Back in June 2019, I published a detailed Forbes piece called “Current U.S. Recession Odds Are The Same As During ‘The Big Short’ Heyday.” In that piece, I argued that the U.S. Federal Reserve and other central banks’ aggressive monetary policies since the 2008 Global Financial Crisis created a series of extremely dangerous economic bubbles that would burst in the coming recession. Moreover, I argued that the odds of a U.S. recession in the next 12-months were approximately 64%, which was identical to the recession odds the U.S. economy faced in the Big Short heyday in July 2007. I believe that the U.S. economy was already heading for a recession and that the coronavirus pandemic has acted like a “pin” that burst nearly all of the bubbles that I was warning about.

In this current piece, I’d like to take a quick look at one of the bubbles I warned about in my June 2019 piece – U.S. Housing Bubble 2.0 – and why I believe it is at risk of bursting in the recession that we are already likely in. Like the other bubbles I’ve been warning about, U.S. Housing Bubble 2.0 formed as a result of the Fed’s extremely stimulative monetary policies in the past decade – namely zero interest rate policy (ZIRP) and quantitative easing (QE).

The Great Recession was largely caused by the bursting of the mid-2000s housing bubble and the damage it caused in the U.S. financial and banking system. As a “quick fix” to end the recession and create another economic boom, the Fed simply re-inflated housing prices. According to the Case-Shiller U.S. National Home Price Index, housing prices have surged by 59% since their bottom in 2012:

Case Shiller Index

Jesse Colombo

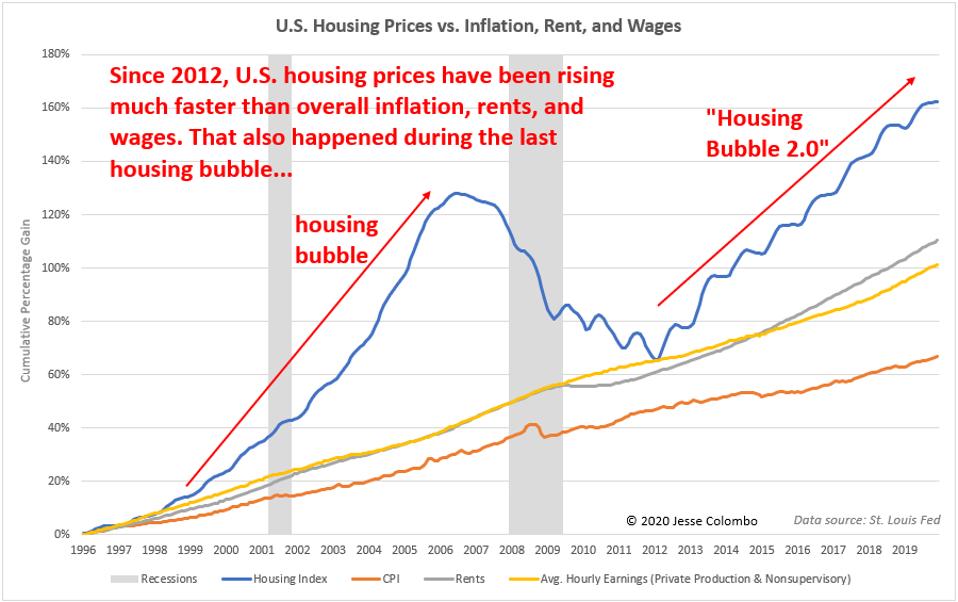

Like nearly all artificial booms, U.S. Housing Bubble 2.0 has inflated faster than the underlying fundamentals. As the chart below shows, U.S. housing prices have been rising much faster than overall inflation, rents, and wages, which is exactly what happened during the last housing bubble. I believe that a correction is inevitable.

Housing vs. CPI

Jesse Colombo

As in the last housing bubble, all sorts of shenanigans has occurred during the making of U.S. Housing Bubble 2.0. Of course, it’s not shenanigans that is identical to the last housing bubble – “history doesn’t repeat, it rhymes…lightning doesn’t strike the same place twice, etc.” One form of shenanigans that occurred during Housing Bubble 2.0 is the fact that many AirBnB “super-hosts” bought scores of properties with cheap mortgages for the purposes of renting out. The coronavirus pandemic has now put these over-leveraged super-hosts in extreme jeopardy:

In addition to the housing market grinding to a halt because prospective homeowners face difficulty actually viewing houses that are for sale during this pandemic, extreme job market uncertainty and unemployment has come back with a vengeance in just March 2020 alone. According to one recent Fed estimate, job losses could total 47 million, while the unemployment rate may hit 32% – truly depression figures, forget about recession. I’m very concerned that the frothy U.S. housing market will be forced to come back to planet earth very soon, which will drag the overall economy down even more.

Please add me on Twitter and LinkedIn to follow my updates and economic commentary.