As population has begun to surge in Minneapolis, the city gets ahead of a potential affordability crisis in a way that other cities should emulate.

Minneapolis made national headlines in December when the City Council voted to completely eliminate exclusively single-family zoning throughout the city. This means that neighborhoods where new construction was previously limited to one single-family home per lot are now also open to the construction of duplexes and triplexes (two- and three-family homes). The move is part of a larger plan called Minneapolis 2040 that seeks to address a broad variety of issues including population and job growth, public health, the environment, and housing affordability.

Minneapolis is now the first major city in the United States to entirely eliminate single-family zoning. “It is a bold step by Minneapolis to end a policy that has historically contributed to segregation and inequality along economic and racial lines,” said Redfin chief economist Daryl Fairweather. “Eliminating strict zoning restrictions citywide rather than attempting to change regulations neighborhood by neighborhood is perhaps the most fair and efficient way to make room for healthy growth.”

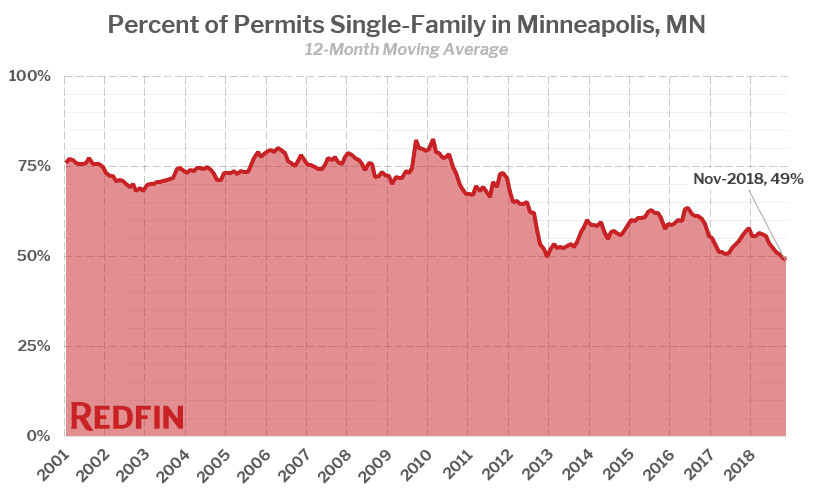

The zoning change came just a month after another milestone: In November (latest data available from the Census Building Permits Survey), the share of permits to build single-family homes fell below 50 percent of total building permits in Minneapolis for the first time ever, following a general downward trend for most of the past decade.

Eliminating single-family zoning in Minneapolis looks less like a revolution and more like smart evolution of a growing city that is doing a lot of things right.

As of 2017 (the latest year with income data available from the Census Bureau), a household in Minneapolis earning the median $55,270 income would spend just 19 percent of their monthly income on the mortgage payment of a median-priced $235,000 home. In Seattle, it’s double that: 38 percent, and in San Francisco it was a whopping 62 percent. Typically housing is considered affordable when it takes no more than 30 percent of your income.

In fact, Minneapolis is already one of the most affordable major cities in the U.S., as more than four out of five homes for sale in 2018 were affordable to locals earning the median household income. Minneapolis is also one of the cities with the highest rates of homeownership for low-income families.

Before the change, more than half of Minneapolis was zoned for single-family housing only. Now, homes as large as duplexes or triplexes will be allowed in all neighborhoods, tripling the potential capacity of the formerly single-family zones and doubling the city’s overall housing potential.

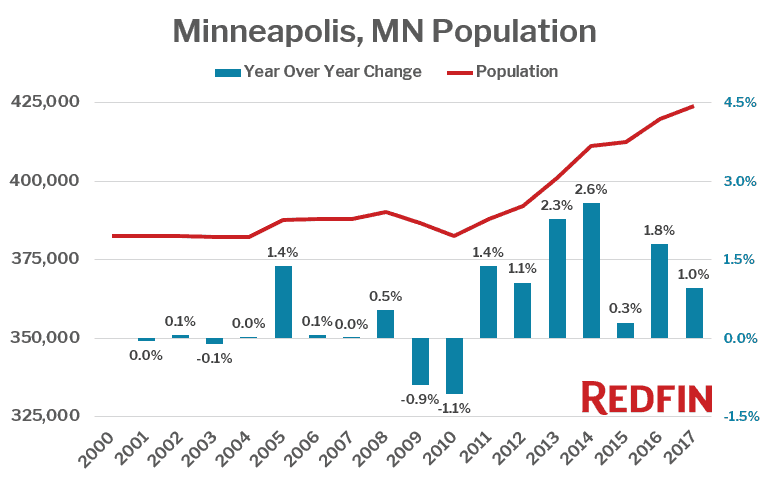

It’s easy to see why leaders in Minneapolis have been feeling pressure to expand the city’s capacity for housing. After nearly a decade of stagnation, the city’s population began growing rapidly in 2011, up 11 percent (41,000 people) between 2010 and 2017.

Over the last four years, the number of homes for sale on the market in the fall has dropped an average of 10 percent per year in Minneapolis, while home sales have risen as much as 7 percent per year as the population booms. As a result of this imbalance in supply and demand, home prices have risen an average of 7 percent per year since 2015.

The change comes at a critical time for the city. Although house prices in Minneapolis are currently lower than the national median, they have grown at a faster rate–up 8 percent year over year as of February–than in several other major cities with larger populations and less affordable housing.

Median home price and 12-month year-over-year growth in select cities

As of February 2019

| City | Year-Over-Year Change (12-mo avg.) | Median Sale Price (all residential) |

|---|---|---|

| Atlanta, GA | 8.7% | $275,000 |

| Memphis, TN | 8.3% | $128,000 |

| Milwaukee, WI | 8.3% | $127,000 |

| Phoenix, AZ | 8.3% | $252,000 |

| Minneapolis, MN | 7.8% | $260,000 |

| Boston, MA | 7.5% | $590,000 |

| Denver, CO | 7.3% | $400,000 |

| Raleigh, NC | 7.3% | $275,000 |

| Philadelphia, PA | 6.2% | $185,000 |

| Los Angeles, CA | 5.8% | $670,000 |

| San Francisco, CA | 5.5% | $1,311,000 |

| Seattle, WA | 5.0% | $675,000 |

| Washington, DC | 4.0% | $570,000 |

| Portland, OR | 3.0% | $423,000 |

| Chicago, IL | 1.7% | $265,000 |

| Dallas, TX | -0.6% | $300,000 |

| National | 4.3% | $287,000 |

It remains to be seen exactly how this change will play out, but as demand for housing in Minneapolis continues to grow, enabling and encouraging the supply of housing to grow along with it is likely to help moderate home price growth in Minneapolis and avoid an extreme affordability crisis like the situations in San Francisco and Seattle.

Homebuyers are generally in favor of the policy change. “I talk to most of my homebuyers about the shift in zoning,” said local Redfin agent Dan Caudill. “It’s generally favorably received as a progressive and reasonable way to go forward. Our customers feel that Minneapolis is a desirable area and they’re not worried about the change in zoning affecting future home values. It’s a smart plan that will increase housing density and expand the Minneapolis workforce in a way that will help the city grow in a healthy way and keep commutes under control.”

According to MinnPost, “about three-fourths of the city’s population live in neighborhoods zoned primarily for single-family homes or small multifamily housing.” That’s about 138,000 households, based on 2017 Census estimates. If 5 percent of the single-family homes in these neighborhoods were replaced with duplexes and 5 percent with triplexes, that would result in an additional 20,750 homes–enough for an additional 47,500 people to live in the city. That’s more than the total population growth in Minneapolis between 2010 and 2017, even without accounting for growth in higher-density parts of town.

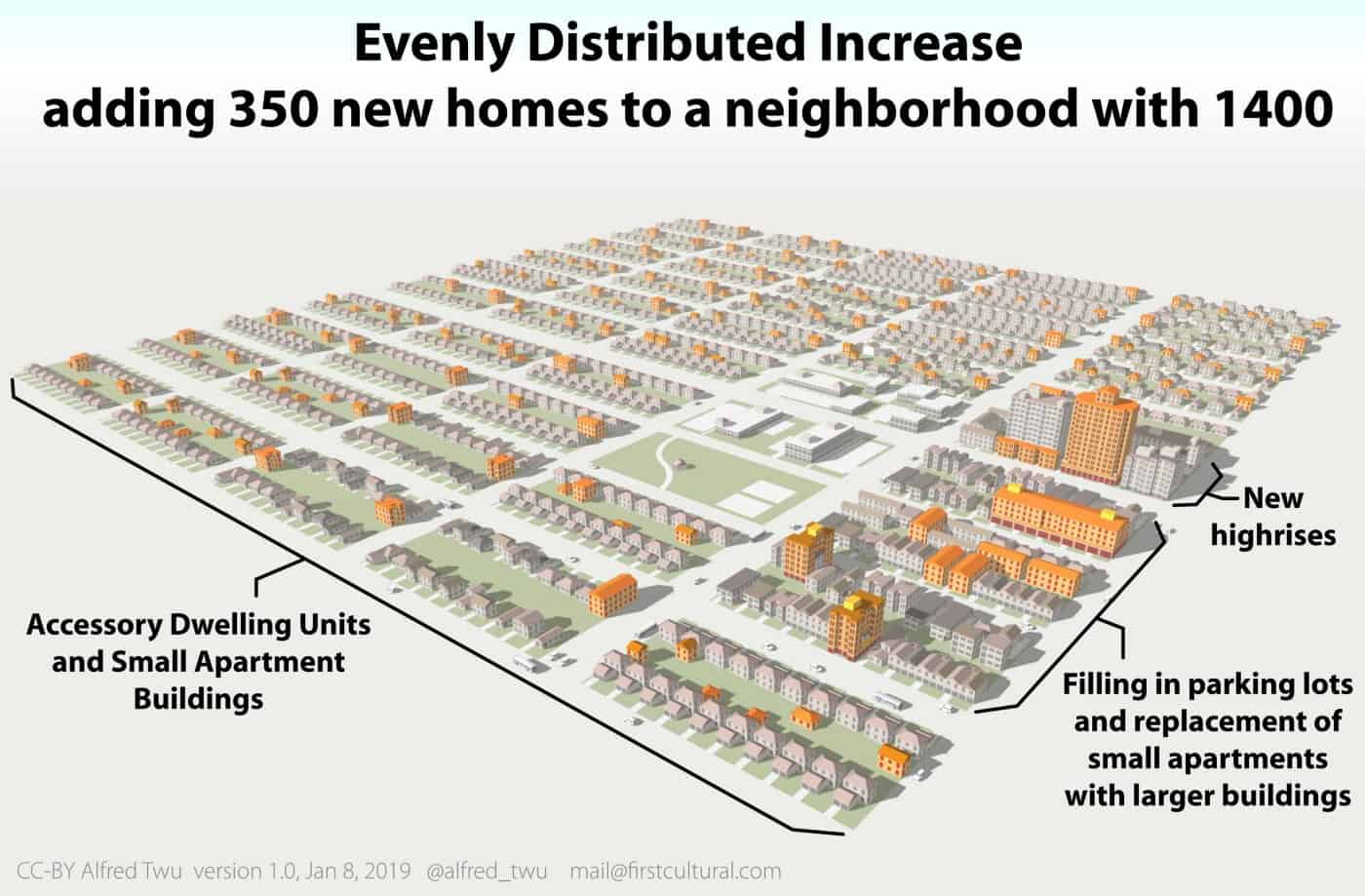

Even a more dramatic increase in housing under this change would not take as much new development as you might think. In a block of 20 single-family homes, replacing just three single-family homes with duplexes and one with a triplex would increase the total housing by 25 percent. Here’s how a 25 percent increase in housing might look like evenly-distributed across a mostly single-family neighborhood with 1,400 homes (source: Alfred Twu).

Of course, while keeping affordability in check is a huge benefit, increasing density does involve trade-offs. The lack of private yards can be a turn-off for young families, which could drive them to neighboring St. Paul, that still have neighborhoods exclusive to single-family homes, or to other parts of the country. On the flip side, higher-density communities tend to rely more heavily on shared public spaces like parks to satisfy their need for outdoor space, which has its own benefits such as increasing interactions between neighbors and bringing together people of different socioeconomic backgrounds.

Duplexes and triplexes aren’t for everyone, and this change doesn’t mean that whole neighborhoods will suddenly double or triple their density overnight. But, more housing choices and more housing overall is definitely a good thing and will allow Minneapolis to grow smartly.

This post first appeared on Redfin.com. To see the original, click here.