Getty

The drumbeat of headlines have made clear that New York City’s real estate market is weakening. The median asking price for a Manhattan apartment is below $3,000 for the first time since 2011. Landlords are in distress. The vast majority of restaurants can’t make their full rent.

But there are nuances within those trends. Rent prices, for instance, are falling the least in some high-density neighborhoods like Elmhurst and Jackson Heights, which have been among the areas hit hardest by the Covid-19 pandemic, notes StreetEasy economist Nancy Wu in a recent report. “They’re also home to more immigrants, Black and Hispanic New Yorkers, and those on lower incomes,” she adds.

In an effort to better understand one slice of the real estate landscape—residential transactions—Forbes partnered with ABCData, a startup that collects data from public web listings, to map deals across all five boroughs. The analysis reveals a number of interesting results: sales are skewing dramatically towards larger homes and apartments, for example, and Manhattan units are bouncing back quicker than those in Brooklyn (though Manhattan’s sales volume dipped further at the onset of the pandemic).

While the findings are not perfect—the data can be skewed by particularly large deals, for instance—they nonetheless offer a more granular picture of the current market.

OVERALL NYC MARKET

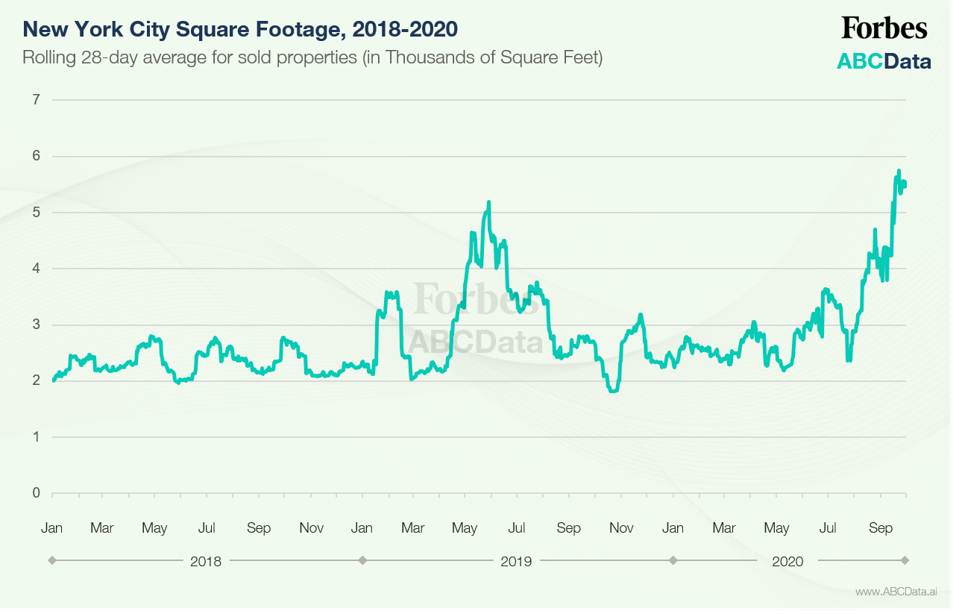

Recent sales have trended towards larger properties.

ABCData

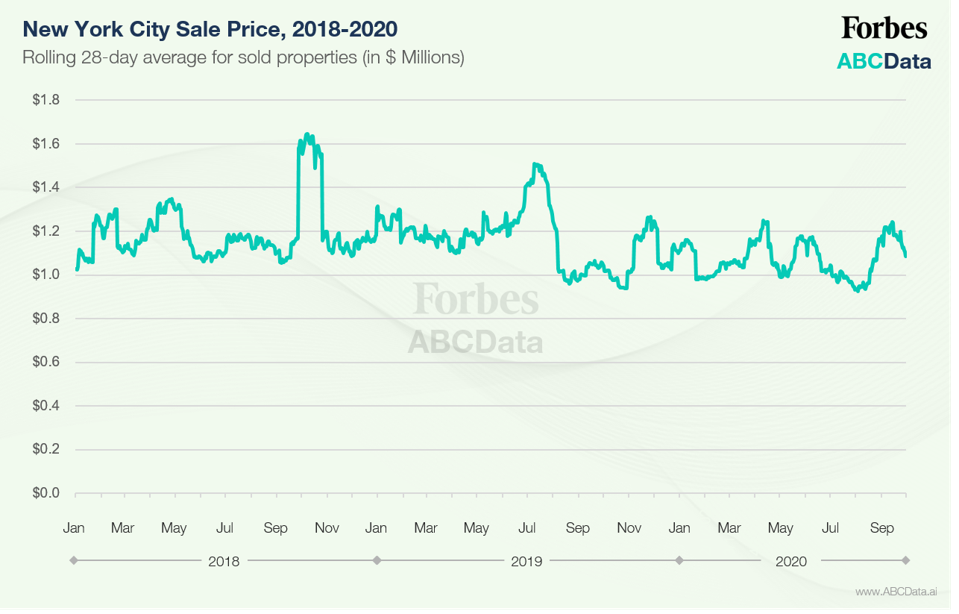

Overall, sale prices are relatively steady.

ABCData

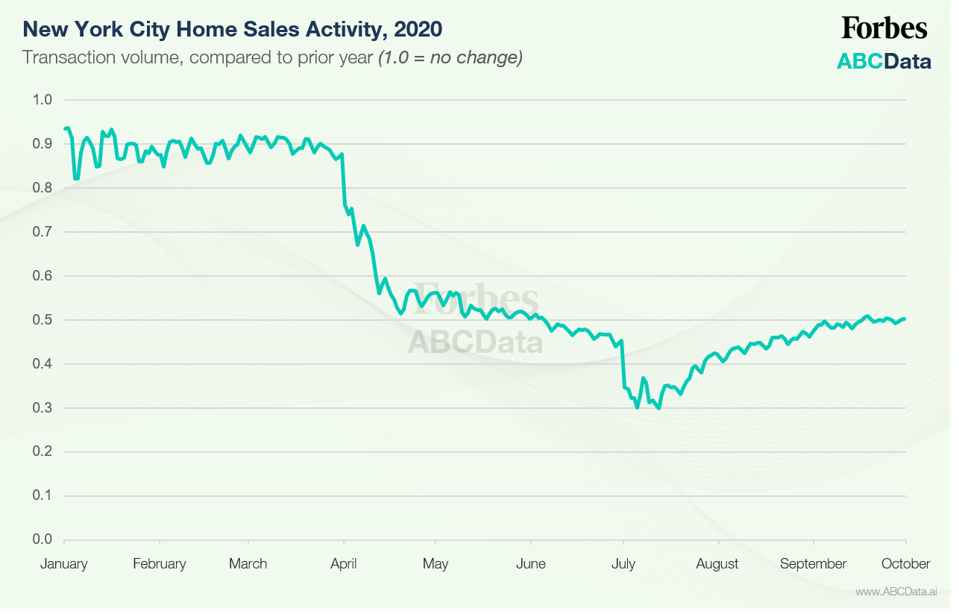

Sales volume is picking back up. It now sits at about 50% of last year’s figures.

ABCData

MANHATTAN

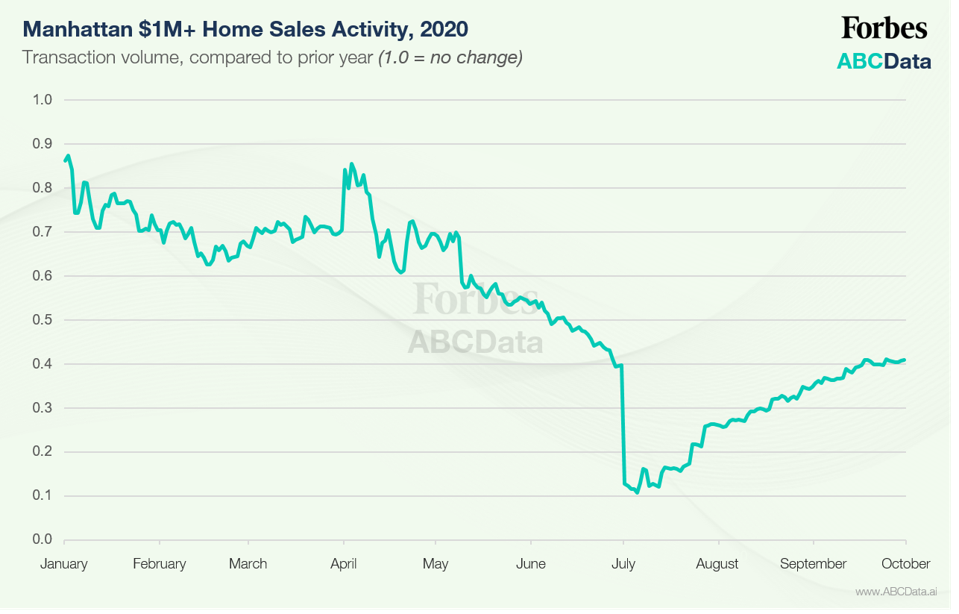

Sales above $1 million, which comprise the majority of deals, are rebounding after a precipitous drop.

ABCData

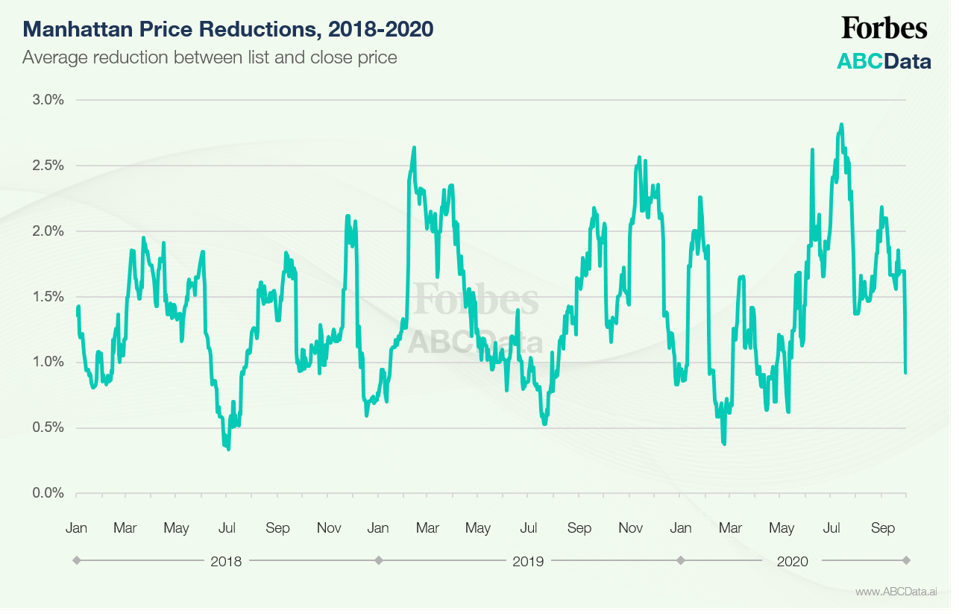

Price reductions appear to have peaked mid-summer.

ABCData

BROOKLYN

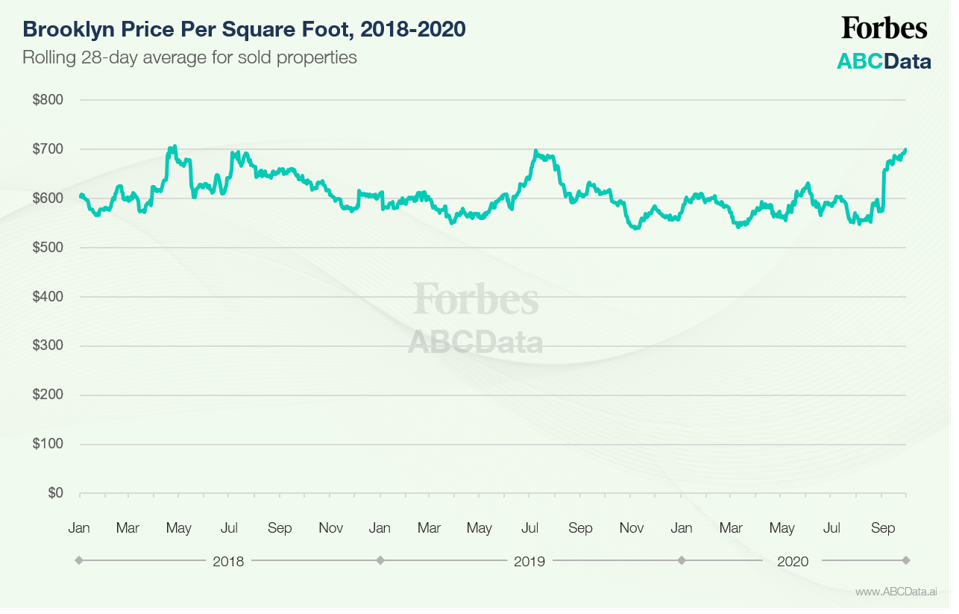

The average price per square foot is ticking up.

ABCData

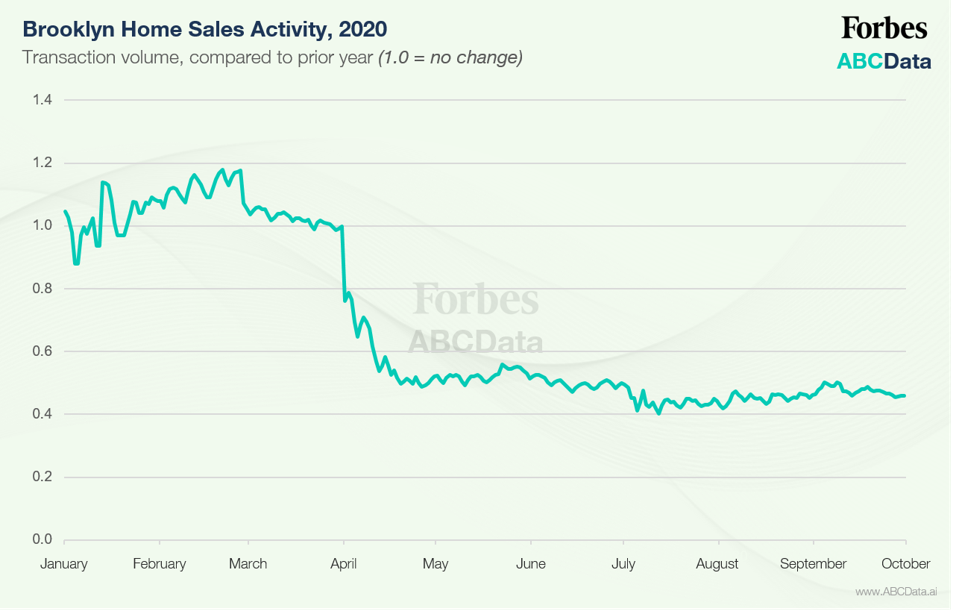

Sales volume remains depressed, however.

ABCData

THE BRONX

Home sales are near the same place as the start of the year.

ABCData

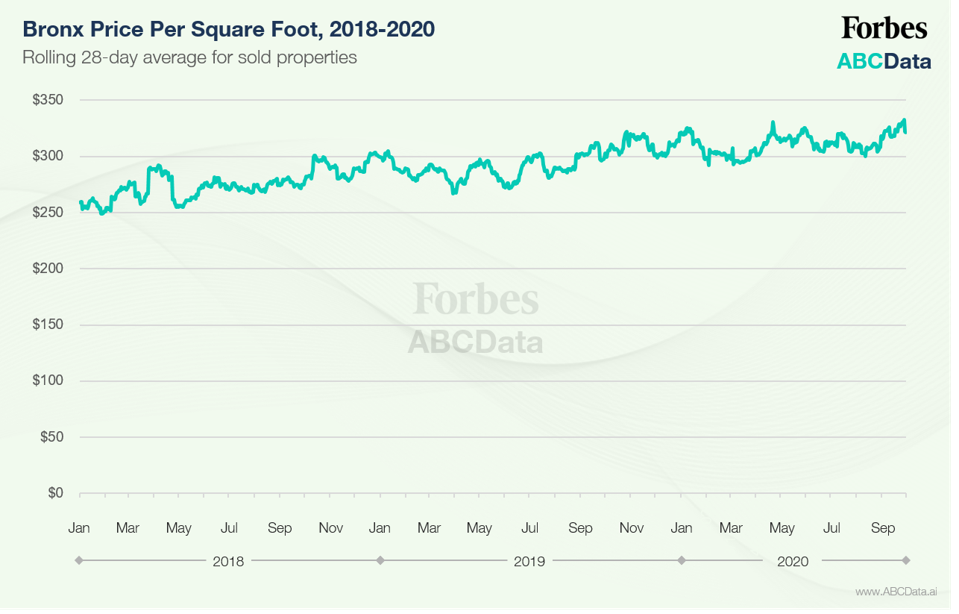

The average price per square foot has steadily climbed since 2018.

ABCData

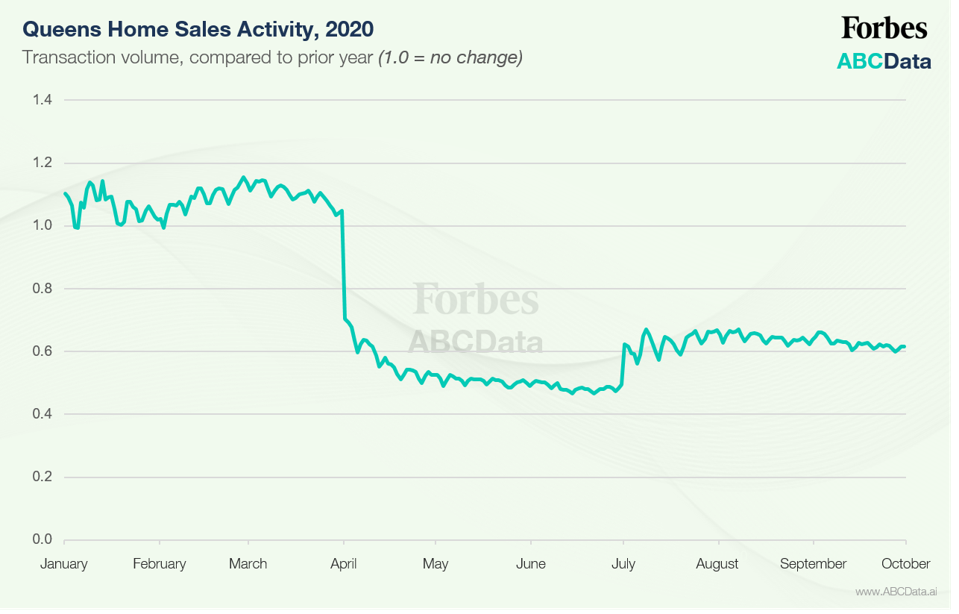

QUEENS

Home sales have flattened in recent months.

ABCData

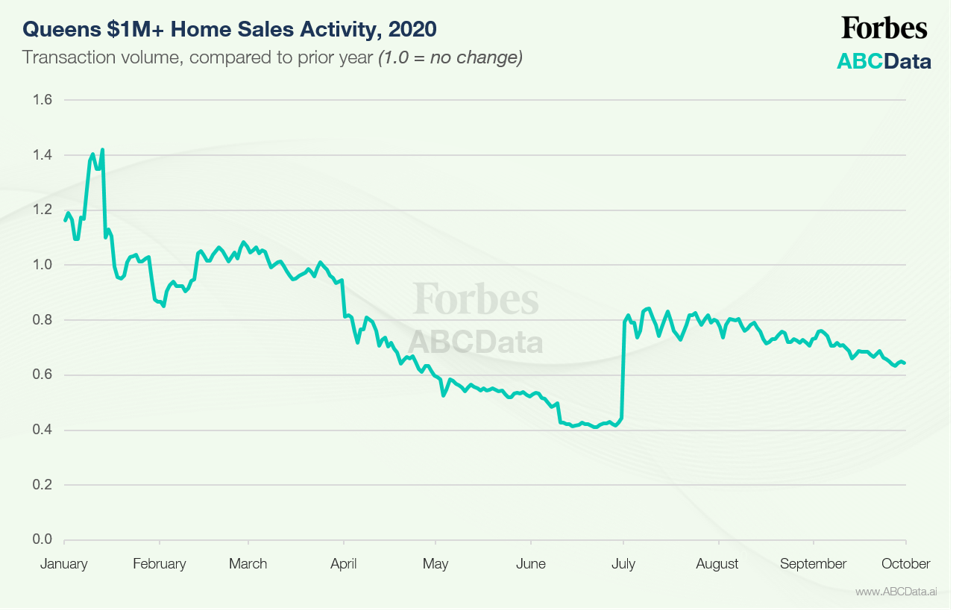

Million-dollar deals are beginning to dip.

ABCData

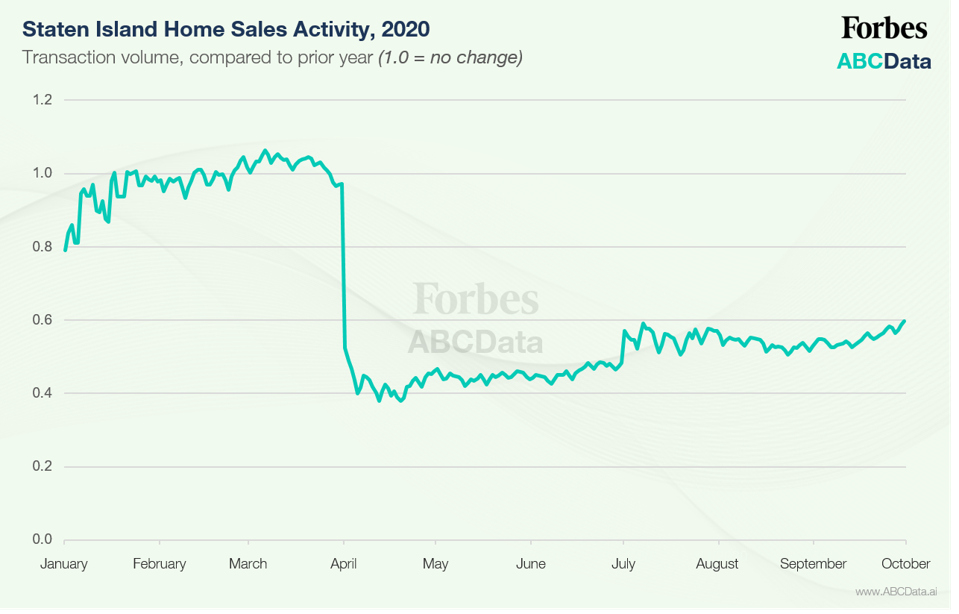

STATEN ISLAND

Sales are slowly inching back.

ABCData

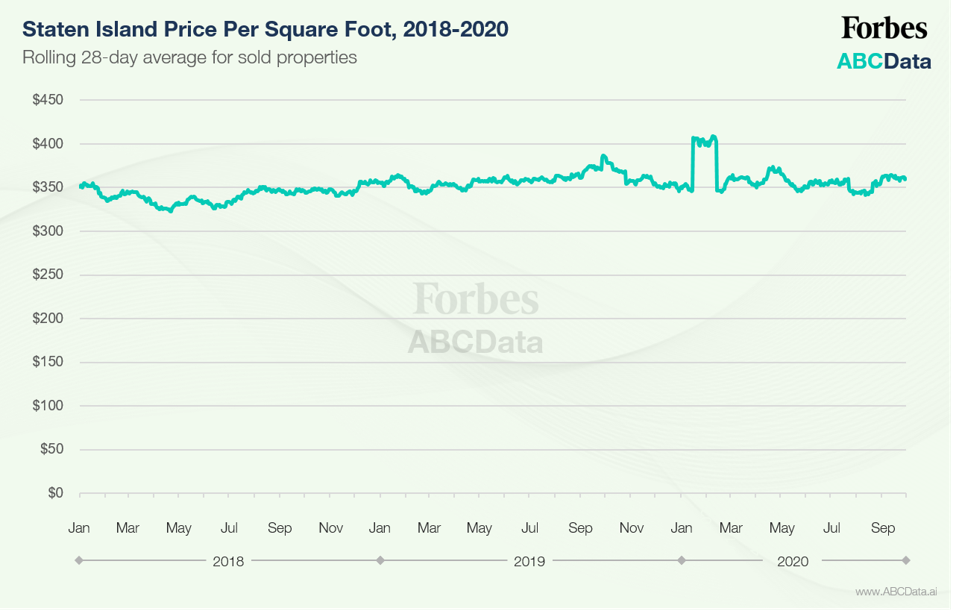

Prices have stayed virtually flat over the past two years.

ABCData

I’ve been a reporter at Forbes since 2016. Before that, I spent a year on the road—driving for Uber in Cleveland, volcano climbing in Guatemala, cattle farming in

…

I’ve been a reporter at Forbes since 2016. Before that, I spent a year on the road—driving for Uber in Cleveland, volcano climbing in Guatemala, cattle farming in Uruguay, and lots of stuff in between. I graduated from Tufts University with a dual degree in international relations and Arabic. Feel free to reach out at [email protected] with any story ideas or tips, or follow me on Twitter @Noah_Kirsch.