Cantabria at Bradenton, a built-for-rent community in Florida planned by Clean Living Communities

Clean Living Communities, a division of Transcendent Investment Management

It’s the newest, hottest trend in residential development, so new that it does not yet have a standardized abbreviation, talked about by various players as BFR, B2R, or BTR. The dramatic emergence of “built-for-rent” single-family over the past eight years is supported by voracious demand, but the participants in this space will need to pick their strategies skillfully and think increasingly in terms of diversification, niches, and even new methods of production.

The demand for newly-built rental homes is being fueled in part by the wave of millennials who are finally forming families. Many of them are having kids now, which is driving them to want to have a home in the suburbs, with a yard, other kids in the neighborhood, parks nearby, and good schools. Adding to that demand are young singles and empty-nesters who want the convenience that comes with a professionally-managed rental community and who want something bigger than an apartment. When members of these groups lack the savings for a downpayment or simply prefer the freedom that comes with being a renter, they often choose a single-family home for rent.

The boom in building single family homes for rent is new, but the renting of single-family homes is not. Most people are surprised to learn what a large share of the single-family existing housing stock is already renter-occupied. There are approximately 15-16 million rental homes (single-family and townhomes) in the country, according to Census Bureau data analyzed by Amherst Capital. To put that in perspective: about one household in eight in the U.S. lives in a single-family rental property.

More than 50,000 houses are being built for rent each year, which is approximately 5%-6% of all homes constructed. And it’s not enough. From what I am tracking, it’ll hit 8% in the next year, and still won’t be enough to meet total nationwide demand. Many of the companies that are building homes for rent are struggling to keep up with the flood of interest. Based on the demographic trends that are unfolding, we can double or even triple today’s volume without oversaturating this segment of the housing market (although certain submarkets are about to get very competitive).

These new rental home communities come in a variety of housing types, including single-story or two-story single-family homes, townhomes, duplexes, “horizontal multifamily” (discussed below), and row homes.

Strategies for Success: Choose Wisely

The successful players in this space can tell you that it’s an opportunity, but not a “no-brainer.” One has to strategize carefully, and differently than one does in the for-sale business, about land as well as product. In this business, you think differently about what makes a good location, and you have to have a long-term mentality when designing and finishing the homes.

This is a period of expansion, but also of experimentation and testing, within this relatively young niche. The various players in this space have vastly different approaches. Some are creating single-family communities on a single plat, similar to an apartment building (hence the term “horizontal multifamily,”) while others, like American Homes 4 Rent AMH (AH4R) have individual lots/plats for each house.

A good location for BFR is an established or growing area with plenty of neighborhood conveniences, including a branded grocery store. Some companies prefer to offer homes within a master-planned community in order to benefit from the comprehensive feel, community marketing, breadth of segmentation of housing, and the shopping and entertainment that comes with it, but there are ample opportunities in standalone locations as well.

The types of product can vary, according to the demands of the market in a certain location, and according to the strategy employed by the operator. Some rental companies stick to full-sized single-family homes, while others have found a successful niche building higher-density product.

How does the cost to rent a home compare with the cost of renting a large apartment? As an example, the rent on a 3-bedroom apartment might be $1,750 per month, and in the same market a 3-bedroom single-family home might rent for $2,000, which sometimes comes out lower on a per-square-foot basis even though it is higher in absolute terms.

Renters who compare the cost and the square footage (versus apartments) do so with keen awareness that there are additional benefits of a single family home that include storage, a garage and a yard. “While the two-car garage may not be counted in the heated square footage, it certainly counts and is highly valued by our residents,” points out Brent Landry, Senior Vice President of American Homes 4 Rent. Also adding value is the yard, which can allow a place for kids or dogs to run around, and a place to have a grill and an outside entertainment area. Renters value those aspects highly.

Compared to the Other Alternatives…

For those people who do want to live in a suburban area, they can of course look at buying a home, or they can rent an existing, individually-owned, single-family home.

With mortgage rates this low, ownership is tempting, but a lot of young families have not yet saved up enough for a downpayment, and other householders are “renters by choice,” who want the footloose feeling that comes with renting.

Comparing the rental rates in a professionally-managed rental community with the rent on individually-owned single-family rentals, there can be a premium of 10%, 20%, or sometimes much more, depending upon the age and configuration of the existing homes and other factors. In a full-service BFR community, there is a premium that stems just from the presence of a professional management company to keep the community and the individual units well-maintained, and the front yards looking neat and trim.

Major Players and Their Approaches

One of the first entrants, BB residential, started building new, single-family and townhome for-rent communities in the Phoenix area in 2012. They now have more than 1,000 homes in their portfolio and are now partnered with Toll Brothers.

A home in an Avilla community by NexMetro.

Photo courtesy of NexMetro

Another player who has received a lot of attention is NexMetro, an innovator and leader in this space. NexMetro launched their first Avilla project in Goodyear, Arizona, in 2015, and now they have more than 30 projects, in Phoenix, Denver, Dallas, and Tampa.

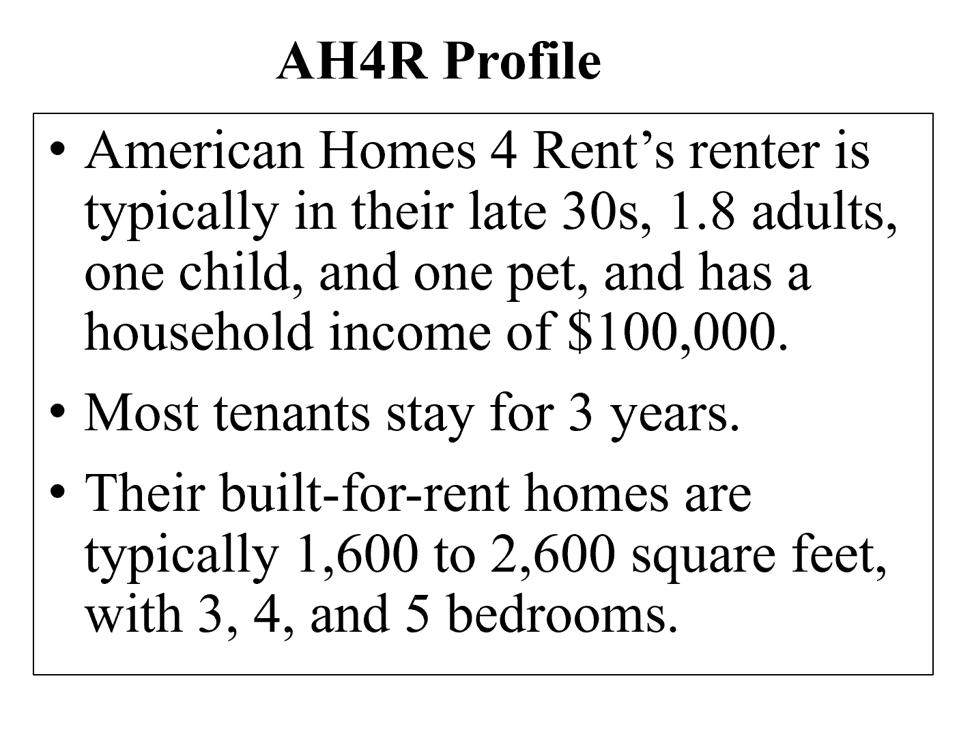

American Homes 4 Rent started out buying already-built homes, and around 2017 started getting into the built-for-rent business, now with more than 50 BFR neighborhoods in their portfolio, adding to the 53,000 homes they had acquired

American Homes 4 Rent builds full-sized homes and attracts mature Millennials.

Source: Hunter Housing Economics discussions with Brent Landry, SVP of AH4R

previously. AH4R benefits from being able to see what worked best in their existing holdings as they plan their new communities. AH4R typically builds better finishes and higher quality than builders put into a for-sale home, because they are going to hold the homes and they want to keep the cost of maintenance low.

Tricon Residential Inc., a rental housing company focused on serving the middle-market demographic in North America, owns and manages 22,000 single-family rental homes (plus 10,000 multifamily homes) throughout North America. While many of Tricon’s single-family rental homes were foreclosure homes that they purchased during the downturn, or resale homes purchased through the MLS, more recently, Tricon has started to acquire new homes from builders (about 500 homes so far), and in the last 18 months has started their built-for-rent initiative. They currently own and manage five completed BFR communities and have an additional six communities in pre-development and under construction.

Tricon is currently targeting a “middle-market strategy,” offering homes that are suited to households with incomes in the $60,000 to $100,000 range. They have noted that households with incomes over $100,000 tend to move more often. Tricon residents tend to stay for three to four years (or longer), which is longer than average in the sector, and much longer than in apartments.

In the market studies I have done for individual BFR sites, I find that demand often outstrips the pace of production. SFR demand is strong, as the practitioners will tell you. “We get seven inquiries for every signed lease,” said Andy Carmody, managing director for Tricon.

This success has attracted large institutional players. Last year Tricon announced a $450 million joint venture with a large U.S. pension fund to target the development of BFR communities, and Tricon recently announced that a syndicate of investors led by Blackstone Real Estate Income Trust, Inc. has made a $300 million preferred equity investment in Tricon, so watch for an explosion of growth from them.

The Homebuilders Have Their Own Strategies

Some homebuilders have been dabbling in the rental home business since the end of the Great Recession, and they have done so across a wide range of strategies. Toll Brothers formed a venture with BB Living. Other builders simply spin off some of their new homes to operators who will rent them out. Still others are staying out of it, sticking to their roots, building homes for sale.

The homebuilders are still focused chiefly on building and selling, but several majors, like Lennar, DR Horton, LGI, Taylor Morrison TMHC , and Toll Brothers TOL are devoting some of their home production to BFR, and there are solid business reasons to do so. Selling homes typically involves offering the buyer a range of choices of colors, materials, and finishes, to personalize their home. This costly and time-consuming step is not needed when building homes for rent. Eliminating it means that builders can execute the identical way all the way through the subdivision, which creates efficiency and saves money.

There are other efficiencies, such as being able to look at the total cost over a long time horizon. You can pay more for a refrigerator if is going to last longer and need less maintenance, since you are holding the house on your books.

There are also tax advantages, of course, to a long-term hold. If the owner/builder decides to sell the asset after a few years, they can record the gain as long-term, paying a lower tax rate.

As mentioned, one of the common strategies for a builder is to spin off a parcel and build the homes for a fee on a behalf of the owner-operator, and then be “out” of the deal and on to the next one. That is more in keeping with a builder’s model, and it is a low-risk high-inventory-turn strategy that is easy on the balance sheet.

This market niche is deep, but it is not bottomless, and there are some potentially painful pitfalls along the way. Chief among them: builders should avoid the trap of using a BFR strategy as a way to justify a land deal that doesn’t pencil out for a for-sale program. It still has to be the right submarket, with the right product type, and that will be different for BFR than for for-sale.

A Florida BFR Boom is Coming

The west and southwest have been the cradle for this type of business so far, but Florida will be the next state to see a large increase in built-for-rent development. We are tracking BFR communities coming up in Boca Raton, Stuart, Central Florida, and St. Lucie County. NexMetro is just opening a new built-for-rent community in the Tampa area (in Odessa). The single family rental neighborhood, called Avilla Suncoast, is located 15 miles north of downtown Tampa. Construction is under way, and opening is planned for early 2021. NexMetro’s detached single level 1, 2 and 3-bedroom homes will include private backyards and front entries, open floor plans, high ceilings, granite countertops, stainless steel appliances and hard-surface flooring. The Avilla Suncoast neighborhood will be gated and offer garages, covered parking areas and amenities such as a resort-style pool and spa, outdoor grills, lounge areas, dog park, walking areas and open space.

A healthy-living-focused company called Clean Living Communities (TM) is about to launch a major initiative in Florida via joint ventures with Lennar Homes and other builders. In these JV’s the builder builds the homes for Clean Living Communities on a cost-plus basis; the builder is assured of being able to sell the homes at a certain pace and at a certain price. Then Clean Living Communities, which was founded in 2008, rents out the homes, typically with 24-month leases. “Our customers are families with young kids, retirees who are just trying out the area, and graduate-level students,” said Jordan Kavana, the company’s founder.

Clean Living Communities, as the name implies, emphasizes health and wellness in its homes and in its communities. The company has set a goal to get five projects in the ground per year for the next five years. They currently have five projects in the pipeline, in Florida, Texas, and the Carolinas. Their first Florida community is to be marketed as Contabria at Bradenton, consisting of rental townhomes with six and eight per building, and is breaking ground in the fourth quarter of 2020.

Another developer, Stellar Communities, is currently developing 39 townhome units at Siena at Palm Aire, with additional communities coming up, called Stellar at Emerald Hills (197 townhomes), and Stellar at Florida City (350 villas). They will be building detached homes for rent in Boynton Beach and Delray Beach, and plan to build 10,000 BFR units in the Southeast, most of them in Florida.

A Tampa-based builder, ERC Homebuilders, is launching a business based upon renting new manufactured homes. “We can rent a manufactured home for $1,395 a month instead of the $2,000 a month we’d need to charge for a site-built home,” said Jerry Ellenburg, the chairman and CEO of ERC. They are preparing to open a 60 unit development for rent in Zephyrhills and a 40-unit subdivision in Wesley Chapel, but they say that the ideal size will be 150 to 200 units in each subdivision. They seek to grow to a development pace that will accommodate 1,000 manufactured homes per year over the next few years.

On the broader subject of “offsite construction,” which includes manufactured housing as well as modular housing, Dennis Steigerwalt, the President of the Housing Innovation Alliance said, “the build-to-rent movement is seeing increased utilization of advanced building methods specifically when it comes to delivering offsite-built components, and expanding use of alternative materials such as cold-formed-steel structural systems. Among other advantages, steel has not been subjected to the same price volatility that lumber is currently experiencing, and this is driving an increased interest from several large players. ” The steel wall, and floor, panels are built to the exact dimensions and pre-punched with coding for electrical conduit, plumbing backing, runs and vents, and unobstructed vent paths for all mechanicals. This lean methodology is to simplify and speed the assembly process once the systems arrive on the home site. “With the build-to-rent business model, it’s all about velocity. These offsite building solutions improve quality, reduce owner insurance rates, mitigate waste, reduce time on-site, and empower trades, allowing builders to do more with less in the face of the skilled labor shortage,” added Steigerwalt. This is critical given the replacement rate for framers is 1:5; for every five that retire or leave the work force, we only add one.

The Pandemic Adds Fuel For BFR

Nowadays, there are new factors adding to the demand for BFR.

- First, it is a lot easier to socially-distance in a single-family home than in a mid-rise or high-rise apartment. Some people prefer to avoid the close quarters involved in an elevator building and instead pull into their attached garage and walk directly into their home.

- Second, the demand for home offices is exploding, and it is easier to find the space for such a use within a home than in an apartment.

- Third (not a pandemic effect, but piling demand on top of it), the Millennials are starting to have kids, which is just adding more demand for the suburbs as they look for the good schools, yards, parks, and neighborhoods with other kids.

- Fourth, in dense cities, people are trying to get away from subways and other mass transit, again, adding to the demand for the suburbs.

Many factors are providing tailwinds to this still-evolving and rapidly-growing niche in the housing business. There is enough demand to absorb a very large increase in BFR production. But bear in mind: there is a lot of competition entering this space, and there are plenty of ways to miss the market. Some of the players getting involved with BFR are better at certain aspects of the business than others, and it’s often all about having the right partners and the right advisors. This is still, after all, a developing business.