

| Fort Worth, TX | $213,100 | 0.3% | 8.5% |

| Fresno, CA | $253,600 | 0.2% | 6.8% |

| Grand Rapids, MI | $159,700 | -0.1% | 7.9% |

| Greenville, SC | $169,400 | 0.4% | 8.6% |

| Hampton Roads, VA | $223,800 | -0.2% | 3.7% |

| Honolulu, HI | $689,100 | -0.1% | 2.9% |

| Houston, TX | $208,000 | 0.3% | 5.8% |

| Indianapolis, IN | $160,100 | 0.1% | 8.8% |

| Jacksonville, FL | $217,000 | 0.3% | 8.8% |

| Kansas City, MO | $185,700 | 0.0% | 6.8% |

| Knoxville, TN | $150,500 | 0.3% | 7.8% |

| Las Vegas, NV | $273,200 | 0.2% | 12.1% |

| Long Island, NY | $443,100 | 0.0% | 5.0% |

| Los Angeles, CA | $629,200 | -0.2% | 6.8% |

| Louisville, KY | $150,800 | 0.1% | 5.8% |

| Memphis, TN | $135,700 | 0.9% | 6.7% |

| Miami, FL | $296,700 | 0.5% | 6.4% |

| Milwaukee, WI | $208,100 | -0.6% | 9.4% |

| Minneapolis, MN | $258,500 | 0.0% | 7.0% |

| Montgomery County, PA | $316,000 | 0.0% | 3.2% |

| Nashville, TN | $248,300 | 0.2% | 7.9% |

| New Orleans, LA | $169,800 | 0.1% | 1.7% |

| Newark, NJ | $372,000 | 0.1% | 15.0% |

| Oakland, CA | $760,400 | -0.8% | 5.5% |

| Oklahoma City, OK | $141,400 | 0.3% | 4.8% |

| Omaha, NE | $169,200 | 0.2% | 6.5% |

| Orange County, CA | $711,800 | -0.2% | 4.0% |

| Orlando, FL | $231,800 | 0.4% | 7.6% |

| Oxnard, CA | $599,800 | -0.3% | 3.4% |

| Philadelphia, PA | $199,000 | -0.5% | 5.3% |

| Phoenix, AZ | $268,100 | 0.3% | 7.5% |

| Pittsburgh, PA | $144,400 | -0.2% | 6.8% |

| Portland, OR | $390,600 | 0.2% | 3.7% |

| Providence, RI | $294,500 | -0.2% | 5.1% |

| Raleigh, NC | $260,000 | -1.7% | 4.8% |

| Richmond, VA | $222,600 | 0.1% | 5.5% |

| Riverside, CA | $364,600 | 0.0% | 6.0% |

| Rochester, NY | $143,700 | -0.6% | 6.0% |

| Sacramento, CA | $400,200 | -0.3% | 5.1% |

| Salt Lake City, UT | $324,800 | 0.2% | 9.1% |

| San Antonio, TX | $192,200 | 0.3% | 5.8% |

| San Diego, CA | $590,300 | -0.3% | 4.9% |

| San Francisco, CA | $1,328,000 | -1.0% | 5.7% |

| San Jose, CA | $1,208,600 | -1.2% | 7.7% |

| Seattle, WA | $556,700 | -0.7% | 6.5% |

| St. Louis, MO | $155,600 | 0.2% | 5.6% |

| Tacoma, WA | $344,500 | 0.0% | 7.6% |

| Tampa, FL | $218,700 | 0.2% | 7.2% |

| Tucson, AZ | $207,800 | 0.4% | 7.2% |

| Tulsa, OK | $138,900 | 0.0% | 4.5% |

| Warren, MI | $210,900 | -0.3% | 6.8% |

| Washington, DC | $387,200 | -0.1% | 3.7% |

| West Palm Beach, FL | $265,200 | 0.1% | 4.9% |

| Worcester, MA | $283,500 | -0.2% | 6.6% |

| National | $298,800 | 5.6% | 6.3% |

This post first appeared on Redfin.com. To see the original, click here.