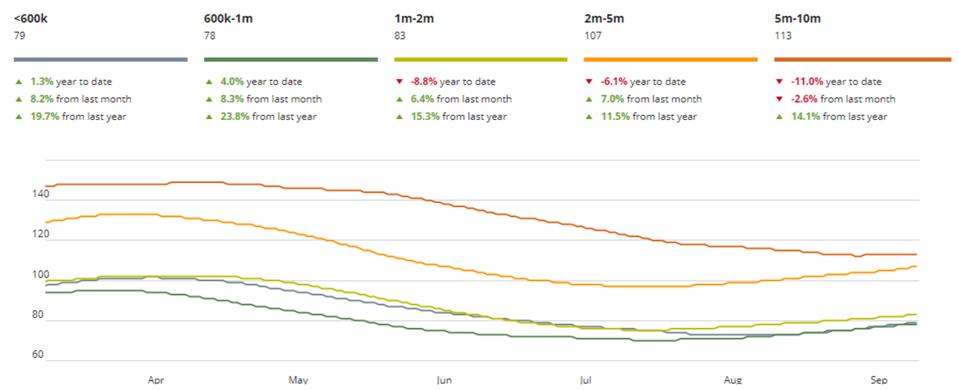

No Russians. Fewer Chinese. But more Americans. That’s how it looked during the third quarter of 2019, as the New York real estate market began to find equilibrium. While each day still brings scores of e-mails announcing price reductions, and while multiple properties, especially at the high-end, have logged over a year on the market, overall the market has continued to stabilize over the summer. We see competitive bidding for some well-priced and well renovated properties, and there is a gradual decline in the average number of days on market throughout the market below $10 million.

Days on market for all Manhattan property types <$10M, April 2019 – September 2019 (Urban Digs)

Urban Digs

The apex market still faces challenges. Foreign sales don’t make up nearly so substantial a percentage of total sales as heretofore. Russians completely disappeared from our high-end market years ago, and most Chinese buyers feel hesitant, caught between a slowing economy at home and a hostile government in the United States. This means the transactions taking place originate much more frequently in America than in Europe or Asia. As a result of the substantial reduction in the number of active buyers for these units, developers compete aggressively to attract them, offering to include lawyers’ fees, taxes, even some decorating so as to keep the recorded prices higher. And still the line of these new super high-end condos winds out the door and around the block, with more inventory being added every month. It is one of the ongoing challenges for developers that the market in which they PLAN buildings and the market in which they SELL them are rarely the same!

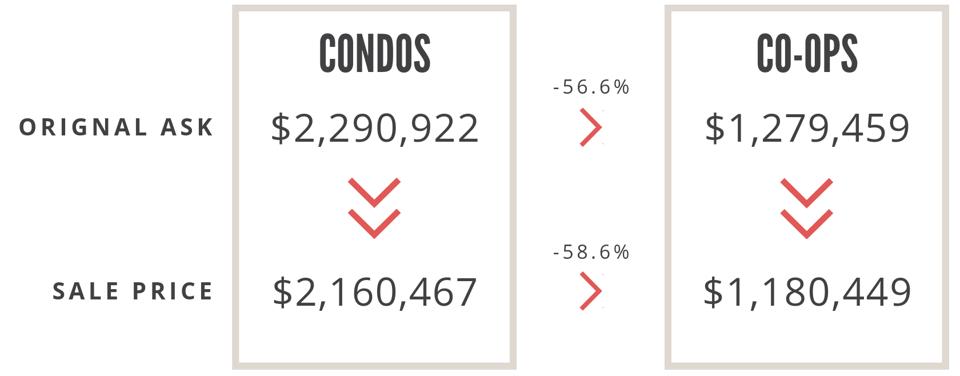

Elsewhere in the market, co-op Boards continue to make decisions which devalue their own properties, turning down completely appropriate buyers for arcane reasons, leaving the owners of those units to re-market and almost certainly receive a lower price the second time around. A notable result of this phenomenon is the lawsuit recently filed by James Cayne, former CEO of Bear Stearns, against the co-op Board of his building, 510 Park Avenue, which has rejected three buyers with no explanation. Publicity like this devalues co-ops citywide as buyers contemplate the illiquidity of an asset subject to the vicissitudes of a group of neighbors. This concern, added to often rigorous renovation guidelines, makes condominium purchases a more attractive option for increasing numbers of buyers, thus widening the gulf between co-op and condominium prices.

Average original asking price vs. sale price for all Manhattan condo and co-ops <$10M, July 2019 – … [+]

Perchwell

Ongoing examples of price capitulation abound throughout the market, contributing to its gradually returning sense of stability. While agents continue to find the market extremely challenging (one told me recently he found it worse than 2009) there is an overall sense that prices are settling at a level anywhere between 10% and 20% below their 2015 highs. And as that happens, some buyers recognize a moment of opportunity and see these price reductions and less expensive asking prices as invitations to re-enter the market.

Interestingly enough, while this renaissance of buyer activity animates the 6- to 9-room marketplace for well-priced homes (mostly co-ops) on the Upper East and West Sides, and the 2,000 to 3,500-square-foot loft marketplace downtown, the market for one and small two-bedroom apartments has sunk into the doldrums. Even when these smaller units are well priced they have received little buyer attention during the past few months.

As we look to the fourth quarter there are numerous areas of uncertainty. Will the slowdown which the press is promoting so aggressively actually take place? Will an impeachment inquiry further roil markets already insecure because of Brexit, the China trade conflict, and other hotspots of global unrest? All I can say in response is that regardless of world events, life still goes on. Prices have been dropping in Manhattan for almost four years now. They seem to have reached a state of relative equilibrium, except at the ultra-high end. It will be telling to discover in the months ahead whether buyers respond in increasing numbers to the chance for a good buy which that equilibrium provides.