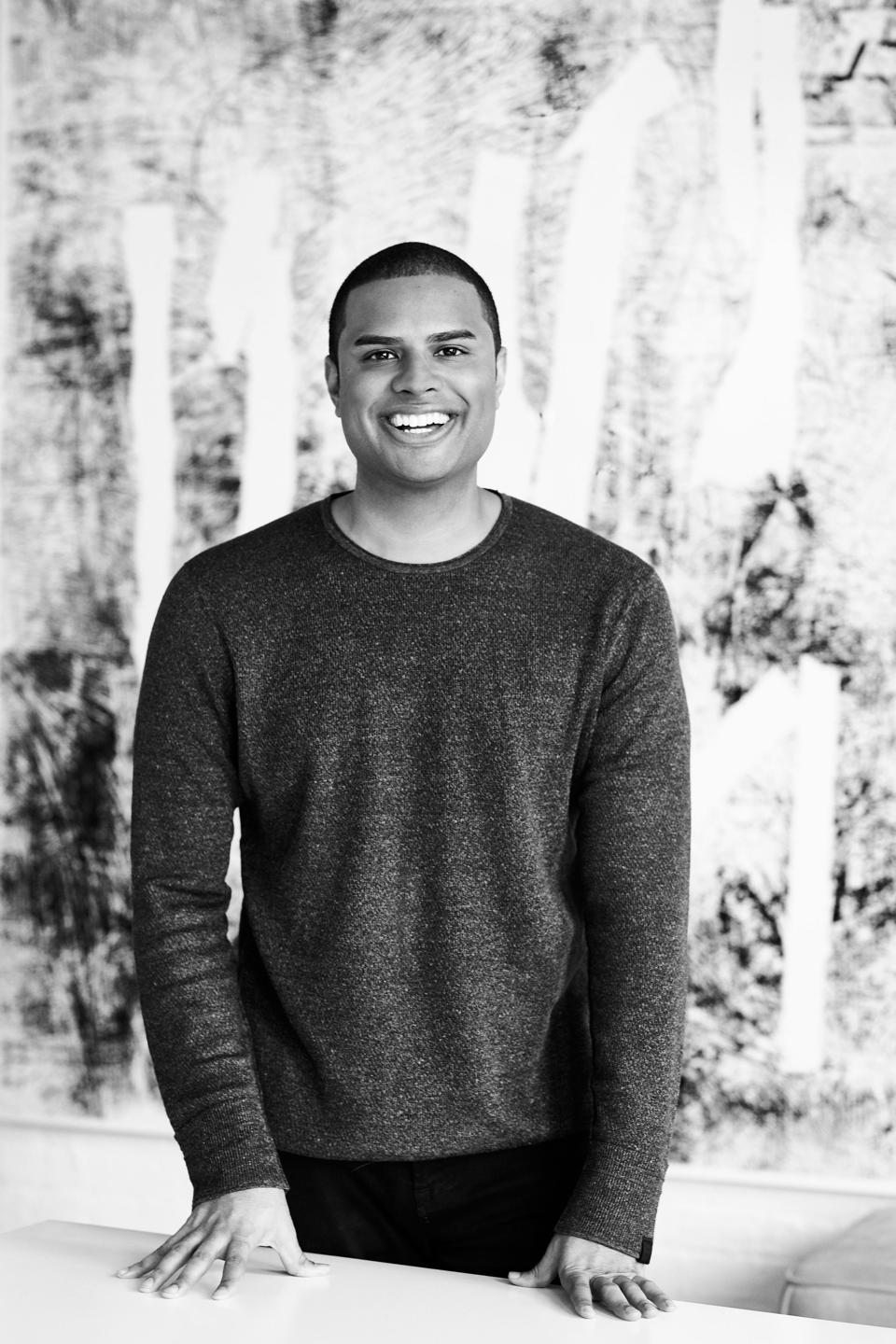

Cadre’s Ryan Williams graced the cover of Forbes in 2019 as his real estate startup neared unicorn status. After a brutal slog for real estate during Coronavirus, Williams is revving up growth at his company.

Jamel Toppin for Forbes

Ryan Williams got his start in real estate investing as a student at Harvard University in the years during the financial crisis, sourcing capital from his network to opportunistically buy distressed properties in areas like the Atlanta suburbs. A decade later, after time at Goldman Sachs and Blackstone, Williams was at the helm of his own fast-growing real estate company, backed by some of the biggest names in investing and business, and facing a new economic storm to navigate.

Last spring, as the Coronavirus pandemic ravaged the U.S. economy and all but froze real estate and financing markets, Williams’s real estate financial technology company Cadre saw revenues drop sharply. To ensure survival, Williams battened down the hatches, laying off a quarter of Cadre’s then over 100-worker staff, cutting redundant staff and extraneous growth projects. The move proved overly conservative as financial markets came roaring back and changes generated by the pandemic positively impacted Cadre’s $3 billion real estate portfolio of multi-family residential, office and hotel properties.

Now, Williams is back on the offensive, launching a new $400 million real estate fund oriented to individual investors, financial advisors and institutions. The Cadre Direct Access Fund is an attempt by Williams to push Cadre’s real estate technology investment platform closer to smaller investors and advisors looking to invest directly in real estate deals at reasonable costs, but maintain good liquidity.

Cadre’s built a StubHub-like secondary market that can help an investor exit their investment with a few mouse clicks, and has handled hundreds of secondary transactions for investors. When it comes to costs, Cadre doesn’t charge the double fees of traditional property investment firms, which pay a “promote” to real estate operators and at the fund level. Currently, it charges at least 1% up front, plus 1.5% annually on the equity value it oversees and also claims a small portion of the 15% cut of profits kept by the real estate operating partners.

“I believe we are entering a period that will potentially be a once in a lifetime opportunity to invest in attractively-priced properties,” Williams tells Forbes, adding the new fund “will allow an unlimited number of individuals and advisors to benefit from investing in these assets.”

With stock markets at record valuations and investors hunting for yield, Williams hopes to broaden Cadre’s market opportunity and capitalize on demand for real assets that can benefit from low interest rates and any uptick in inflation. Presently, to gain exposure to real estate, investors’ options are to invest in real estate investment trusts, or REITS, which are generally large portfolios of properties in single real asset classes. For larger investors, options include private REITs, or large real estate private equity funds.

Cadre, however, uses technology and a network of hundreds of real estate operators nationwide to identify advantageous geographies and property types, building diversified portfolios. Since Williams founded the company in 2014, it has won backing from Goldman Sachs and secured a financial backstop from George Soros’s investment operation. Venture investors in the platform include Peter Thiel, Mark Cuban and Vinod Khosla. Months before Covid hit, Williams was using his resources to make big name hires, including former Four Seasons CEO Allen Smith, who is now president. In 2019, Forbes revealed Cadre was worth about $800 million and Williams’ 20% stake worth hundreds of millions of dollars: (See story)

Despite Williams’s initial pessimism about Covid-19, the firm has sidestepped the worst of the carnage the pandemic has wrought on the real estate market. A few years ago, for instance, Williams and his team grew bearish on gateway cities like New York and San Francisco, instead focusing on smaller, less expensive markets like the Atlanta exurbs and Nashville, Orlando, Tampa and Phoenix. Those cities have enjoyed strong demand through the pandemic.

As of year-end, occupancy in Cadre’s multifamily portfolio is the same as it was at the beginning of the pandemic, with rent collections averaging north of 96% from April to December 2020. In its office portfolio, Cadre has averaged over 95% rent collections since April 2020 and less than 1% of portfolio tenants by square footage have moved out of their space prior to lease expiration over the past nine months.

The Direct Access Fund, which already has commitments from some large institutional investors, will be made available to qualified investors with minimum per-property checks that can be as low as $5,000. Presently, 50% of Cadre’s portfolio is focused on multi-family real estate, with the remainder covering office, industrial, life sciences and hotel properties.

“We want to usher in a new era of institutional real estate investing for individuals, where they can invest alongside an experienced team such as ours, and alongside institutional investors, in a way they’ve never been able to do before,” says Williams.

Since inception, Cadre has distributed more than $168 million to its investors, delivering an over 18% net investment return on multiple realizations. In 2019, for instance, Cadre monetized a 268-unit multifamily property in Atlanta at a net IRR of 27.4%, and a 364-unit multifamily property in Chicago at a 15% net IRR, both above its underwriting objectives. The markets Cadre is most excited heading as Covid-19 wanes include Seattle, Denver, Houston, the DC-area, Dallas, Austin, Charlotte and Miami. Williams also says he expects to invest a portion of its portfolio in value opportunities that may emerge in New York and San Francisco.

Critically, Williams will use Cadre’s growing resources to bolster minority-owned real estate operators, and is joining a trend of companies like Apple that are putting their cash in minority owned banks or minority depository institutions.

For at least 10% of Cadre’s portfolio, Williams will work with minority-owned local real estate operators and he says he hopes the figure reaches 20%. Between 5% and 10% of Cadre’s cash will be held at black-owned banks. “I’ve seen personally just how undercapitalized black and other underrepresented minorities are in real estate operations,” says Williams. “We’re hoping that we will be able to find opportunities that others have overlooked and drive greater diversity in the industry, which is very much needed.”

Like Covid-19, one issue that may recede for Williams in the new year, is Cadre’s connections to former president Donald Trump.

During the Trump presidency, the fintech was dogged by its connections with Jared Kushner, the son-in-law and senior advisor to President Trump. Kushner, who helped Cadre get off the ground in its early days, failed to disclose or divest his stake in the company, creating questions about conflicts of interest and a stream of bad press. The Trumps are gone from the White House and Kushner disclosed in February 2020 that he finally has begun the process to divest from Cadre.

-With prior reporting from Nathan Vardi