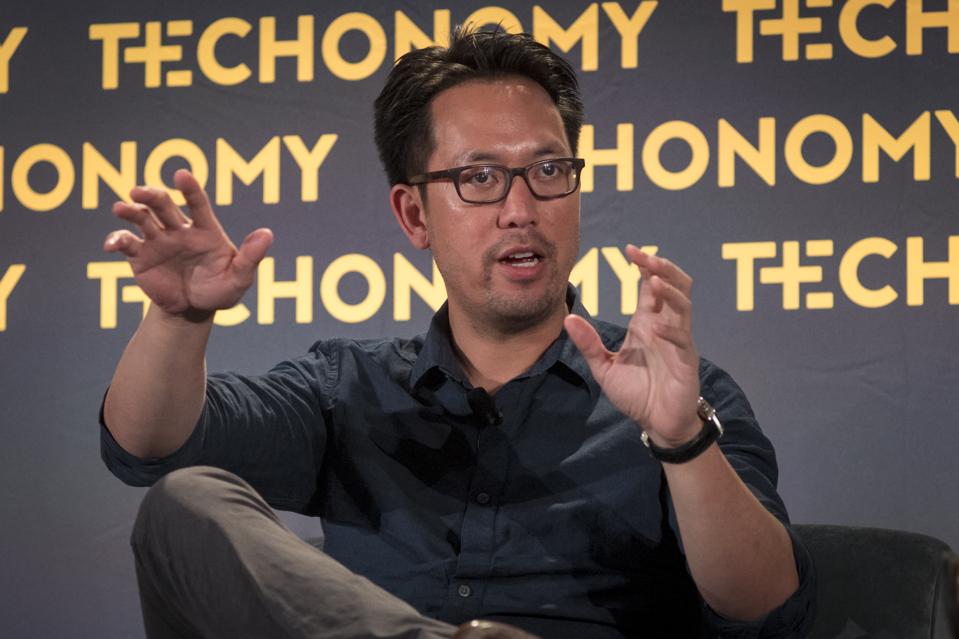

Eric Wu, CEO of OpenDoor, speaks at a conference in 2018. (Photo by David Paul Morris/Bloomberg)

© 2018 Bloomberg Finance LP

Opendoor, an online platform that lets homeowners quickly sell their houses, announced on Tuesday that it will go public through a merger with Social Capital Hedosophia Holdings II, a shell company helmed by Chamath Palihapitiya, a venture capitalist and early Facebook executive.

The deal values Opendoor at an enterprise value of $4.8 billion, and will generate up to $1 billion in cash proceeds, the company says. Palihapitiya himself is putting $100 million into the business.

“We founded Opendoor to make it simple and instant to buy and sell a home,” Opendoor’s founder and CEO, Eric Wu, said in a statement. “This is one of many milestones towards our mission.”

Founded in 2014, Opendoor is the dominant player in the “iBuying” space, a term for start-ups that let homeowners rapidly sell their homes to the company, which then lists it on its platform—taking a cut from both sides of the transaction. Opendoor utilizes data analysis to determine its pricing, a central element of its business plan; if it overpays for a home upfront, it could take a loss. If it tries to underpay, sellers will look elsewhere.

The firm’s valuation has soared in recent years—it was most recently pegged at $3.8 billion in 2019—helped along by a $400 million infusion from SoftBank in 2018.

Opendoor generated $4.7 billion in revenue last year on 18,000 home sales across 21 markets. Still, the company is operating at a substantial loss. In April, it laid off a third of its employees.

Opendoor also faces increased competition, from Zillow Z , Offerpad, Redfin RDFN and others. Even still, iBuying comprises just 0.5% of the $1.6 trillion home-buying market, according to The Real Deal.

Social Capital Hedosophia Holdings II was formed earlier this year as a blank-check firm—also known as a special purpose acquisition company, or SPAC. In simple terms, it went public as a shell company, then scouted the market for an attractive tech start-up with which to merge.

Last year, Social Capital Hedosophia’s first SPAC helped take public Richard Branson’s rocket company, Virgin Galactic SPCE . Its shares have since ticked up.

So far, the market is reacting positively to its second major deal, with Opendoor. As of 9:50 am eastern time on Tuesday, the SPAC’s stock is up 16%.